POST-MARKET SUMMARY 13th June 2024

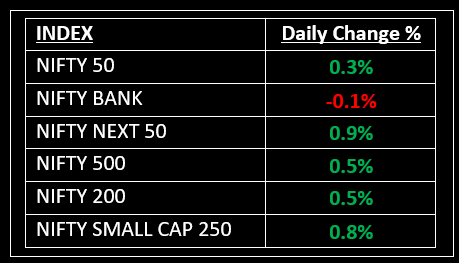

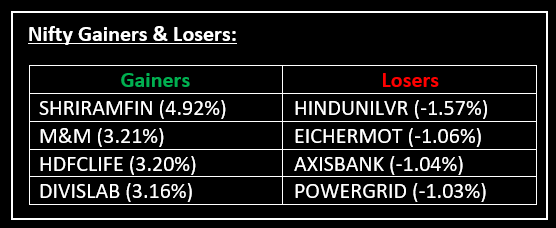

On June 13, Nifty pulled back from its record high but still managed to close in positive territory. The broader market outperformed the benchmarks, with both the BSE Midcap and Small cap indices rising nearly 1% each. Top Gainer: SHRIRAMFIN | Top Loser: HINDUNILVR

On June 13, Nifty pulled back from its record high but still managed to close in positive territory. The broader market outperformed the benchmarks, with both the BSE Midcap and Small cap indices rising nearly 1% each. The volatility index, India VIX, declined over 7% to 13.4.

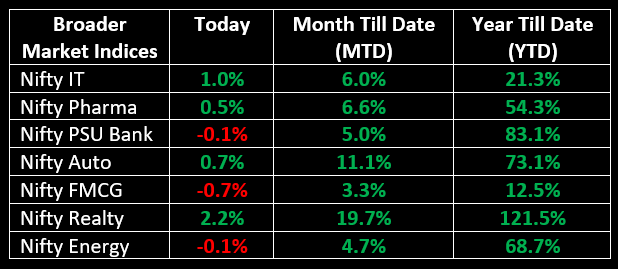

Among sectoral indices, Nifty Realty and Nifty IT were the major gainers, rising 2% and 1%, respectively. Meanwhile, Nifty Media and Nifty FMCG were the worst hit, declining 1% and 0.6%.

NIFTY: The index opened 158 points higher at 23,480 and made a high of 23,481 before closing at 23,398. Nifty has formed a bearish candlestick pattern on the daily chart. Its immediate resistance level is now placed at 23,440 while immediate support is at 23,350.

BANK NIFTY: The index opened 284 points higher at 50,179 and closed at 49,846. Bank Nifty has formed a long-bodied bearish candle on the daily timeframe. Its immediate resistance level is now placed at 50,250 while support is at 49,600.

Stocks in Spotlight

▪ Paytm: Stock jumped 7.5% after Samsung partnered with the payments & financial services distribution company to bring travel and entertainment services to Samsung Wallet in India.

▪ Sobha: Sugar jumped 5% after the company board greenlit the offer and issuance of equity shares for Rs 2,000 crore through a rights issue.

▪ Suzlon: Stock fell 2.4% as investors rushed to book some profits after the stock's strong run to its 52-week high in the previous session.

Global News

▪ U.S. Treasury yields slipped once again on Thursday after the latest inflation data showed an unexpected drop.

▪ Gold prices fell after the U.S. Federal Reserve projected just one interest rate reduction this year, dashing investors’ hopes of two cuts, while a cooler-than-expected inflation report limited the dip.

▪ European stocks were lower as regional investors reacted to the U.S. Federal Reserve’s latest monetary policy decision and U.S. inflation data.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.