POST-MARKET SUMMARY 13th December 2024

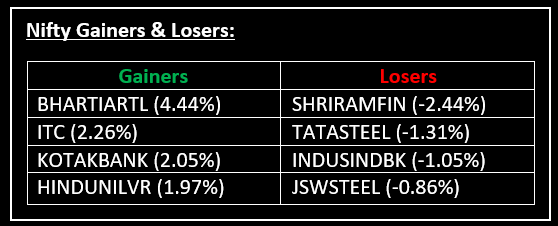

On December 13, the Indian equity indices made a sharp recovery in a highly volatile session, ending on a strong note. Top Gainer: BHARTIARTL | Top Loser: SHRIRAMFIN

On December 13, the Indian equity indices made a sharp recovery in a highly volatile session, ending on a strong note. The market opened negative, extending losses in the first half amid weak global cues. However, buying in heavyweights and broad-based recovery in the second half helped the indices regain momentum.

Sectoral performance was mixed, with auto, bank, FMCG and telecom sectors rising by 0.5-2%, while realty, metal, and media sectors declined by 0.5%.

In the primary market, the grey market premium (GMP) for the IPO of International Gemmological Institute Ltd dipped to 18%. Get a detailed overview of the IPO here: IGI IPO Analysis: Will Investors Certify this Diamond Expert?

NIFTY: The index opened 50 points lower at 24,498 and made a high of 24,792 before closing at 24,768. Nifty has formed a bullish candlestick pattern with a lower shadow on the daily chart, indicating strong buying interest at lower levels. Its crucial resistance level is now placed at 24,860 while support is at 24,700.

BANK NIFTY: The index opened 107 points lower at 53,109 and closed at 53,583. Bank Nifty has formed a bullish candlestick pattern with a long lower shadow on the daily chart. Its crucial resistance level is now placed at 53,900 while support is at 53,200.

Stocks in Spotlight

▪ Bajel Projects: Stock surged 20% after securing a contract from Solapur Transmission, a project company of Torrent Power for supply, installation, and commissioning of a new 400/220 KV substation in Maharashtra.

▪ Astra Microwave Products: Stock surged over 6% intraday after its joint venture, Astra Rafael Comsys, won a Rs 255.88 crore order from the Ministry of Defence.

▪ Bharti Airtel: Stock surged over 4%, driven by a block deal of 13.2 lakh shares worth around Rs 212.60 crore, making it the top gainer on the Nifty 50 index.

Global News

▪ European markets were trading lower on Friday, following unexpected contractions in both U.K. GDP and key export data from Germany.

▪ Oil prices nudged upwards on Friday, heading for their first weekly rise since the end of November, as additional sanctions on Iran and Russia ratcheted up supply worries, while a surplus outlook weighed on markets.

▪ The dollar headed for its best weekly performance in a month on Friday, as investors priced in the possibility of the Federal Reserve cutting rates more slowly next year, while sterling fell after a surprise contraction in UK economic activity.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.