Liquide Market Summary 2nd February 2026

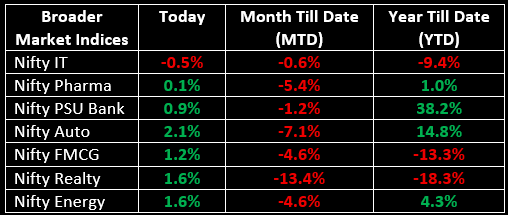

In a volatile session on February 2, Indian equity benchmarks made a strong recovery, closing higher and erasing part of the losses from the previous Budget day. Sector-wise, all sectors, except IT and Healthcare, ended in the green.

Indian Stock Market Today: In a volatile session on February 2, Indian equity benchmarks made a strong recovery, closing higher and erasing part of the losses from the previous Budget day. The Nifty ended just shy of the 25,100 mark.

The indices opened flat, tracking mixed global cues, and remained rangebound and volatile during the first half of the session. However, sustained buying interest in the latter half of the day helped the market rebound, closing near the day’s high.

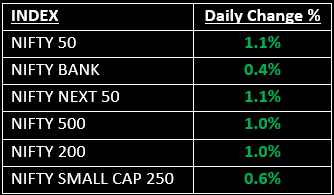

Broader indices also staged a sharp rebound from their intraday lows, with the Nifty Midcap rising by 1% and the Nifty Smallcap advancing by 0.6%. Sector-wise, all sectors, except IT and Healthcare, ended in the green.

NIFTY: The index opened 29 points lower at 24,796.50, reached a high of 25,108.10 and closed at 25,088.40. Nifty formed a long bullish candle with a lower shadow. Its immediate resistance level is now placed at 25,200 while immediate support is at 24,900.

BANK NIFTY: The index opened 178 points lower at 58,239.30, reached a high of 58,687.05 and closed at 58,619. Bank Nifty also formed a bullish candle with a long lower shadow. Its immediate resistance level is now placed at 58,900 while immediate support is around 58,250.

Stocks in News

- Power Grid Corp: Stock surged nearly 8% after the company raised its FY26 capex guidance to ₹32,000 crore from ₹28,000 crore.

- Campus Activewear: Stock jumped nearly 7% after the company's Q3 profit rose 37% to ₹63.7 crore, with a 14% YoY revenue growth to ₹588.6 crore.

- UPL: Stock rose more than 5% after the company reported a 12% YoY revenue increase to ₹12,269 crore in Q3, surpassing the expected 5% growth. EBITDA for the quarter also grew 13% YoY to ₹2,433 crore.

Other News

- Asian markets tumbled on Monday, as a collapse in precious metals spilled over into equities, triggering widespread selling across many of the top-performing stocks of the past year.

- European markets were flat, with losses in commodity-linked stocks offset by gains in consumer staples. Investors also assessed earnings reports to gauge corporate Europe's health.

- Oil prices fell 5% after U.S. President Donald Trump stated that Iran was "seriously talking" with Washington, suggesting a de-escalation of tensions with the OPEC member, easing concerns over potential supply disruptions.

- Gold and Silver prices declined as higher CME margin requirements added to selling pressure, following last week's selloff triggered by Kevin Warsh's Federal Reserve chair nomination.

This document has been issued by Liquide Solutions Private Limited for information purposes only and should not be construed as

i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or

ii) an offer to sell or a solicitation or an offer for the purchase of any of the baskets of Liquide Solutions; or

iii) investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment, or investment strategies that may have been discussed or referred to herein and should understand that the views regarding future prospects may or may not be realized. In no event shall Liquide Life Private Limited and/or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information/opinion herein.

With Liquide, you can explore stocks, trade securely in your own broker account, and receive expert-recommended trade setups. Stay updated with real-time tracking, market commentary, and AI-powered insights from LiMo, our intelligent bot. Whether you're a seasoned investor or a newbie, Liquide provides the tools you need to discover your next big investment opportunity. Download the app now from Google Play Store and Apple App Store to revolutionize your investment journey. Don't miss out on the chance to level up your investing game with Liquide.