Weekly Market Recap | Market in Turmoil: Top Stocks to Watch This Week

Global markets took a hit after fresh US tariffs reignited trade war fears. While Nifty dropped 2.6%, stocks like Tata Consumer and IndusInd Bank stood tall. Here’s your weekly market outlook with stocks to watch, sector trends and expert insights.

Weekly Recap

D-Street witnessed a Trump-induced bloodbath last week, ending a two-week winning streak. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Deep in the Red

- Domestic indices fell sharply last week, mirroring global markets, as investor sentiment soured globally. Fears of a trade war resurfaced after US President Trump announced reciprocal tariffs, triggering a broad sell-off and renewed concerns of an economic slowdown.

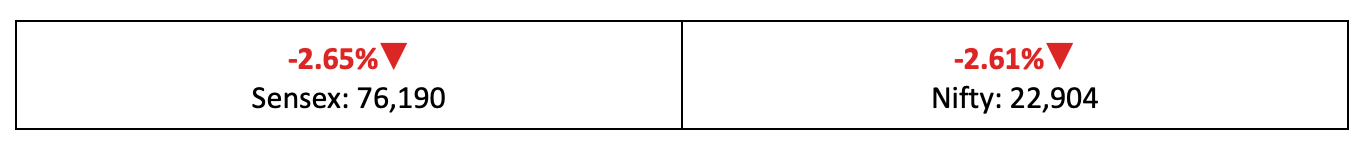

- The Nifty dropped 2.61% over the week. In the broader market, the BSE Large-Cap and Mid-Cap indices fell 2.5% each, while the BSE Small-Cap index declined 1.6%.

- Volatility expectations also surged globally, with the India VIX fear gauge rising 8.2% from last Friday’s levels.

“Liberation” day?

- It was clear that global equity markets were not convinced by the Trump administration’s talk of “Liberation Day” on Wednesday, especially with eye-watering tariffs being imposed by the US.

- Friend or foe, nearly every country was hit with tariffs — with Asia facing the steepest ones (China’s cumulative total is over 60%). India is facing tariffs of up to 27%.

- Also read: US Tariff Impact: How to Trump-Proof Your Portfolio.

The Winners

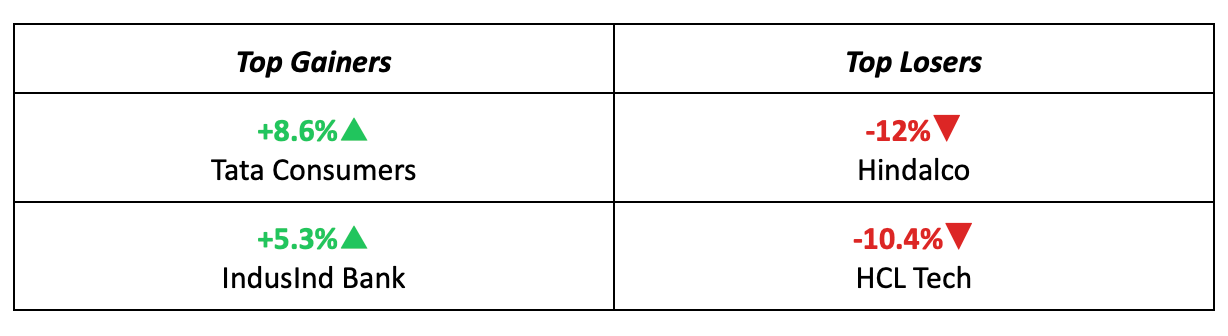

- Tata Consumer Products was the week’s top performer, with the stock surging 8.6% after Goldman Sachs upgraded it to a “Buy” rating, citing improving financials.

- Recently beleaguered IndusInd Bank claimed the runner-up spot, rising 5.3% on value buying at attractive valuations, as the negative news cycle surrounding it began to settle.

The Losers

- Metal major Hindalco sank like an anvil along with its peers, plunging 12% on growth concerns stemming from the now all-but-certain global trade war.

