2023 Boom to 2024 Promise: An Insightful Look at India’s Stock Market's Performance

Explore India's 2023 stock market journey and 2024 outlook, with insights on Nifty's performance, sectoral gains, and investment strategies.

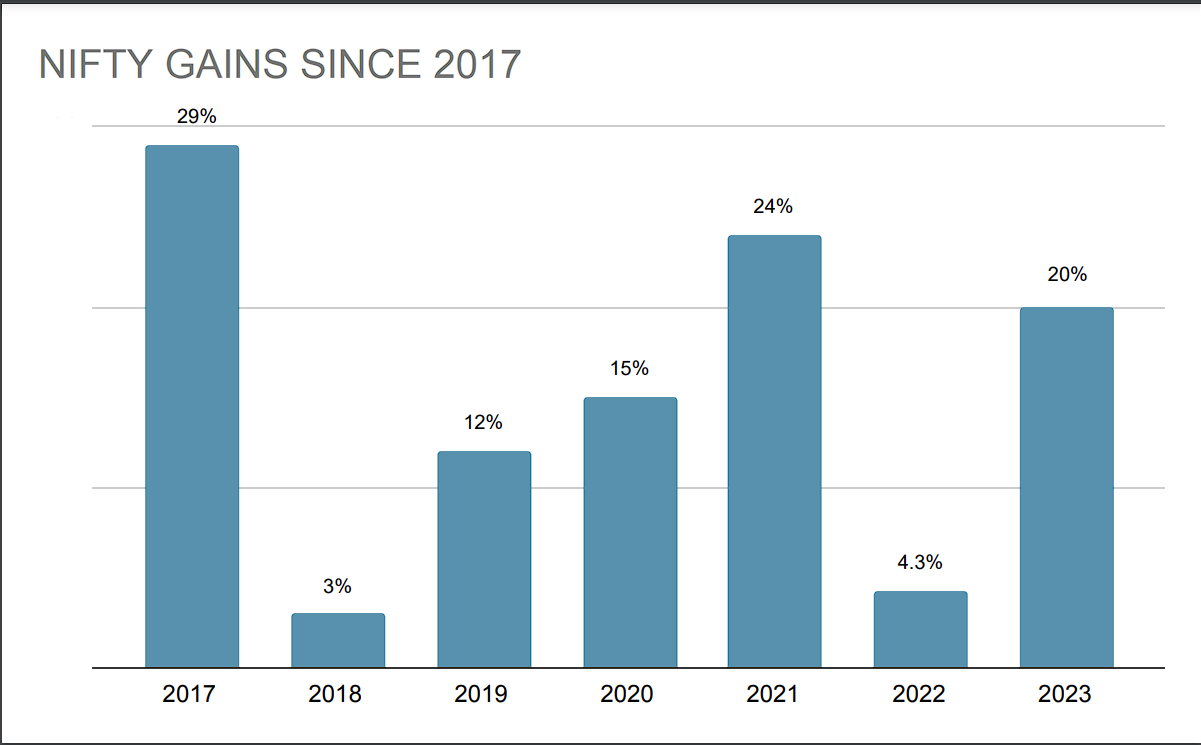

2023 marked a prosperous period for global stock markets. However, even with a near 20% annual return, the performance of Indian stock markets was relatively modest compared to international counterparts like Japan's Nikkei 225, Germany's DAX, and the US's S&P 500 and NASDAQ.

Yet, what sets the Indian stock markets apart is their unique trajectory compared to other global markets. While many international markets experienced a slowdown as the year progressed, India's markets gained momentum. The major gains in markets like the US, Japan, and Korea were concentrated in the first half of the year, in contrast to India's Nifty 50, which accelerated in the latter half. This late surge signals a promising outlook for the Indian stock markets as we head into 2024.

2023: A Year of Record-Breaking Gains and Resilience in Indian Markets

- While the Nifty 50 saw a respectable 20% increase this year, the real excitement unfolded in the broader market segments. The Nifty Midcap index soared by 46.5% in 2023, achieving its most successful year since 2017, and the Nifty Smallcap index climbed 55%, marking its highest annual gain since 2017 as well.

- Nifty Bank continued its upward trend for the third consecutive year, though its 12% gain was comparatively modest. 2023 witnessed gains across all sectoral indices, with the spotlight shining on Public Sector Undertaking (PSU) stocks. The PSU index skyrocketed by 81%, registering its best annual performance since 2007.

- Almost all stocks in the Nifty index, with the exception of Adani Enterprises and UPL, yielded positive returns in 2023. Leading the charge were Tata Motors, NTPC, Bajaj Auto, L&T, Coal India, Hero Motocorp, and Ultratech Cement as the top performers.

- The Nifty Midcap index advanced for the fourth year in a row, with REC and PFC standing out as the biggest mid-cap gainers, each surging by 250%.

