POST-MARKET SUMMARY 10 August 2023

Post-market report and news around trending stocks.

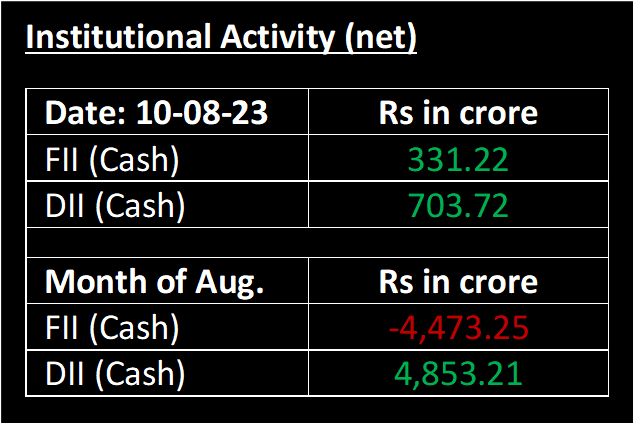

On August 10, the market reversed its gains from the previous day and ended the session in the negative territory. As widely expected, the RBI opted to keep its policy rates unchanged, maintaining the repo rate at 6.5%, and affirmed its commitment to gradually withdraw accommodation measures. However, the negative surprise in today's policy meeting was the increase in projected annual inflation rate and introduction of an additional cash reserve requirement of 10% for banks.

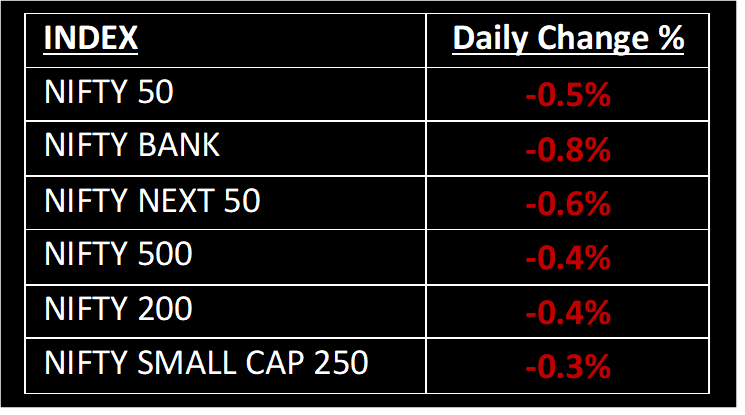

NIFTY: The index opened 27 points lower at 19,605 and made a high of 19,623 before closing at 19,543. Nifty has formed a bearish candlestick pattern with minor upper and lower shadow on the daily chart. Its immediate resistance level is now placed at 19,650 while immediate support is at 19,500.

BANK NIFTY: The index opened 83 points lower at 44,797 and closed at 44,541. Bank Nifty has formed a bearish candlestick pattern with a long upper shadow on the daily chart. Its immediate resistance level is now placed at 45,000 while support is at 44,300.

Stocks in Spotlight

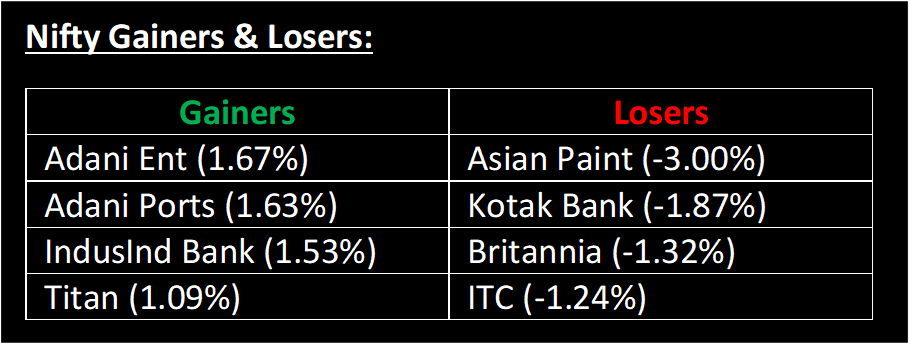

▪ Zee Entertainment Ent: Stock rallied over 16%, hitting a new 52-week high after NCLT approved its merger with Sony India.

▪ Force Motors Ltd: Stock raced 10% to hit a 52-week high and was locked in the upper circuit after the automobile company turned profitable in the April-June quarter.

▪ Thomas Cook Ltd: Stock gained 3.2% after the travel services firm swung back into the black in Q1 with a net profit of Rs 70.9 crore.

Global News

▪ European markets traded higher on Thursday as investors digested a fresh round of corporate earnings and looked ahead to a key US inflation print, which could provide hints about the Federal Reserve’s next monetary policy move.

▪ The dollar dipped against most currencies on Thursday ahead of US inflation data later in the day, though the greenback did touch a one-month high against the Japanese yen, partly on higher energy costs.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.