Weekly Market Recap | Sensex, Nifty Hit New Milestones: Check Top Gainers, Key Losers | Liquide

Discover this week's record market gains, the driving economic factors, and what lies ahead for Nifty and Sensex.

Markets reached a new milestone this week, achieving their largest two-week gains in the past five months. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly report.

New peaks!

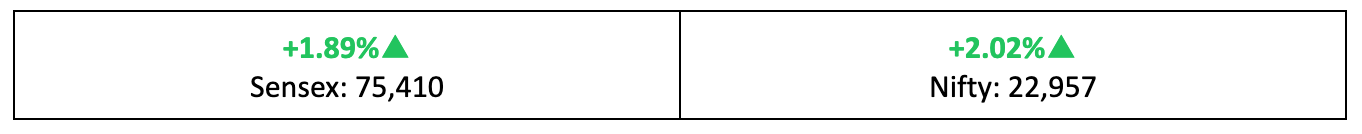

- As anticipated, the markets reached new heights this week, with the Nifty briefly topping 23,000 and the Sensex climbing over 75,000.

- In contrast to the major benchmarks, the broader markets lagged, with the BSE Mid-Cap index rising by 1% and the BSE Small-Cap index nearly unchanged.

What gives?

- Domestic markets reacted positively to the RBI's Rs 2.1 lakh crore dividend announcement, seen as an economic boost, and were buoyed by Q4 results that met expectations.

Read more: RBI’s record dividend payout announcement lifts markets

- Globally, market sentiment was tempered after the release of the Federal Reserve's meeting minutes earlier this week, which highlighted ongoing concerns about inflation and supported the 'higher for longer' interest rate narrative.

- Currently, the markets are assigning a 49.4% likelihood of a rate cut at the Fed's September meeting, down from 54.8% a week ago.

The winners

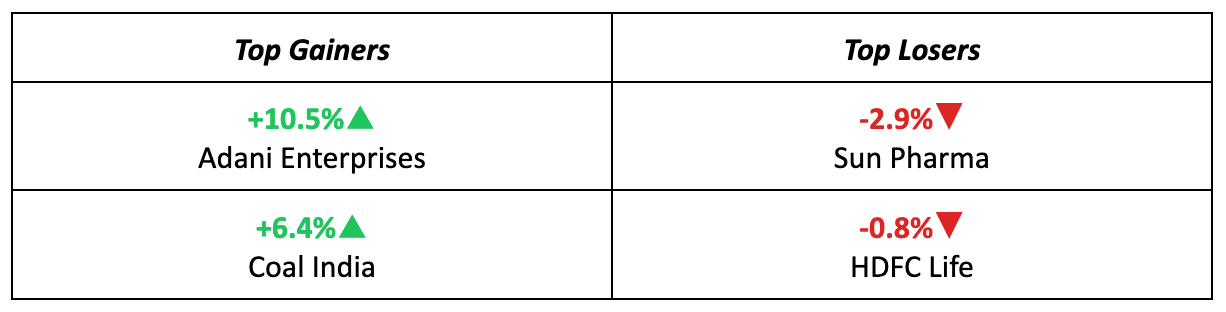

- Adani Enterprises led the Nifty50 pack with a 10.5% gain, driven by news it may replace Wipro in the upcoming BSE Sensex rejig.

- Coal India rose over 6% amid record power demand due to heatwaves, with the weather department issuing a 'red alert' for extreme temperatures, also benefiting energy and power stocks.

The losers

- Sun Pharma fell 2.9% over the week, due to a subdued outlook and guidance for only high single-digit revenue growth for FY25, which disappointed investors.

- HDFC Life slipped 0.8%, affected by declines in crucial life-insurance metrics like annualized premium equivalent (APE) and Value of New Business (VNB).

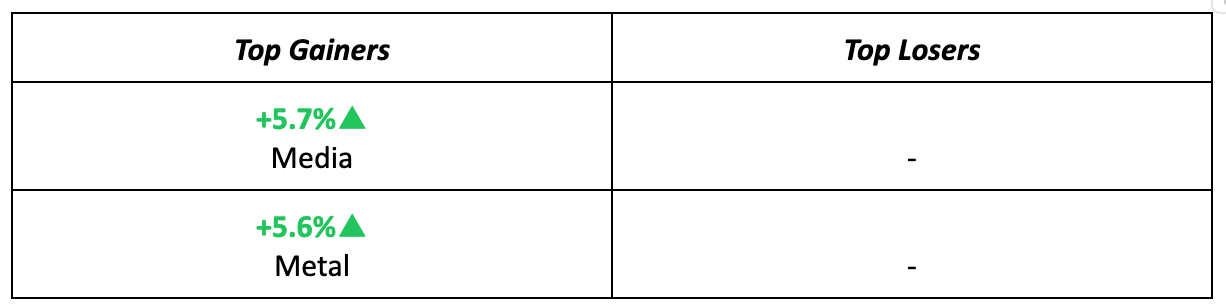

- Notably, there was no loser on the sectoral front as all sectors closed the week positively.

Meanwhile…

- US data surpassed expectations, with lower weekly jobless claims and PMIs exceeding estimates, diminishing expectations for a Fed rate cut.

- The May Flash Composite PMI for India, which measures private sector activity, registered at 61.7, slightly higher than April’s 61.5, showing robust growth momentum.

- Furthermore, the RBI Bulletin for May reports that GDP growth for Q1 FY25 is projected to be ~7.5%, surpassing the Monetary Policy Committee’s estimate of 7.1% growth for the quarter.

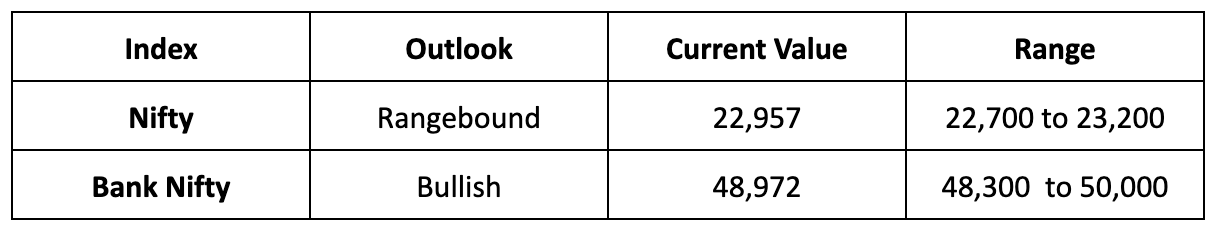

Market Brief

Market Outlook

Our take

- With the election results on June 4th, we may see reduced positions and fewer rollovers next week, potentially leading to thinner markets with no significant movements.

- Consequently, we predict the market will be rangebound, with the Nifty expected to oscillate between 22,700 and 23,300 levels.

Stay ahead in the world of finance with the most relevant business news and market updates. With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey