POST-MARKET SUMMARY 10 July 2023

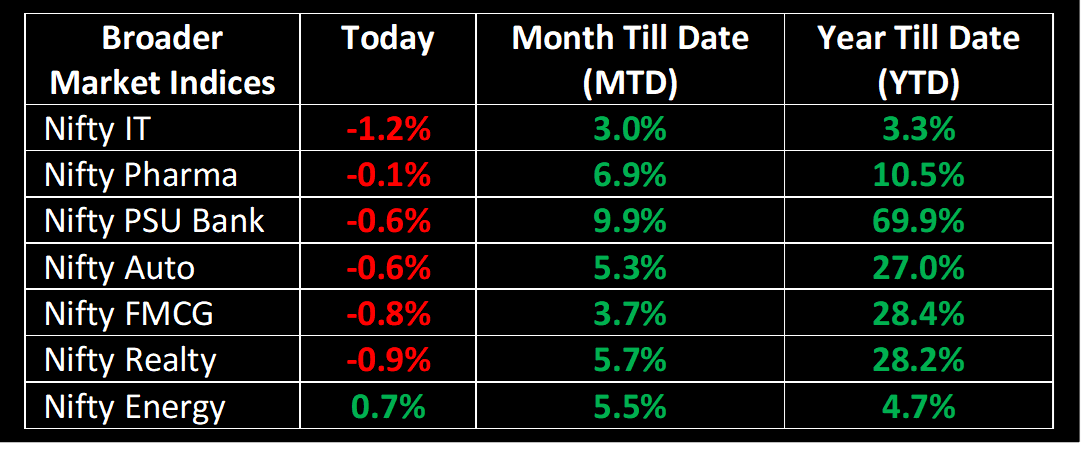

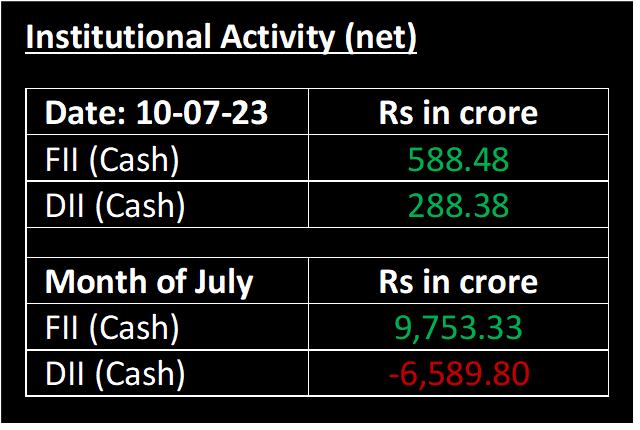

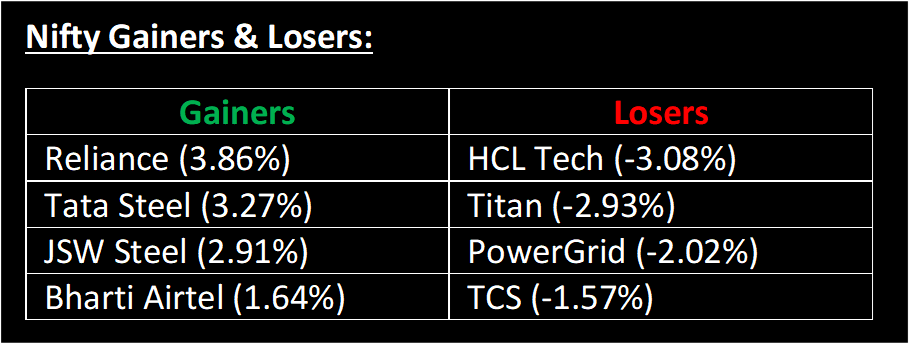

On July 10, the Indian stock market ended marginally higher amid a volatile trading session, led by index heavyweight Reliance Industries. Most sectors saw selling pressure except for metals and oil and gas. Despite a mixed global outlook, the market opened positively and continued to rise during the day. However, profit booking in the middle of the session erased the earlier gains. Although the market made a significant recovery later, it was unable to maintain the momentum and closed with a marginal rise.

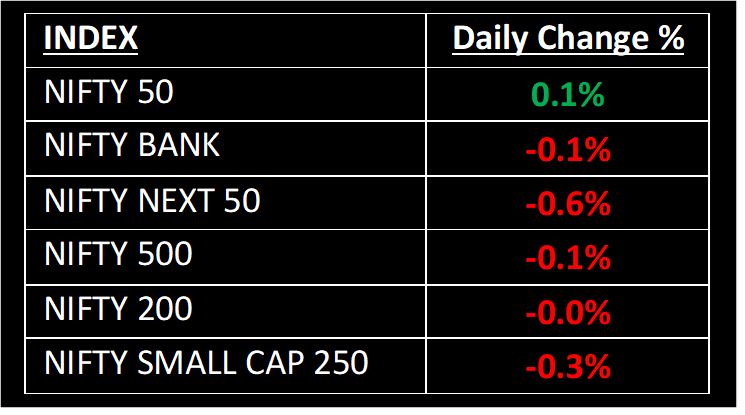

NIFTY: The index opened 69 points higher at 19,400 and made a high of 19,435 before closing at 19,355. Nifty has formed a small bearish candlestick pattern, with minor upper and lower shadows on the daily chart. It can also be looked upon as an Inside Bar kind of pattern with respect to previous day's closing candle. The index's immediate resistance level is now placed at 19,500 while immediate support is at 19,200.

BANK NIFTY: The index opened 33 points higher at 44,958 and closed at 44,860. Bank Nifty has formed a bearish candlestick pattern, with small upper and lower shadows on the daily chart. Its immediate resistance level is now placed at 45,250 while support is at 44,500.

Stocks in Spotlight

▪ Reliance Industries Ltd: Stock surged nearly 4% after the Mukesh Ambani-led oil-to-telecom conglomerate fixed July 20 as the record date for determining the equity shareholders entitled to receive shares of Reliance Strategic Investments Ltd.

▪ SpiceJet Ltd: Stock gained nearly 2% after the company announced its plan to raise fresh capital through an issue of equity shares and/or convertible securities on a preferential basis.

▪ Servotech Power Systems Ltd: Stock fell 5% after fixing July 28 as the record date for the purpose of subdivision (split) of equity shares.

Global News

▪ Pan-European Stoxx 600 was up 0.2% by early afternoon, having reversed opening losses of around 0.3%. Travel and leisure stocks added 0.7% while basic resources shed 0.9%.

▪ Asia-Pacific markets traded mixed ahead of key inflation reports this week, including the US consumer price index report due Wednesday and the producer price index on Thursday.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.