Stock Market Weekly Recap: War Tensions, Top Gainers & Market Outlook

In this week's stock market recap, we explore the impact of escalating India-Pakistan tensions, key winners like Tata Motors and Titan and top losers such as Sun Pharma. Get insights on global market trends, sector performance and expert predictions on what lies ahead.

Weekly Recap

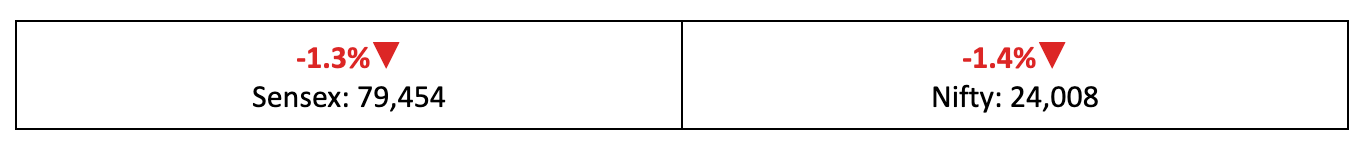

Markets broke their three-week winning streak, with benchmark indices dropping over 1% amid rising war tensions between India and Pakistan. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

On a War Footing!

- Last week, the Nifty couldn't escape the war jitters, closing 1.4% down as investors pulled back, bracing for potential military escalations.

- Among the broader indices, the BSE Large-cap index fell 1.5%, the BSE Mid-cap Index dropped 1.4% and the BSE Small-cap index slipped 1.3%.

- The India VIX, our fear gauge, understandably spiked by 18.5%, continuing its upward trend since the Kashmir developments on April 22.

The Big Picture

- Last week, investors had a lot on their plate, juggling everything from wars and geopolitics to trade deals and ongoing earnings reports for the past quarter.

- In more positive news, the UK and India struck a landmark trade agreement, which could boost bilateral trade by $34 billion a year by 2040.

- On Thursday, the US and UK announced a limited trade deal, maintaining Trump’s 10% tariffs on British exports, expanding agricultural access for both nations and reducing U.S. duties on British car exports.

