POST-MARKET SUMMARY 16th April 2025

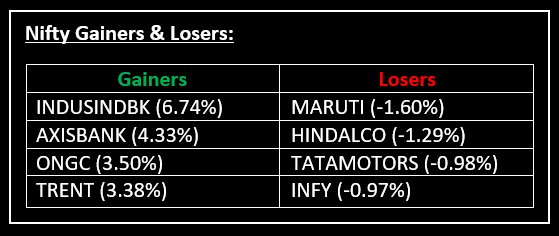

On April 16, benchmark indices moved higher, extending their gains for a third consecutive session. Top Gainer: INDUSINDBK | Top Loser: MARUTI

On April 16, benchmark indices moved higher, extending their gains for a third consecutive session. After a rangebound first half, the rally was fuelled by reports that China is open to trade talks with the US.

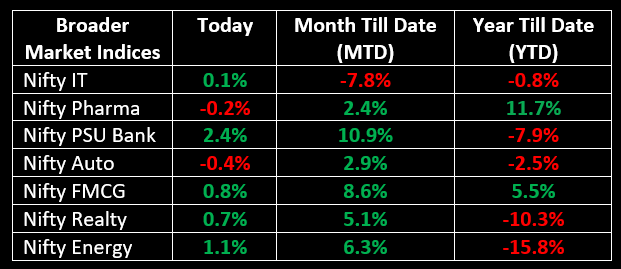

The rally was supported by strong performances in the media, PSU banks and oil & gas sectors, which rose between 1% and 2%. However, the auto, IT and pharma sectors saw some selling pressure. Banks played a pivotal role in the rally, with PSU lenders leading the charge among mid-cap stocks.

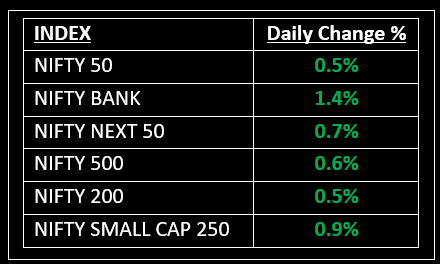

NIFTY: The index opened flat at 23,344 and made a high of 23,452 before closing at 23,437. Nifty has formed a bullish candlestick pattern with a minor lower shadow on the daily chart. Its immediate resistance level is now placed at 23,550 while its immediate support is at 23,350.

BANK NIFTY: The index opened 311 points higher at 52,690 and closed at 53,117. Bank Nifty has formed a bullish candle on the daily chart. Its immediate resistance level is now placed around 53,500 while immediate support is around 52,800.

Stocks in Spotlight

▪ IREDA: Stock jumped over 7% intraday, fuelled by strong Q4FY25 earnings. The state-run green energy financier reported a profit of ₹501.55 crore for the fourth quarter, up from ₹337.39 crore a year earlier.

▪ ICICI Bank: Stock rose 0.5% after the bank announced a 0.25% reduction in its savings account deposit interest rate.

▪ Hindalco: Stock slipped more than 2% intraday, as worries about market volatility in the metals sector intensified, fuelled by President Trump's policies.

Global News

▪ Asian stock markets displayed a mixed performance on Wednesday, mainly driven by escalating U.S.-China trade tensions and new export restrictions on semiconductor chips.

▪ European stocks retreated after a strong start to the week, pressured by ASML's warning that U.S. tariffs were heightening uncertainty around its outlook for 2025 and 2026.

▪ Oil prices gained around 1% on Wednesday, bolstered by the prospect of trade talks between China and the U.S. and news that Iraq would reduce oil production in April.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.