POST-MARKET SUMMARY 15th January 2025

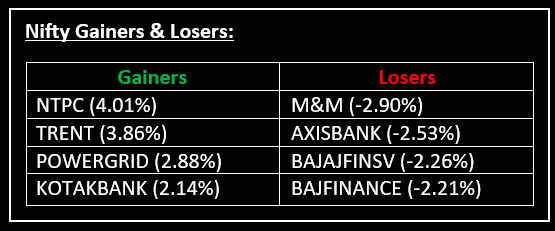

On January 15, the Indian benchmark indices extended gains for the second consecutive session, supported by buying in IT, metal, power, and realty stocks. Top Gainer: NTPC | Top Loser: M&M

On January 15, the Indian benchmark indices extended gains for the second consecutive session, supported by buying in IT, metal, power, and realty stocks. The indices opened strongly despite mixed global cues and traded within a range, with the Nifty moving closer to key resistance levels.

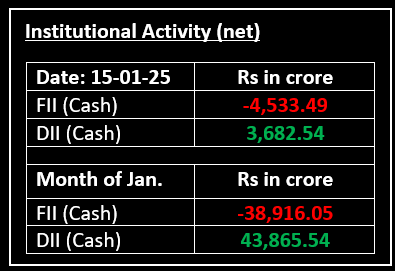

Investors are closely watching data that could clarify the US Federal Reserve's rate cut trajectory, following strong US jobs data that tempered expectations of multiple cuts. Concerns also persist over President-elect Donald Trump’s proposed tariffs, which may fuel inflation and limit the Fed’s options.

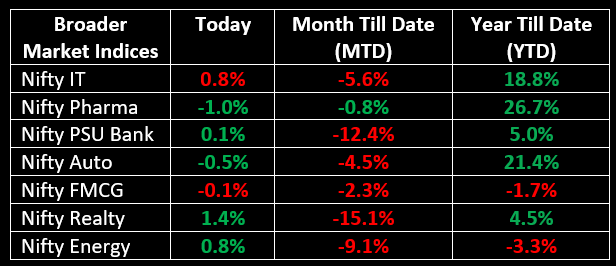

On the sectoral front, IT, realty, and power sectors rose 0.5-1%, while auto, media, and pharma sectors declined by 0.5-1%.

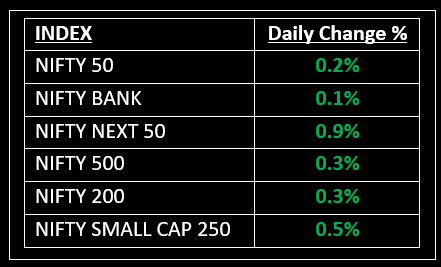

NIFTY: The index opened 74 points higher at 23,250 and made a high of 23,293 before closing at 23,213. Nifty has formed a small bearish candlestick pattern, with upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 23,300 while its immediate support is at 23,130.

BANK NIFTY: The index opened 103 points higher at 48,832 and closed at 48,751. Bank Nifty has formed a small bearish candlestick pattern with long upper and lower shadows, resembling a High Wave-like pattern on the daily chart. Its immediate resistance level is now placed around 49,100 while immediate support is around 48,500.

Stocks in Spotlight

▪ Persistent Systems: Stock ended almost 4% higher following the launch of Contract Assist, an AI-powered contract management solution developed in partnership with Microsoft.

▪ Vodafone Idea: Stock jumped nearly 12% intraday after the company announced its collaboration with HCL Software to enhance the efficiency of its 4G and 5G networks using advanced technologies. Read more about it here.

▪ Premier Energies: Stock gained almost 3% after three subsidiaries announced securing multiple orders worth Rs 1,460 crore for the supply of solar PV cells and modules.

Global News

▪ European markets traded higher on Wednesday as investors reacted to a cooler-than-expected inflation reading out of the U.K.

▪ Gold prices firmed on Wednesday as the U.S. dollar and Treasury yields retreated, while market participants awaited U.S. inflation data for clues on the Federal Reserve’s interest rate strategy.

▪ Oil prices crept higher on Wednesday as the market focused on potential supply disruptions from sanctions on Russian tankers, though gains were tempered by a lack of clarity on their impact.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.