POST-MARKET SUMMARY 13th March 2024

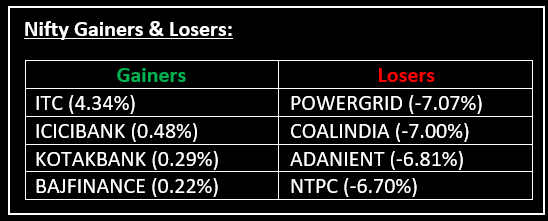

On March 13, the Indian market concluded with significant losses as widespread selling and ongoing declines in mid and smallcap stocks continued, unsettling investors. Top Gainer: ITC | Top Loser: POWERGRID

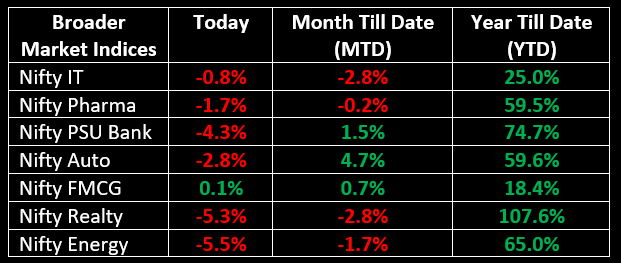

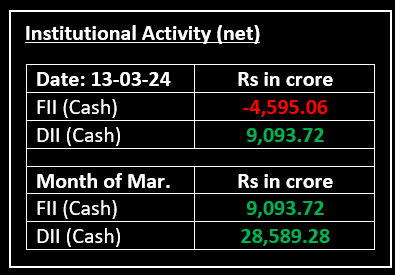

On March 13, the Indian market concluded with significant losses as widespread selling and ongoing declines in mid and smallcap stocks continued, unsettling investors. Despite an initial positive start aided by moderate CPI data and stable industrial production growth, the Indian benchmarks failed to sustain gains as selling pressure intensified during the latter part of the day, causing the Nifty to drop below the 22,000 mark. With the exception of the IT sector, all other sectoral indices closed in negative territory, with realty, media, PSU bank, telecom, power, oil & gas, and metals witnessing declines of 4-6%.

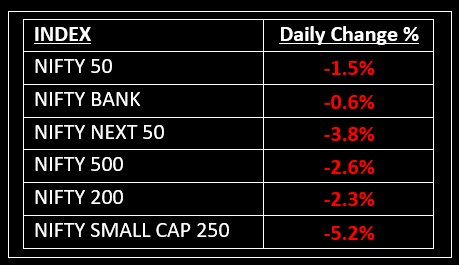

NIFTY: The index opened 97 points higher at 22,432 and made a high of 22,446 before closing at 21,997. Nifty has formed a large bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 22,050 while immediate support is at 21,900.

BANK NIFTY: The index opened 59 points higher at 47,341 and closed at 46,981. Bank Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 47,200 while support is at 46,600.

Stocks in Spotlight

▪ ITC: Stock gained over 4% after its top shareholder British American Tobacco sold 3.5% stake in the company.

▪ Macrotech Developers: Stock plunged 10%, a day after promoter Sambhavnath Infrabuild and Farms sold 49.7 lakh shares, or a 0.5% stake, in the developer at an average of Rs 1,180.02 a share.

▪ Gensol Engineering: Stock fell 5% and hit the lower circuit on the news that Dubai-based hawala operator Hari Shankar Tibrewala’s FPI Zenith Multi Trading DMCC owns a 1.5% stake in the company.

Global News

▪ Gold prices edged higher on Wednesday after dropping more than 1% in the previous session, as investors digested hotter-than-expected U.S. inflation data and still banked on a Federal Reserve interest rate cut in June.

▪ European markets were choppy on Wednesday, moving between losses and gains as investors digested the latest U.S. inflation report and U.K. gross domestic product figures.

▪ The U.S. dollar index held steady on Wednesday as traders shrugged off hotter-than-expected U.S. inflation data.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.