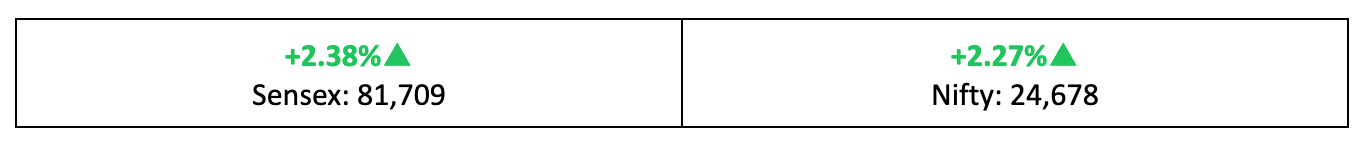

Weekly Market Recap: Bulls Charge as Nifty Surges 2.27%

Markets extended their rally with Nifty surging 2.27% in its best week in six months. Discover what drove the markets, key winners and losers, and the outlook for the coming week.

Markets extended their rally for the third consecutive week, posting their biggest weekly gain in six months. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Weekly Recap

Bulls Charge!

- Bullish sentiment prevailed on D-Street last week, pushing the Nifty up 2.27%, driven by positive global cues, FII inflows, falling crude oil prices, and an in-line RBI policy announcement.

- Except for a short spike on Thursday, the India VIX trended downwards, signalling easing nerves over the short-term outlook.

What went right?

- Globally, optimistic remarks by the US Fed about the resilience of the economy improved investor sentiments, driving Wall Street to record highs.

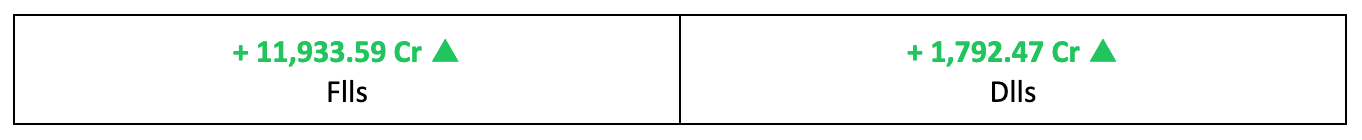

- At home, investor confidence was bolstered by a shift in Foreign Institutional Investors (FIIs) returning to India, anticipating a dovish monetary stance from the RBI, although the repo rate was ultimately left unchanged.

- Also read: RBI Cuts CRR by 50 bps | Positive for Banks

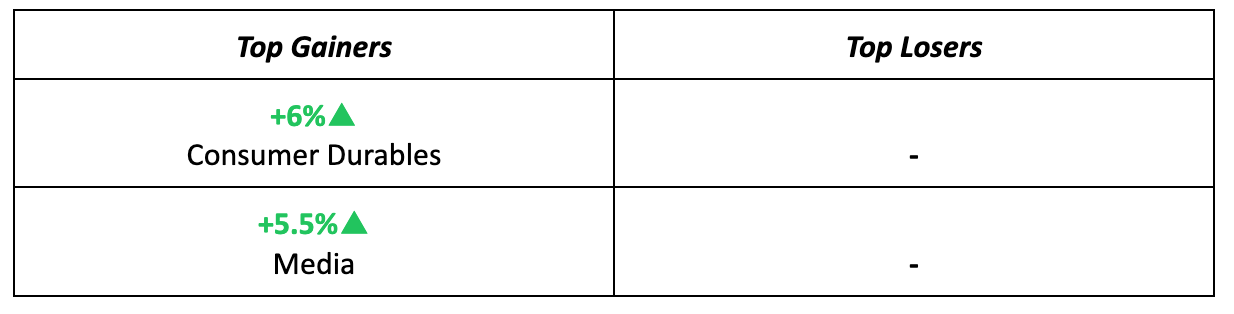

The winners

- Titan was the week’s top winner, whose stock price surged following reports of Tanishq piloting De Beers machines in its stores, coupled with investor confidence in market premiumization.

- Apollo Hospitals also gained traction, receiving positive outlooks from brokerages such as HSBC, which have grown bullish on the overall sector due to increasing capital expenditures.

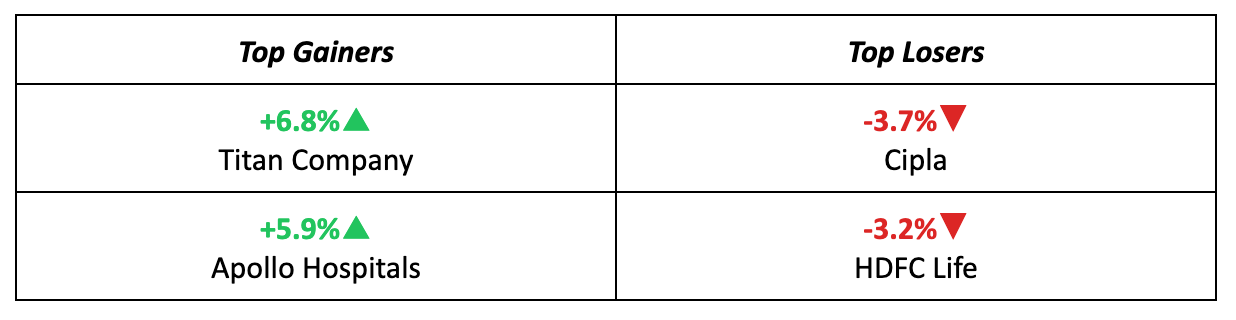

The losers

- Cipla lost quite a bit of ground last week, with its stock price declining by 3.7% following news that its promoters sold a 1.72% stake in the company.

- HDFC Life also extended its downward trend, influenced by investors assessing ongoing changes in regulatory guidance impacting the sector.

Meanwhile…

- India's Service activity slightly declined to 58.4 in November from 58.5 the previous month, amid slower sales growth and rising cost pressures.

- In Asia, markets experienced mixed results due to political unrest and the impact of an unsuccessful attempt to impose martial law in South Korea, which unsettled investors.

Market Brief

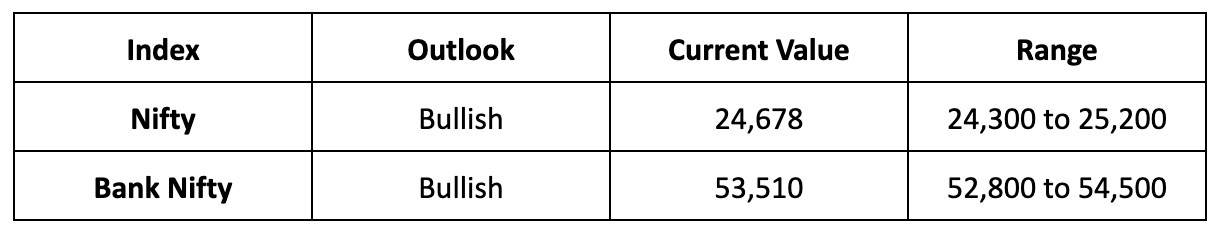

Market Outlook

Our take

- Despite subdued trading activity on Friday, influenced by mixed economic projections from the RBI, the overall trend remained bullish and is expected to persist.

- Technical indicators support the continuation of this bullish momentum, projecting a trading range between 24,300 and 25,200 for the upcoming week.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.