- Nifty Realty emerged as the top sector for the year 2023, up over 81% followed by Auto and Pharma with returns of 48% and 34%, respectively.

- Despite foreign investors withdrawing Rs 14,653 crore from the cash market, the resilience of the markets was upheld thanks to robust investment by domestic investors through systematic investment plans (SIPs), which repeatedly hit new highs. In total, domestic investors infused nearly Rs 1.7 lakh crore into the market this year.

2023 proved to be a successful year for users of 'Liquide One' too! On average, Liquide One subscribers yielded a 7.2% greater return on their investments compared to Nifty50.

Overcoming Early Challenges: India's Economic Resilience in 2023

Reflecting on 2023 as it draws to a close, it's astounding to see the unexpected yet impressive returns for equity investors. At the year's outset, fears of a looming recession were sparked by multiple global interest rate hikes, including those in the US and India. However, the year took a surprisingly positive turn.

India demonstrated robust economic fortitude, outperforming growth expectations with an impressive 7.6% GDP increase in Q2, surpassing the Reserve Bank of India's initial projections. Despite facing early challenges, such as disruptions in US banks and a significant sell-off in the Indian equity market due to the Hindenburg report, the Indian banking sector stood strong through these fluctuations. As 2023 comes to an end, the economic situation seems ready for a smooth transition, marked by controlled inflation and setting up an environment favourable for possible interest rate adjustments that could stimulate further growth.

The equity market's performance reflected this narrative, beginning with a challenging first quarter where equity indices saw negative returns. However, a significant shift occurred in the following nine months. This surge was supported by significant fiscal measures, including increased budgetary capital expenditure and a move towards self-sufficiency in defence, thereby exceeding budget forecasts.

Market Outlook for 2024

Despite an overall positive outlook, 2024 looks to be a year of volatility with key events such as elections in India and the US, potential shifts in central banks' monetary policies, China's economic slowdown and ongoing geopolitical tensions in various parts of the world. Considering that positive cues are already reflected in these valuations, we anticipate a ~6-8% increase in the Nifty index from its current levels in the mid-term.

Currently, India's economy is showing promising signs of consistent growth, affecting all major sectors. In terms of themes, we are looking at infra, power, banking and auto with much zeal for the next year. The same is reflected in the picks for our flagship “India Growth” wealth basket and we expect it to perform optimally even with the lingering uncertainties in the market.

Despite the Reserve Bank of India's monetary tightening policies, the Indian economy has remained steadfastly resilient. With two successive quarters registering growth above 7.5%, it's anticipated that the financial year will conclude with a 7% growth rate, maintaining India's position as the fastest-growing major economy. The International Monetary Fund (IMF) has even predicted India to be one of the global economy's "star performers," expected to contribute 16% to worldwide growth.

The year 2024 is poised to usher in political stability and a decrease in interest rates, which is likely to boost private capital expenditure. With a forecasted decline in interest rates, U.S. yields might reduce more rapidly than Indian treasuries. This shift is expected to broaden the yield gap, making emerging market equities, including India, more attractive to foreign investors. The anticipation of lower interest rates has already started channelling more focus towards equity investments, marking a positive shift in investment trends.

Anticipating Headwinds: Navigating 2024’s Challenges

As we embark on the journey towards 2024, the transformation of the economy from one driven by expectations to one grounded in solid fundamentals is crucial. The impressive returns of 2023 were largely based on anticipatory factors – the prospect of political stability post the general elections in 2024, influenced by the ruling party's strong performance in this year's assembly elections; the expectation of interest rate cuts by the US Federal Reserve, following their dovish stance; and the hope for controlled inflation. However, potential shocks in these areas could lead to notable market adjustments.

On a global scale, geopolitical tensions continue to linger. The US economy, while resilient, contrasts with the European economy, which is grappling with the effects of stringent monetary policies. China's economy, with its fluctuating performance and ongoing real estate downturn, presents a mixed picture. While export demand is expected to rise, reaching pre-pandemic levels might take some time. Interestingly, the slowdown in China's economy could help regulate global crude and commodity prices, potentially benefiting India in the process.

Concluding Thoughts

Despite these challenges, India's economic growth has been commendable. However, the upcoming year could be challenging in terms of living up to these expectations. Much of the anticipated returns for 2024 have already been factored in, suggesting that investors might need to recalibrate their expectations for the coming year.

As we celebrate the achievements of 2023, it is essential to approach 2024 with a level-headed perspective. The Indian market is poised for a year that promises both potential and challenges. As we step into the New Year, let's prepare for a period defined by cautious optimism and thoughtful investment strategies.

Also Read: Smart Investment Strategies for 2024

Here's to a Happy New Year and wishing you the very best for 2024!