POST-MARKET SUMMARY 01 January 2024

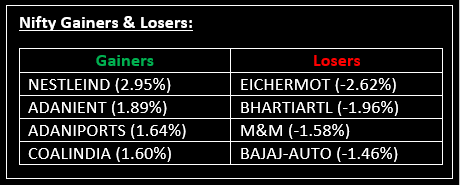

On January 1, the benchmark indices experienced a rangebound but volatile session, concluding the first day of the New Year with little change after reaching new record highs. Top Gainer: NESTLEIND | Top Loser: EICHERMOT

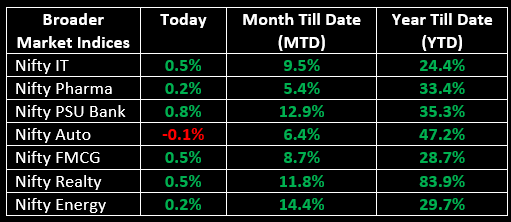

On January 1, the benchmark indices experienced a rangebound but volatile session, concluding the first day of the New Year with little change after reaching new record highs. The market commenced with slight losses and predominantly remained in negative territory throughout the session. In the final hour, a surge in buying activity propelled Nifty50 to achieve fresh record levels of 21,834.35. Nevertheless, profit booking at elevated levels nullified the gains, resulting in a marginal closing uptick. On the sectoral front, healthcare and PSU Bank witnessed a 0.5% increase each.

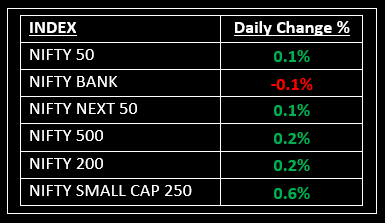

NIFTY: The index opened flat at 21,727 and made a high of 21,834 before closing at 21,741. Nifty has formed a small-bodied bullish candlestick pattern with a long upper shadow and a small lower shadow, which resembles a Spinning Top kind of pattern on the daily chart. Its immediate resistance level is now placed at 21,800 while immediate support is at 21,675.

BANK NIFTY: The index opened 89 points lower at 48,203 and closed at 48,234. Bank Nifty has formed a Doji sort of candlestick pattern on the daily chart. Its immediate resistance level is now placed at 48,300 while support is at 47,900.

Stocks in Spotlight

▪ Vodafone Idea: Stock rallied nearly 6% with strong volumes as the street awaits fundraising plans for the struggling telecom company.

▪ Bajaj Auto: Stock fell 1.5% after the company reported a 16% growth in total sales in December 2023, lagging behind analyst estimates of 25%.

▪ Yes Bank: Stock surged 4.7% after the bank received Rs 150 crore from a single trust in security receipts portfolio after the NPA portfolio sale.

Global News

▪ Gold prices gained on Friday and were headed for their best year in three, supported by expectations that the US Federal Reserve could begin easing its monetary policy as early as March next year.

▪ The dollar ended 2023 with its first loss since 2020 against the euro and a basket of currencies.

▪ Asia-Pacific markets fell on the last trading day of 2023, with China stocks being the sole exception as the country's tech companies continued their advance.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.