POST-MARKET SUMMARY 07 July 2023

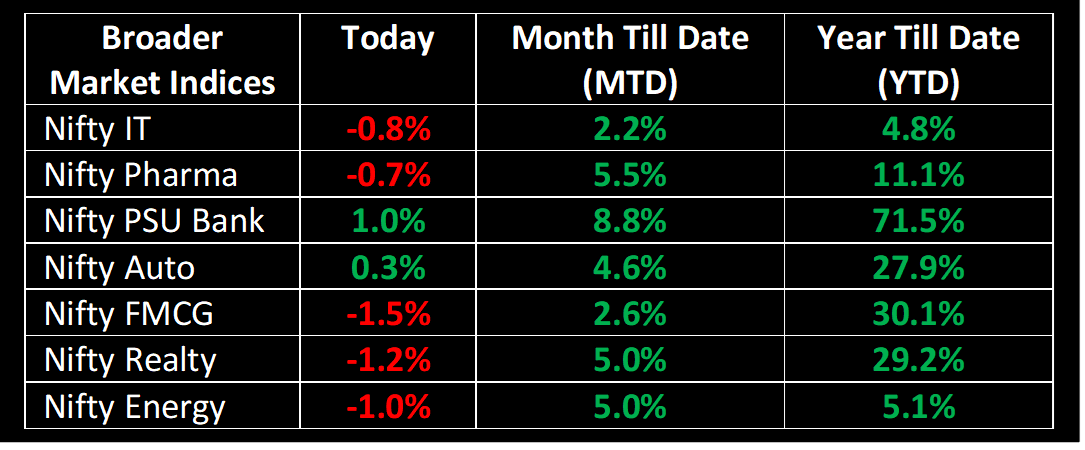

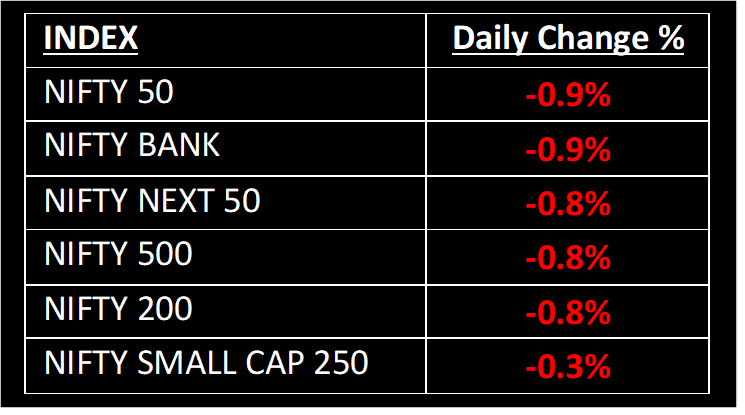

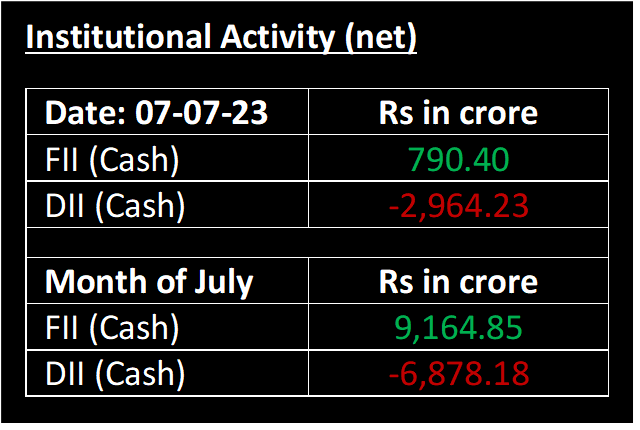

After a continuous upward trend over the past two weeks, the Nifty experienced a decline of nearly 1% on July 7, due to selling pressure. The market was influenced by profit-booking activities following a significant rally of more than 4.5% since June 26. Sectors such as banking & financial services, FMCG, and technology had a negative impact on the market performance.

NIFTY: The index opened 75 points lower at 19,422 and made a high of 19,523 before closing at 19,331. Nifty has formed a bearish candlestick pattern, with a long upper shadow on the daily chart, indicating selling pressure at higher levels. Its immediate resistance level is now placed at 19,500 while immediate support is at 19,000.

BANK NIFTY: The index opened 221 points lower at 45,118 and closed at 44,925. Bank Nifty has formed a bearish candlestick pattern on the daily chart, making a lower high formation for the third straight session. Its immediate resistance level is now placed at 45,300 while support is at 44,500.

Stocks in Spotlight

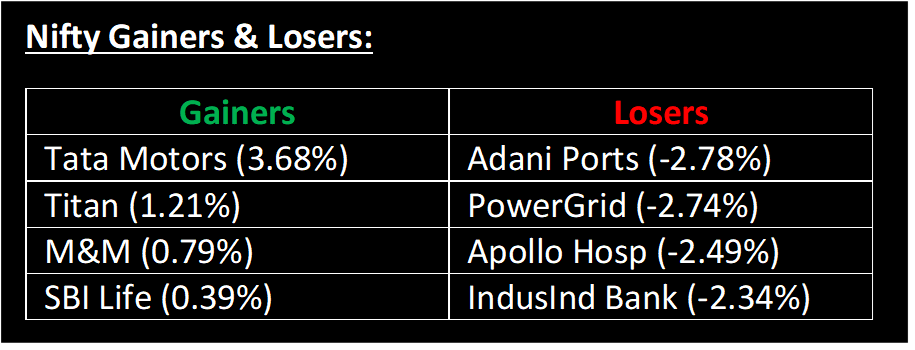

▪ Tata Motors Ltd: Stock gained 2.9% after the company reported a strong jump in its Jaguar-Land Rover sales in the April-June quarter.

▪ Olectra Greentech Ltd: Stock surged 17.96% after it bagged an order worth Rs 10,000 crore, bigger than its market cap, from the Maharashtra State Road Transportation Corporation.

▪ Ideaforge Technology: The Drone maker recorded the best performance amongst the IPOs listed since November 2021, on its debut on July 7, with a premium of 94%

Global News

▪ European Stoxx 600 index was up 0.1% in early afternoon trading, with sectors posting a mix of marginal gains and declines. Utility stocks logged the biggest losses with a 1.2% drop, while mining stocks were up 1.4%.

▪ Asia-Pacific markets marked a second day of declines after Wall Street sold off on stronger-than-expected US jobs data, leaving room for more rate hikes ahead by the Federal Reserve.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.