POST-MARKET SUMMARY 14th June 2024

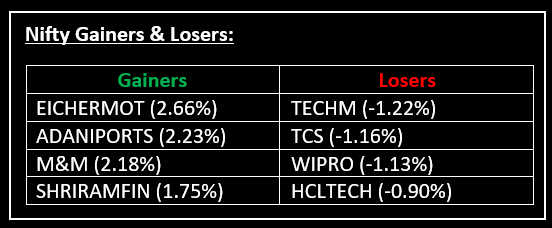

On June 14, Sensex and Nifty climbed due to market optimism and anticipation surrounding the upcoming budget, according to market experts. Top Gainer: EICHERMOT | Top Loser: TECHM

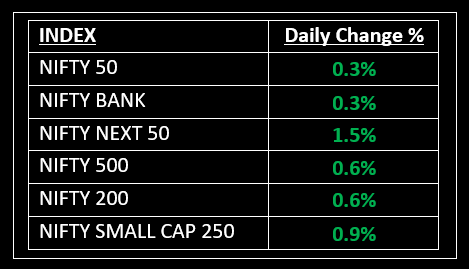

On June 14, Sensex and Nifty climbed due to market optimism and anticipation surrounding the upcoming budget, according to market experts. The Nifty 50 reached a fresh lifetime high of 23,490 in the last hour of trade, driven by gains in financial services and automobile stocks.

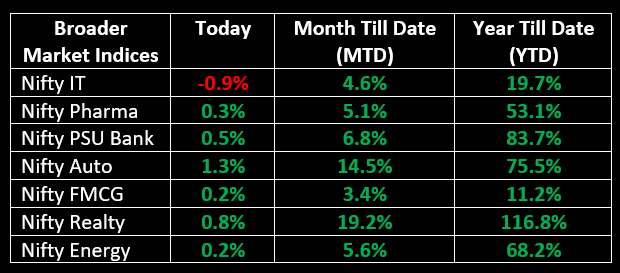

Nifty Auto outperformed the sectoral indices, rising 1.3%, led by M&M, Bharat Forge, and Tata Motors. Meanwhile, Nifty IT was the worst hit among the 13 sectoral indices, falling nearly 1%.

NIFTY: The index opened 66 points higher at 23,464 and made a high of 23,490 before closing at 23,465. Nifty has formed a dragonfly doji on the daily chart. Its immediate resistance level is now placed at 23,500 while immediate support is at 23,350.

BANK NIFTY: The index opened 147 points higher at 49,993 and closed at 50,002. Bank Nifty has formed a dragonfly doji on the daily timeframe. Its immediate resistance level is now placed at 50,250 while support is at 49,700.

Stocks in Spotlight

▪ Ambuja Cement: Stock gained over 1% after it announced the acquisition of South-based Penna Cement for Rs 10,442 crore.

▪ EIH Associated Hotels: Stock gained around 6.5% ahead of the company's board meeting to consider and approve the issue of bonus shares to the equity shareholders of the company.

▪ Puravankara Limited: Stock gained 1% after the real estate company said it will be raising funds up to Rs 1,000 crore via the Qualified Institutional Placement (QIP) route.

Global News

▪ Oil prices fell on Friday but were on track for their first weekly gain in four weeks as markets assessed the impact of higher-for-longer U.S. interest rates versus solid outlooks for crude and fuel demand this year.

▪ Gold prices rose on Friday and were on track for their first weekly gain in four after U.S. economic data indicated a softening of price pressures, fueling optimism that a rate cut by the Federal Reserve could be forthcoming.

▪ The euro was on track for its biggest weekly fall in two months versus the dollar on Friday due to French political turmoil, while the yen clawed back ground after the Bank of Japan (BOJ)surprised markets with a dovish monetary policy update.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.