Weekly Market Wrap: Nifty Slumps 2.4%, IT Shines Amid Market Chaos

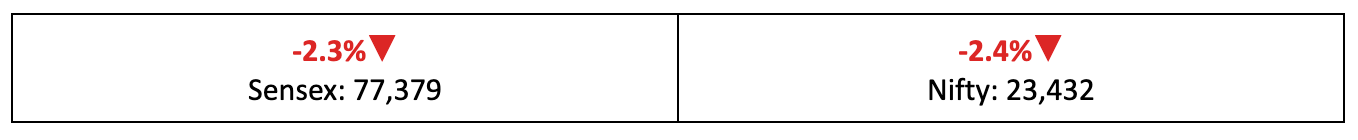

Markets had their sharpest weekly decline in a month, with Nifty dropping 2.4% and volatility surging 8.6%. Discover key insights, sector winners, and our market outlook for the week ahead.

Markets recorded their biggest weekly fall in nearly a month, with both benchmark indices falling over 2% each. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Weekly Recap

Deep in the red

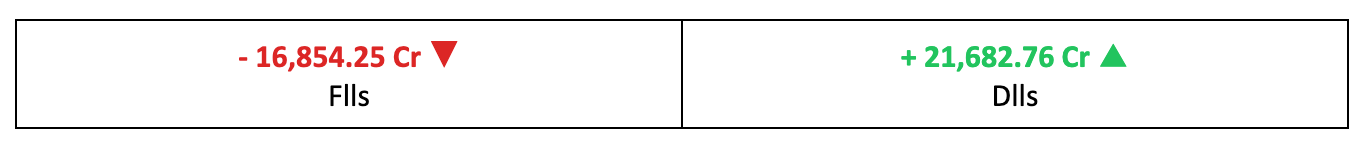

- Investors had a tumultuous week as mixed global market trends, weak Q3 earnings projections, persistent FII outflows, and concerns about India’s economic slowdown weighed heavily on sentiment.

- By Friday’s close, the Nifty had dropped over 2.4% compared to the previous week’s close, while the India VIX, the volatility index often referred to as the “fear gauge,” surged by over 8.6%.

- The damage was even more pronounced in broader markets, which recorded their steepest declines in over two months. The BSE Large-cap index slipped 3.2%, the BSE Mid-cap index dropped 5.7%, and the BSE Small-cap index tumbled 6%.

Déja vu

- Think back to March 2020, when global markets were rattled by a sharp sell-off driven by fears of the Covid pandemic. This time, it’s the rising cases of HMPV sparking panic and triggering a wave of profit-booking among investors.

- Combine this with a fragile global macroeconomic environment in a politically uncertain 2025 and disappointing Q3 business updates at home, and you get the perfect storm that led to last week’s widespread market sell-off.

