Budget 2024: New Tax Changes Set to Reshape Trading Dynamics – Here’s What You Need to Know!

Discover the latest tax revisions from Budget 2024 and their significant impact on trading strategies. Learn how increased STT and capital gains taxes could reshape your investment approach.

Just one day after the unveiling of the Union Budget, the Indian financial community is buzzing with debates over the substantial tax hikes announced by Finance Minister Nirmala Sitharaman. With substantial tax revisions now in place, investors and traders are keenly analysing the potential impact on their portfolios. Here's a closer look at the critical changes and what they mean for your trading strategy.

Major Hike in STT

One of the significant updates includes an increase in the Securities Transaction Tax (STT), which is levied regardless of whether a trade is profitable or not. For options traders, the STT rate has jumped from 0.0625% to 0.1%. Futures traders aren't left behind, with their rates moving up from 0.0125% to 0.02%.

These changes affect the breakeven point for derivative trades, making it tougher for traders to achieve profitability. This uptick means higher costs upfront for traders, especially those dealing in futures and options.

Assessing the Financial Impact of Tax Changes on Trading

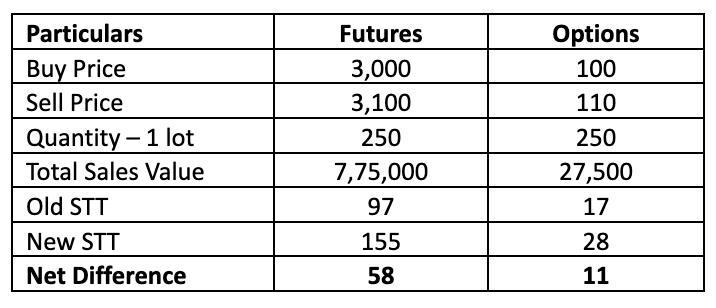

To understand the practical implications, let’s analyse how these changes affect trades using Reliance Industries as an example:

This represents a notable surge in trading costs, especially for futures contracts where the financial impact could prompt a shift in trading strategies, potentially favouring more positional trades over intraday or scalping activities.

Further calculations reveal the STT effects across various futures markets:

- The STT for selling 1 lot of Nifty Futures has risen from approximately Rs 77 to Rs 123, an increase of Rs 46.

- For Bank Nifty futures, the cost impact has escalated by Rs 57.

- Similarly, futures of Sensex, Finnifty, and Midcap Nifty indices, previously costing around Rs 100, Rs 72, and Rs 77 per lot respectively, will now incur charges of Rs 160, Rs 115, and Rs 123.

Revised Capital Gains Tax Structure

The Budget also modified the capital gains tax structure:

- Long-Term Capital Gains (LTCG) on financial and non-financial assets have risen from 10% to 12.5%.

- Short-Term Capital Gains (STCG) taxes have increased from 15% to 20%.

These tax adjustments are crucial for investors to consider, potentially affecting decisions on asset holding periods and investment strategies.

Expert Insights on Market Adaptations

For further insights into how these tax changes could affect the market and trading strategies, don’t miss the interview with Kunal Ambasta, Co-founder and Chief Investment Officer at Liquide, as he rates this budget and discusses its implications. Read Kunal’s full interview here.

Stay tuned to our blog for more updates and expert analysis on how the latest financial developments could impact your investment strategy. Adjust your trades wisely in response to these tax changes and stay ahead in the evolving financial landscape. Available on both Google Play Store and Apple App Store, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download today and enhance your financial journey with Liquide's cutting-edge features.