POST-MARKET SUMMARY 03 August 2023

Post-market report and news around trending stocks.

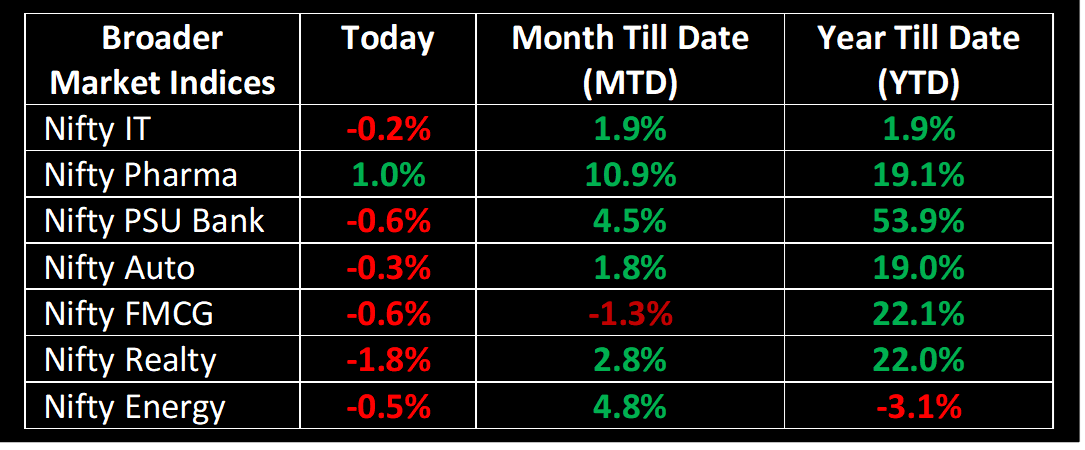

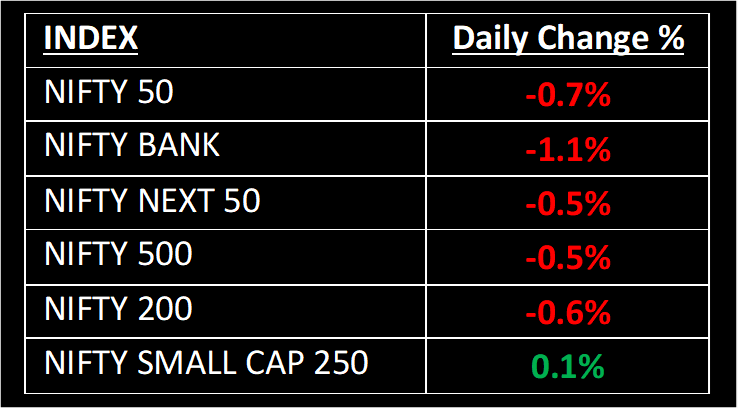

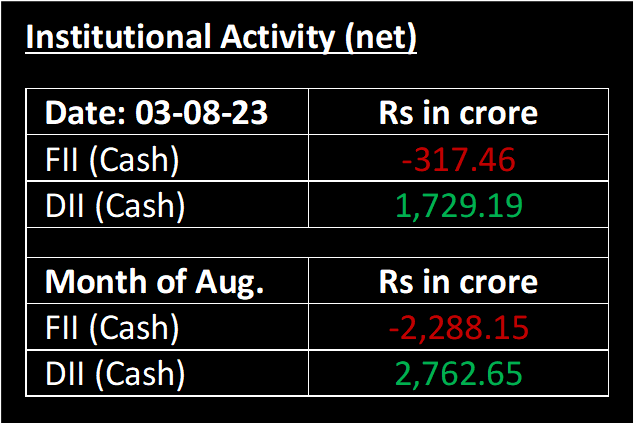

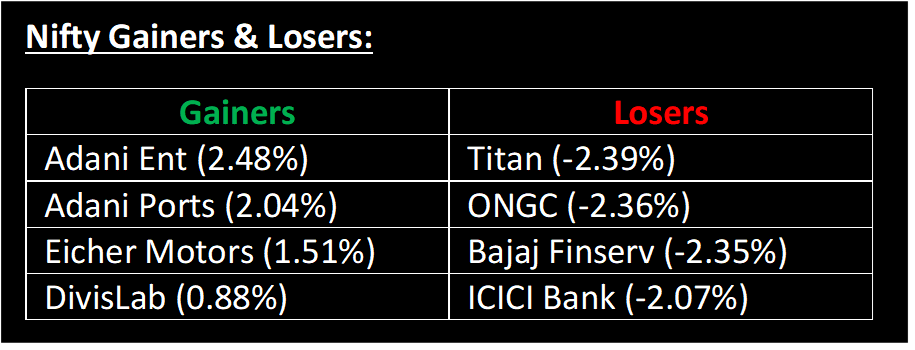

On August 3, the benchmark indices experienced a third consecutive day of losses, following the global market downturn triggered by Fitch's unexpected downgrade of the US credit ratings. Sectors such as banks, metals, oil & gas, and realty suffered significant losses, while some relief came from buying in pharmaceutical stocks, which helped to reduce overall losses. The market began the day with a gap down due to weak global cues, and profit booking extended into the second half of the trading session.

NIFTY: The index opened 63 points lower at 19,463 and made a high of 19,537 before closing at 19,381. Nifty has formed a bearish candlestick with minor upper and lower shadows on the daily chart, making lower highs and lower lows. Its immediate resistance level is now placed at 19,500 while immediate support is at 19,300.

BANK NIFTY: The index opened 133 points lower at 44,862 and closed at 44,513. Bank Nifty has formed a bearish candlestick, with minor upper and lower shadows on the daily scale. Its immediate resistance level is now placed at 45,000 while support is at 44,400.

Stocks in Spotlight

▪ Vedanta Ltd: Stock slumped nearly 7% after large deals took place on the bourses. This is the biggest single day fall since June 2022 for the metal major's stock.

▪ Gujarat Gas Ltd: Stock slumped over 3% after the city gas distribution company posted a 43.4% YoY decline in consolidated net profit at Rs 216 crore for the first quarter of 2023-24.

▪ Dixon Technologies Ltd: Stock jumped nearly 8% after the government restricted imports of electronic items such as laptops, tablets, and personal computers.

Global News

▪ Following the monetary policy announcement, the pan-European Stoxx 600 index sustained losses of ~0.65%. Tech stocks spearheaded the decline with a downturn of 1.4%, reflecting the prevailing gloomy global sentiment.

▪ Gold prices held near three-week lows on Thursday after strong US private payrolls data suggested the economy could avoid a recession, fueling bets of more monetary policy tightening and, in turn, boosting the dollar and Treasury yields.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.