POST-MARKET SUMMARY 14th February 2024

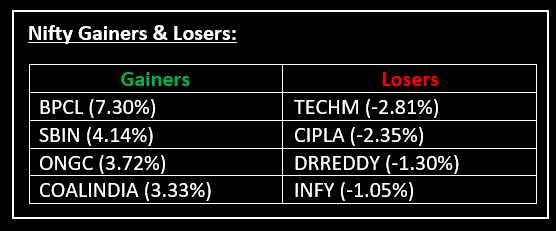

On February 14, amidst a highly volatile session, the market staged a sharp recovery, closing higher driven by gains in SBI and other PSU banks. Top Gainer: BPCL | Top Loser: TECHM

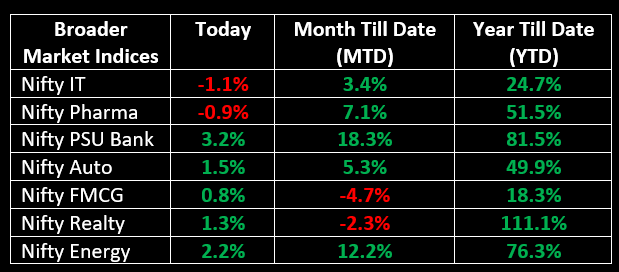

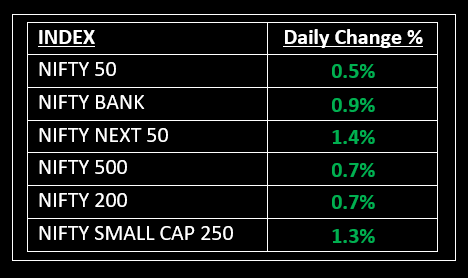

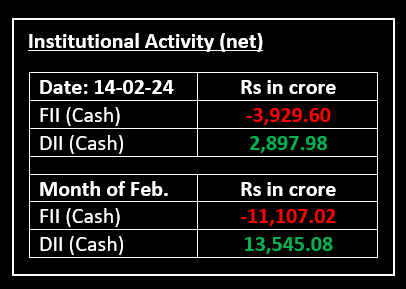

On February 14, amidst a highly volatile session, the market staged a sharp recovery, closing higher driven by gains in SBI and other PSU banks. The Nifty initially dropped to 21,530.20 but later bounced back, ending the day 97 points higher at 21,840, marking a 0.44% increase. In terms of sectors, both PSU bank and oil & gas indices surged by 3%, while auto, banking, FMCG, capital goods, metals, power, and realty sectors all saw gains of over 1% each. Conversely, the information technology and pharmaceutical indices witnessed declines of 1% each.

NIFTY: The index opened 165 points lower at 21,578 and made a high of 21,870 before closing at 21,840. Nifty has formed a long bullish candlestick pattern, which engulfed all the previous three candles on the daily chart. Its immediate resistance level is now placed at 21,900 while immediate support is at 21,770.

BANK NIFTY: The index opened 488 points lower at 45,014 and closed at 45,908. Bank Nifty has formed a long bullish candlestick pattern on the daily timeframe. Its immediate resistance level is now placed at 46,180 while support is at 45,650.

Stocks in Spotlight

▪ Sansera Engineering: Stock gained 3% after the company’s net profit jumped 55 percent on-year to Rs 48.4 crore.

▪ IREDA: Stock surged 5% to get locked in upper circuit after 2 crore shares exchanged hands at average price of Rs 160. The deal was worth Rs 389.8 crore.

▪ BPCL: Stock gained 7.3% after BPCL ESPS Trust sold 68,36,948 equity shares in the company in a block deal.

Global News

▪ Gold prices extended declines on Wednesday, languishing below the key $2,000-per-ounce mark, pressured by a stronger-than-expected U.S. inflation report that caused investors to pull back on bets of rate cuts by the Federal Reserve.

▪ The dollar rose to a fresh three-month high against major peers.

▪ Oil prices fell in early Asian trade on Wednesday after a U.S. industry group reported crude stocks rose more than expected last week.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.