POST-MARKET SUMMARY 12th April 2024

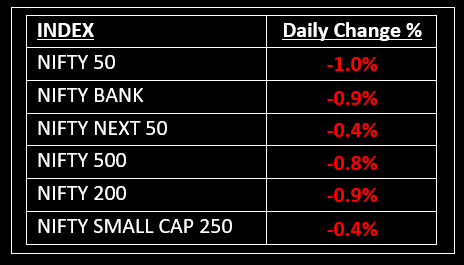

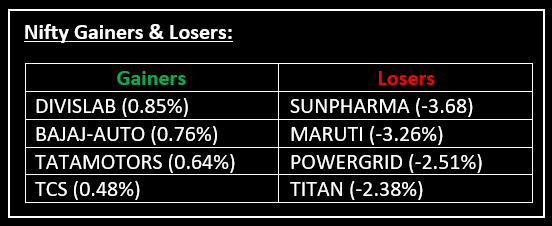

On April 12, both the Sensex and Nifty benchmark indices plunged over 1%, driven by a widespread selloff. Top Gainer: DIVISLAB | Top Loser: SUNPHARMA

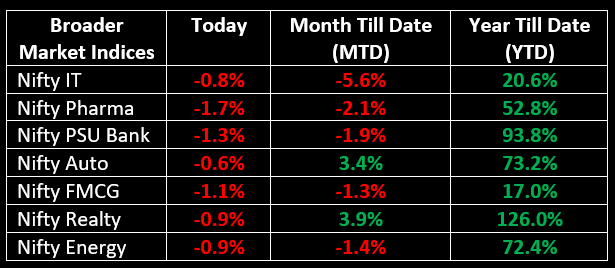

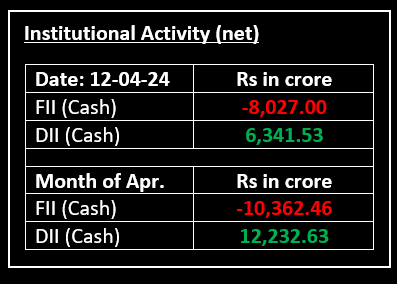

On April 12, both the Sensex and Nifty benchmark indices plunged over 1%, driven by a widespread selloff. The drop in investor confidence was influenced by US CPI inflation data, which dashed hopes for a June rate cut and resulted in a surge in treasury bond yields. All sectoral indices concluded the day in negative territory. Nifty Pharma and Nifty Healthcare took the hardest hit, declining by 1.8% and 1.5%, respectively. Nifty Media, Nifty PSU Bank, and Nifty FMCG also closed more than 1% lower each.

NIFTY: The index opened 76 points lower at 22,677 and made a high of 22,726 before closing at 22,519. Nifty has formed a bearish candle on the daily chart. Its immediate resistance level is now placed at 22,600 while immediate support is at 22,450.

BANK NIFTY: The index opened 315 points lower at 48,671 and closed at 48,564. Bank Nifty has formed a bearish candle with a long upper shadow on the daily chart. Its immediate resistance level is now placed at 48,700 while support is at 48,400.

Stocks in Spotlight

▪ CAMS: Stock gained 2 percent after the company got the nod from RBI to operate as an online payment aggregator.

▪ Sun Pharmaceuticals: Stock declined 4 percent after the US FDA labelled its Dadra facility as 'official action indicated' (OAI), indicating recommended regulatory or administrative actions.

▪ Vakrangee: Stock rose over 2 percent after the company entered an agreement with Global One Enterprises Pvt Ltd (Max TV) for offering subscription-based OTT plans through Vakrangee Kendra networks.

Global News

▪ The euro dropped to its lowest level in five months on Friday after the European Central Bank signaled it could soon cut rates even with a hot U.S. economy likely forcing the Federal Reserve to hold off on a similar move until later in the year.

▪ Gold reached another all-time high on Friday and was poised to post a fourth straight weekly gain as geopolitical risks and economic concerns surrounding China attracted robust demand.

▪ Asia-Pacific markets were mixed Friday after an inflation-fueled selloff in the previous session, with investor assessing economic data from Singapore and South Korea.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.