POST-MARKET SUMMARY 08 August 2023

Post-market report and news around trending stocks.

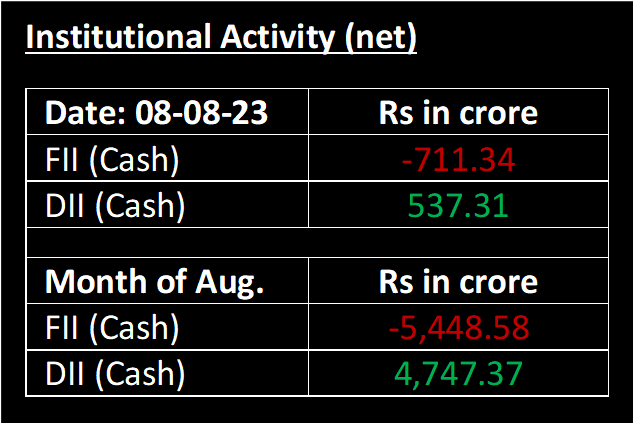

On August 8, the Indian benchmark indices retracted from the gains made in the previous session. The day's trading was marked by volatility, attributed to investor caution stemming from the upcoming Reserve Bank of India policy outcome and the impending release of significant data later in the week. The Monetary Policy Committee (MPC) of the RBI commenced its three-day meeting on this day and is scheduled to reveal its verdict on August 10. Coincidentally, August 10 also marks the release of the US Consumer Price Index (CPI) inflation figures for July.

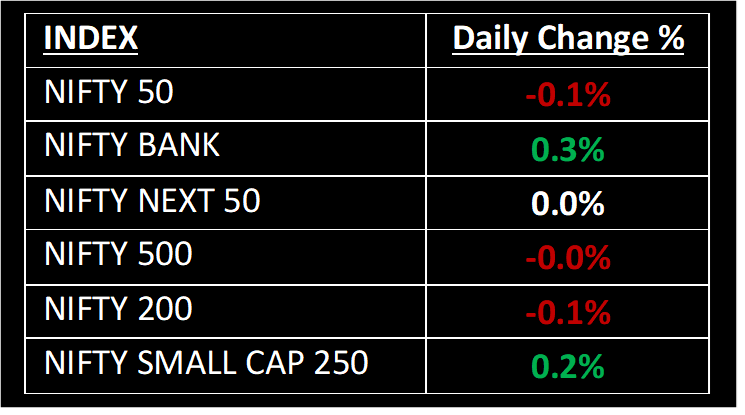

NIFTY: The index opened 30 points higher at 19,627 and made a high of 19,634 before closing at 19,570. Nifty has formed a bearish candlestick, which resembled bearish engulfing pattern on the daily chart. Its immediate resistance level is now placed at 19,650 while immediate support is at 19,500.

BANK NIFTY: The index opened 51 points higher at 44,888 and closed at 44,964. Bank Nifty has formed a small-bodied bullish candlestick with minor upper shadow on the daily chart. Its immediate resistance level is now placed at 45,150 while support is at 44,700.

Stocks in Spotlight

▪ Monte Carlo Ltd: Stock slumped nearly 11% after the company's losses widened to Rs 11 crore in the June quarter from Rs 3.9 crore in the year-ago quarter. It reported a net profit of Rs 19.8 crore in the March quarter.

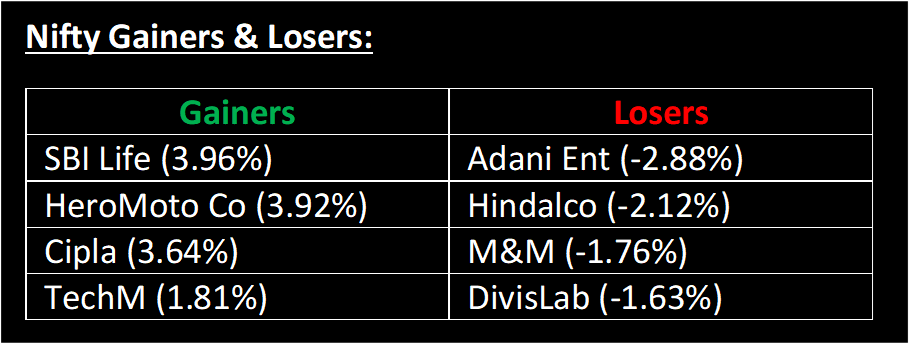

▪ Hero MotoCorp Ltd: Stock surged nearly 4% after company's announcement of receiving 25,597 bookings for the Harley Davidson X440 since it commenced bookings on July 4.

▪ Olectra Greentech Ltd: Stock nosedived over 5% after the company reported a 23% decline in revenue to Rs 216 crore in April to June quarter.

Global News

▪ European Stoxx 600 index was down 0.6% by late morning, with banks shedding 2.9% to lead losses as most sectors slid into the red. Health care bucked the trend to add 1.7%

▪ Asia-Pacific markets were mixed on Tuesday as China’s July trade came in lower than expected. China saw a 14.5% year-on-year drop in exports, while imports came in 12.4% lower year-on-year.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.