POST-MARKET SUMMARY 03 November 2023

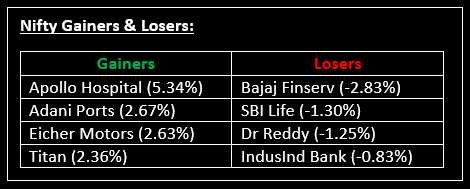

On November 3, the stock market continued its upward momentum for the second consecutive day, buoyed by favorable international market signals and strong financial results for the September quarter. Top Gainer: Apollo Hospital | Top Loser: Bajaj Finserv

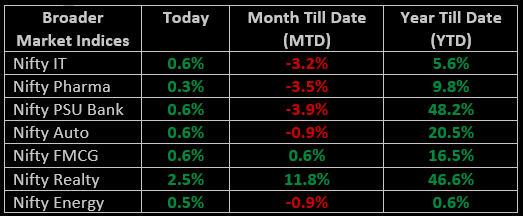

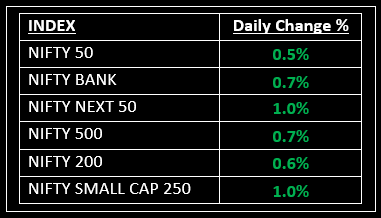

On November 3, the stock market continued its upward momentum for the second consecutive day, buoyed by favorable international market signals, strong financial results for the September quarter, and widespread buying activity across various sectors. All sectors played a part in this positive trend, with real estate, oil & gas, and banking notably recording substantial gains. The broader indices also reflected this optimistic sentiment, showing an increase in the range of 0.6% to 1%.

NIFTY: The index opened 108 points higher at 19,241 and made a high of 19,276 before closing at 19,230. Nifty has formed a small-bodied bearish candlestick pattern with an upper and lower shadow, which resembles a Spinning Top kind of pattern on the daily chart, indicating indecisiveness among bulls and bears for a firm direction. Its immediate resistance level is now placed at 19,280 while immediate support is at 19,150.

BANK NIFTY: The index opened 301 points higher at 43,318 and closed at 43,318. Bank Nifty has formed a Doji candlestick pattern for third consecutive session, indicating a tug-of-war between bulls & bears for a clear direction. Its immediate resistance level is now placed at 43,550 while support is at 43,100.

Stocks in Spotlight

▪ KPI Energy: Stock gained 5.2% after the company’s subsidiary bagged orders for 5.7 MW solar power projects under the Captive Power Producer (CPP) segment.

▪ Arvind Fashions: Stock jumped 5.8% as the fashion player entered into a share purchase agreement with Reliance Beauty & Personal Care, which will acquire Arvind Beauty Brands.

▪ Cholamandalam Investment: Stock fell 3.6% despite the company reporting a 35% on-year rise in net profit at Rs 762.49 crore for the September quarter.

Global News

▪ The dollar on Friday fell to its lowest since September after data showed the world’s largest economy created fewer jobs than expected last month, reinforcing expectations that the Federal Reserve is likely to pause hiking interest rates again at the December meeting.

▪ Gold prices gained on Friday and hovered around the key $2,000 mark as US dollar and Treasury yields slipped.

▪ Asia-Pacific markets rose at the end of the week, with investors accessing a fresh round of data for more clues on the health of business activity through the region.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.