POST-MARKET SUMMARY 11th December 2024

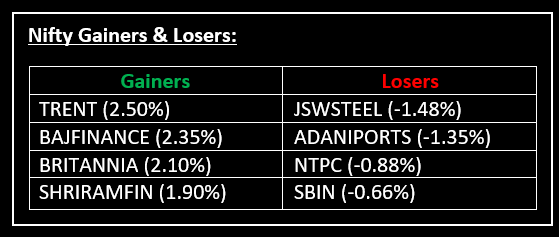

On December 11, Indian equity benchmarks closed marginally higher as investors awaited crucial inflation data from the US and India. Top Gainer: TRENT | Top Loser: JSWSTEEL

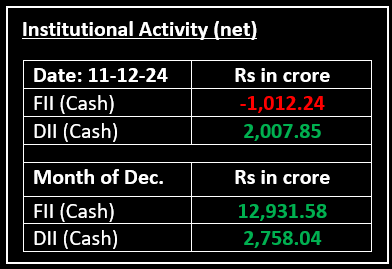

On December 11, Indian equity benchmarks closed marginally higher as investors awaited crucial inflation data from the US and India. Market participants are closely watching the US CPI report, expected to provide insights into the Federal Reserve's policy decision, with an 80% chance of an interest rate cut. Domestically, India's CPI data, due on December 12, is forecast to ease to 5.53% in November, down from October's 6.21%.

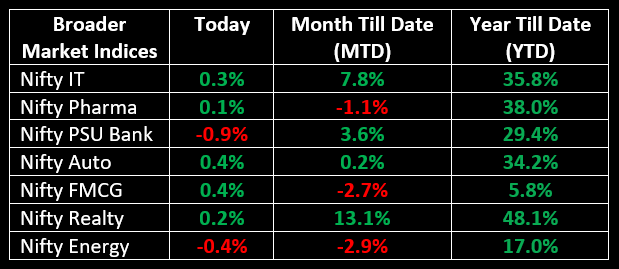

Sectoral trends were mixed today, with FMCG, Auto, and IT posting gains, while Energy and PSU Banks saw slight declines.

In the primary market, the IPO of MobiKwik was fully subscribed within hours of launch. Discover what’s driving the buzz with a detailed overview here.

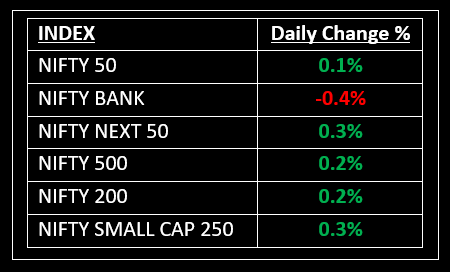

NIFTY: The index opened flat at 24,620 and made a high of 24,691 before closing at 24,641. Nifty has formed an indecisive candlestick pattern on the daily chart. Its immediate resistance level is now placed at 24,700 while immediate support is at 24,500.

BANK NIFTY: The index opened 118 points lower at 53,459 and closed at 53,391. Bank Nifty has formed an indecisive candlestick pattern on the daily chart. Its immediate resistance level is now placed around 53,650 while immediate support is around 53,000.

Stocks in Spotlight

▪ PNC Infratech: Stock jumped nearly 12% after the company earned a bonus of Rs 4.4 crore for early completion of a road project in Uttar Pradesh.

▪ Bajaj Finance: Stock gained over 2% following an investor meet where the company outlined its long-term strategy, including a pivot towards fintech and AI, aiming to save Rs 150 crore annually by FY26 through GenAI adoption.

▪ HG Infra Engineering: Stock surged over 5% after securing a letter of acceptance from the Ministry of Road Transport & Highways for upgrading the NH-227B 84 Kosi Parikrama Marg in Uttar Pradesh.

Global News

▪ Asia-Pacific markets were mixed on Wednesday, after major Wall Street benchmarks declined ahead of key inflation data that could influence the Federal Reserve’s interest rate decision.

▪ European markets were slightly higher on Wednesday, as traders digested corporate updates and awaited the latest U.S. inflation data.

▪ Oil prices climbed 1% on Wednesday as market participants anticipated a rise in demand from top importer China following Beijing’s latest plans to boost economic growth.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.