The Winners

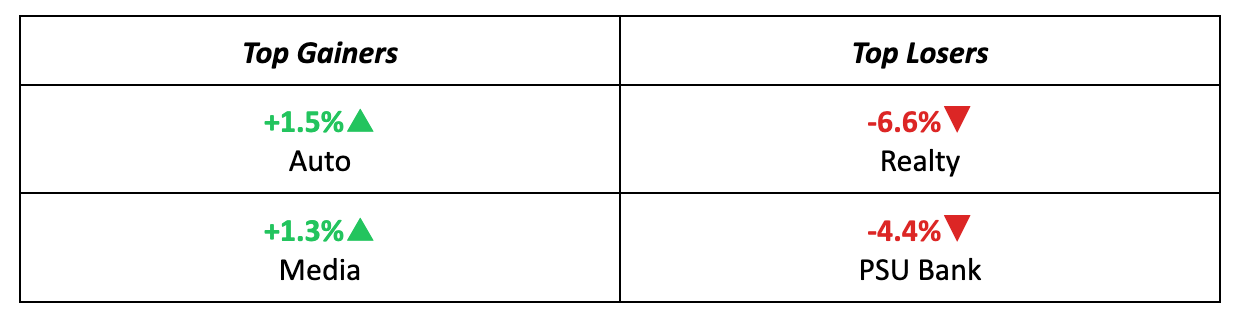

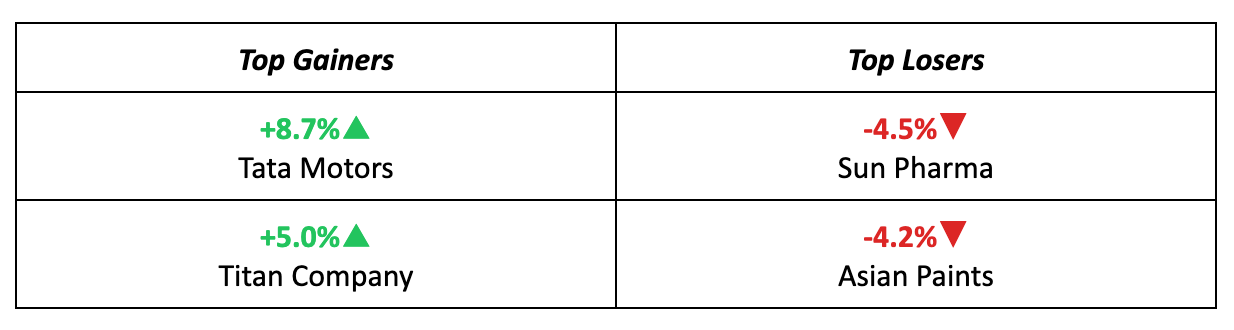

- Tata Motors came out on top with the new UK-US trade deal, as the parent company of Jaguar Land Rover saw an 8.7% jump over the week.

- Titan also had a solid week, with its strong Q4 earnings report driving a 5% rise in stock value, thanks to reassuring growth in net profit and revenue.

The Losers

- Sun Pharma (down 4.5%) and other pharma giants took a hit as the Trump administration pushed for more US-based drug manufacturing.

- Asian Paints had a tough quarter, with net profit dropping 45% and volume growth sluggish at just 1.8%. Its stock slipped 4.2% last week.

Meanwhile…

- The US Federal Reserve kept interest rates unchanged, while the Bank of England’s monetary policy committee cut base rates by 25 bps to 4.25%, aiming to ease the economic strain from growing uncertainty.

- The US and China are set for a new round of trade talks in Switzerland, with Wall Street cautiously optimistic about a potential easing of the trade tensions between the two nations.

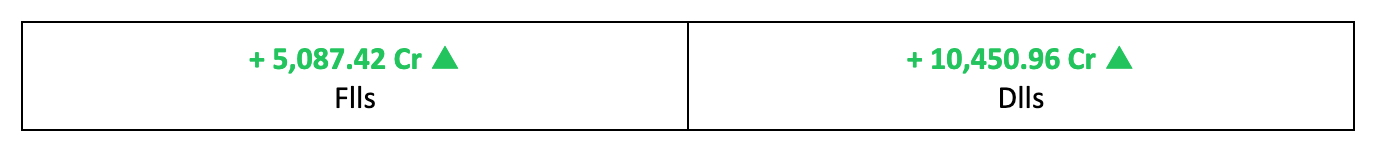

Market Brief

Market Outlook

Our Take

- Last week, all eyes were on the escalating tensions between India and Pakistan, and with the threat of war still looming, market volatility is expected to persist.

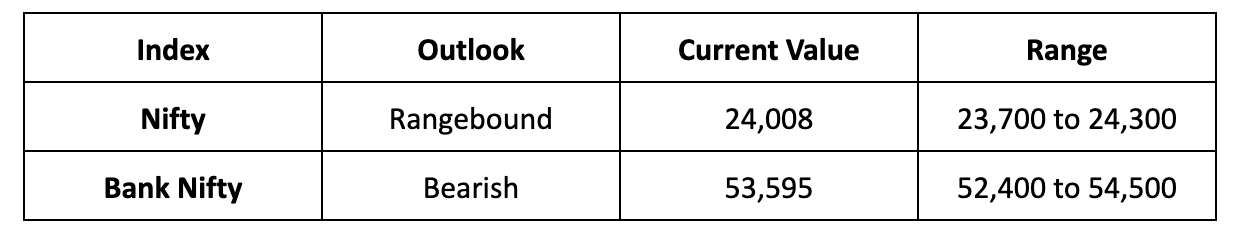

- We anticipate the Nifty will remain rangebound next week, fluctuating between 23,700 and 24,300 levels, as investors closely monitor military movements.

- In these uncertain times, traders should keep positions light while investors should stay selective and focus on sectors and stocks with strong earnings and positive management guidance.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.