POST-MARKET SUMMARY 16th April 2024

On April 16, the Sensex and the Nifty sustained their downward trajectory for the third consecutive session, influenced by global cues. Top Gainer: EICHERMOT | Top Loser: INFY

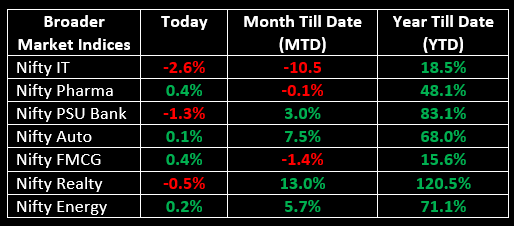

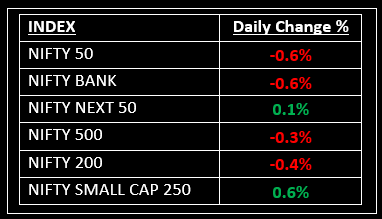

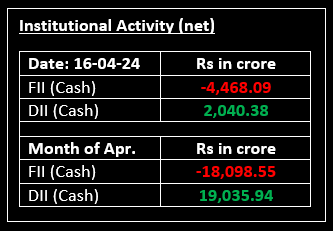

On April 16, the Sensex and the Nifty sustained their downward trajectory for the third consecutive session, influenced by global cues. Factors contributing to this decline included concerns over prolonged high interest rates, tensions in the Middle East, and mixed economic data from China. While China's GDP growth and fixed assets investment exceeded expectations, retail sales and industrial output figures fell short. At close, the Sensex declined by 456.10 points, equivalent to a 0.62% drop, settling at 72,943.68, while the Nifty fell by 124.60 points, or 0.56%, to 22,147.90. The Nifty IT index saw the most significant decline among sectoral indices, plunging 2.6%, followed by the Nifty PSU Bank and Nifty Bank indices, which fell by 1.3% and 0.6%, respectively.

NIFTY: The index opened 147 points lower at 22,125 and made a high of 22,213 before closing at 22,147. Nifty has formed a small bullish candlestick on the daily chart with upper and lower shadows. Its immediate resistance level is now placed at 22,220 while immediate support is at 22,080.

BANK NIFTY: The index opened 337 points lower at 47,436 and closed at 47,484. Bank Nifty has formed a spinning top pattern on the daily chart. Its immediate resistance level is now placed at 47,700 while support is at 47,400.

Stocks in Spotlight

▪ VST Industries: Stock saw buying interest after veteran investor Radhakishan Damani acquired an additional 1.51% stake in the company, raising his holding in the company to 34.4%.

▪ Gujarat Gas: Stock rose 0.42% after Jefferies maintained a 'buy' call on the counter, citing multiple levers from its credit cards business, and assigned a target price of Rs 100 a share, an upside of 22% from the current levels.

▪ Vodafone Idea: Stock fell nearly 3% at open on the NSE on April 16, a day after the company announced an FPO set to be launched on April 18.

Global News

▪ Gold prices fell on Tuesday, under pressure from high U.S. Treasury yields and as investors locked in profits from a rally that drove the precious metal to a record peak last week.

▪ European markets were lower on Tuesday as investors closely followed developments in the Middle East.

▪ The dollar rose to a five-month high against the pound and euro on Tuesday, a day after stronger-than-expected U.S. retail sales sent Treasury yields higher. Meanwhile, the yen languished at its lowest level since 1990.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.