- HCL Technologies and other IT majors also had a rough week, as investors dumped the cyclical sector amid growing fears of a recession in the US and the global economy.

Meanwhile…

- Services activity slowed slightly toward the end of the fiscal year, with the activity index dipping to 58.5 in March from 59 in February.

- In positive news for the digital payments sector, UPI transactions reached a record high in March, touching Rs 24.77 lakh crore for the month.

Brief

Key Indices

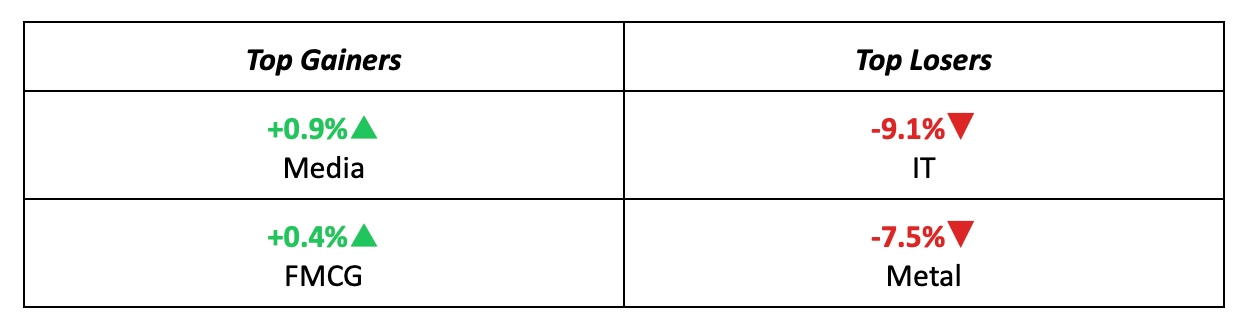

Sectors

Stocks

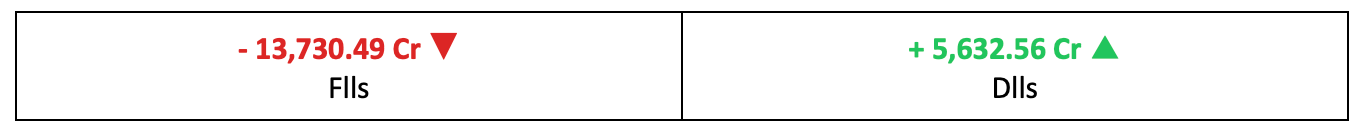

Other Key Data

Market Outlook

Sectors To Watch:

Our take

- It’s been a whirlwind week for investors, with trillions wiped off global markets as the tariff war drags on. All eyes are now on how trade partners respond — any countermeasures could stir up more uncertainty.

- For India, the hit is relatively softer, with lower tariffs than most of Asia. Hopes now rest on positive developments from ongoing India–US bilateral trade negotiations, which could offer some market support.

- Investor focus is also turning to the upcoming MPC meeting, with the key interest rate decision expected next week — a crucial trigger for market sentiment.

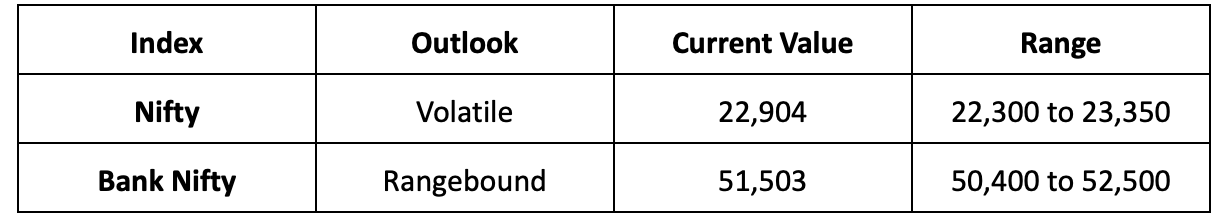

- With a packed-week ahead, the Nifty is expected to stay volatile, likely swinging between 22,300 and 23,350 levels. We’re keeping a close eye on FMCG, banking, and financial sectors this week.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.