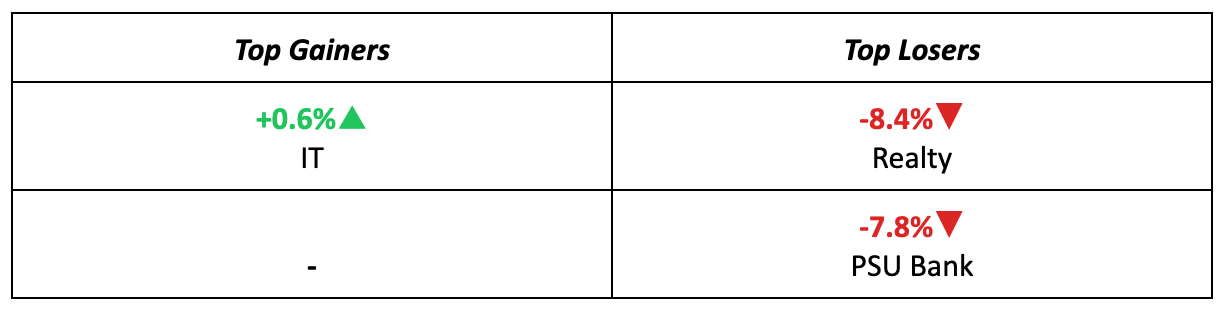

The winners

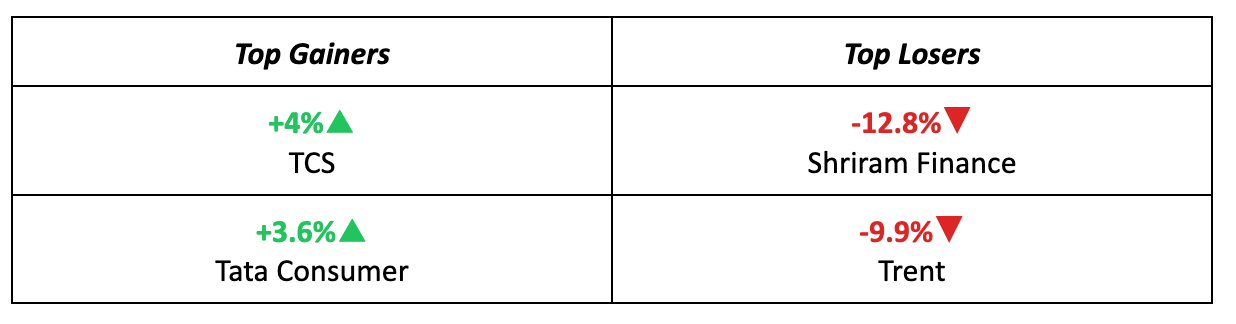

- Despite a challenging week, the IT sector stood out as a silver lining, with TCS taking center stage. The stock delivered an impressive 4% weekly return to investors.

- The rally was fuelled by strong Q3 results, as the IT giant met D-Street expectations. For a detailed breakdown, read: TCS Q3FY25 Results: Profit, Margins Meet Expectations.

The losers

Last week saw significantly more losers than winners, with Shriram Finance topping the list. The stock plunged 12.8%, driven by the stock split that took effect on Friday.

- Close behind was Trent, which dropped 9.9%, weighed down by subdued demand in the retail sector, sparking concerns about potential revenue growth challenges.

Meanwhile…

- On a brighter note, India’s IIP growth hit a six-month high of 5.2% in November, driven by a significant 9% increase in capital goods and a 13.1% jump in consumer durables, reflecting strong festive demand.

- In contrast, Chinese markets struggled last week, weighed down by concerns over a potential second Trump administration and intensifying deflation fears.

Market Brief

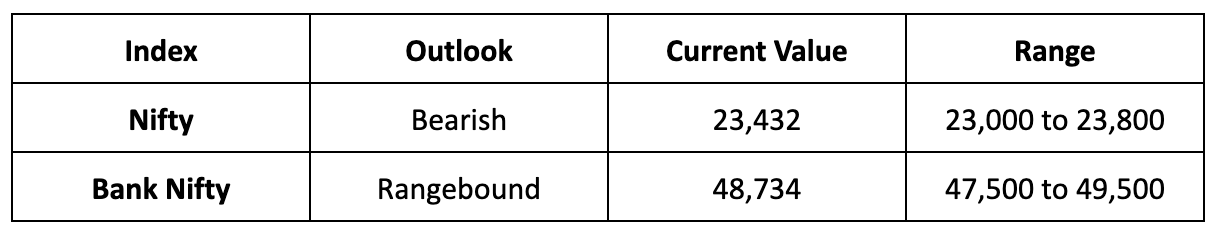

Market Outlook

Our Take

- Markets world over remain clouded by uncertainty as investors await clarity on whether a potential second Trump term will bring a more measured or aggressive policy approach. In the meantime, a cautious, wait-and-watch sentiment is expected to dominate.

- On this basis, we anticipate bearish trends to persist on D-Street in the near term, with the Nifty likely to trade within a range of 23,000 to 23,800 next week. However, stock-specific movements may pick up pace, fuelled by December quarter business updates from companies.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.