Weekly Market Recap: Key Stock Performances & What’s Ahead for Nifty

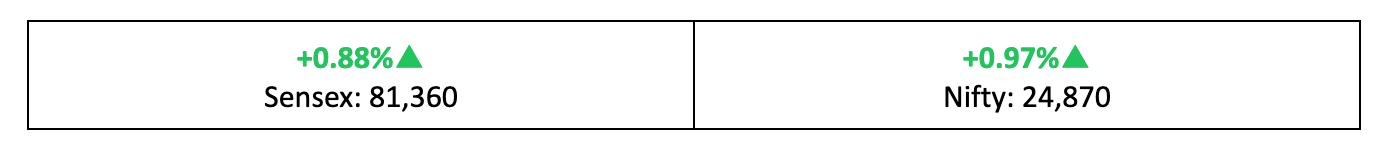

Despite a Friday dip, the market remained positive with nearly 1% gains for the second week in a row. Here’s your weekly recap covering top stories, winners, losers and what lies ahead for investors.

Despite Friday’s fall, the markets managed to rise almost 1% for the second week in a row. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Optimism Prevails

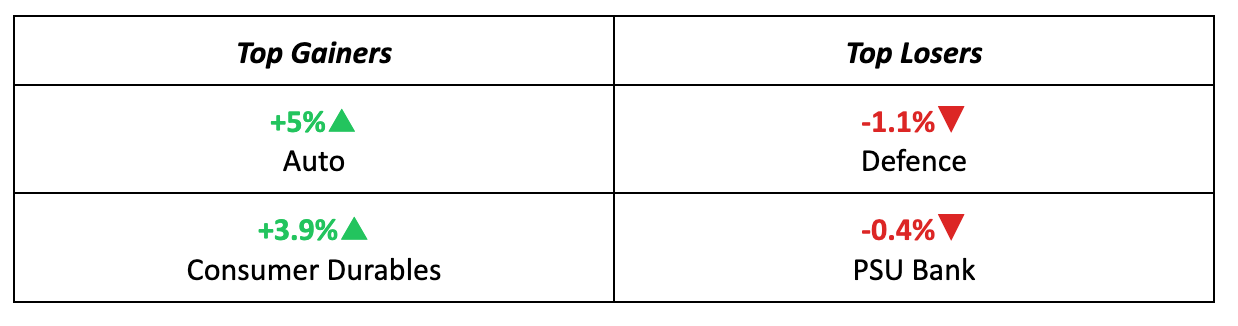

- Market continued its positive trend for the second consecutive week, fuelled by expectations of GST rationalization, favourable monsoon forecasts and lower oil prices.

- However, with the US tariff deadline approaching, investors opted to lock in profits, leading to a 0.85% dip in Nifty on Friday.

- Despite this, key benchmark indices recorded nearly 1% gains on a weekly basis. The broader indices performed even better, with BSE Small and Mid-cap indices rising by 2%, while BSE Large-cap added 1%.

The Big Picture

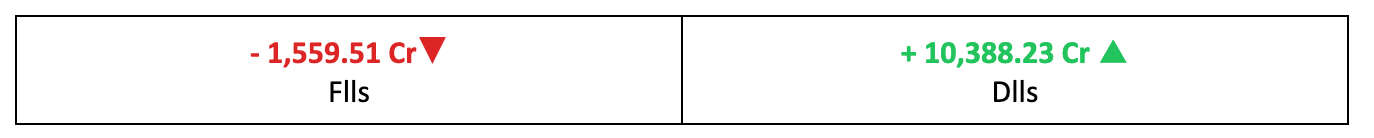

- Investors opted to book profits last week following the S&P sovereign rating upgrade and GST 2.0 announcements by the Prime Minister.

- Also read: GST 2.0: Key Stocks & Sectors to Benefit

- The Fed’s Jackson Hole speech and the looming tariff deadline on August 27 added to market caution, prompting investors to adopt a more conservative stance amid the uncertainty.

The Winners

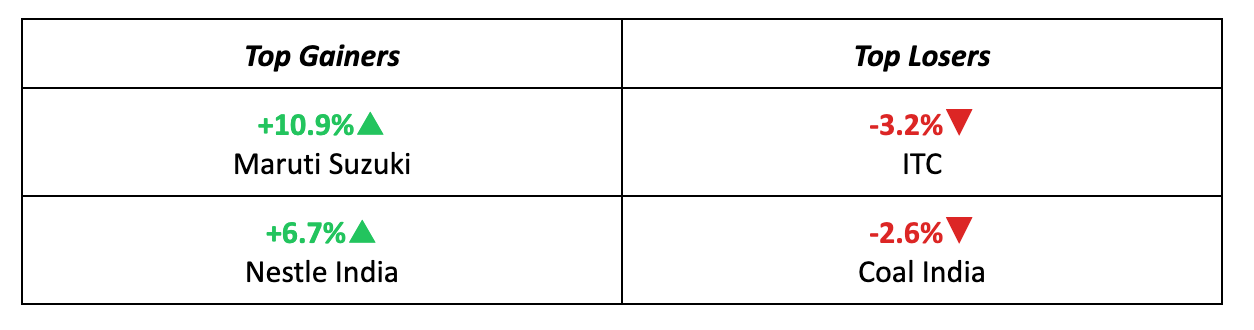

- Maruti Suzuki soared last week, securing the top spot as investors bet on increased demand due to expected GST cuts. The entire auto sector followed suit, rising 5% over the week.

- Nestle India took the runner-up position, supported by a strong consumer story despite mixed Q1 earnings.

The Losers

- ITC was the biggest loser of the week, falling 3.2% after Morgan Stanley downgraded its earnings estimates for the next couple of years.

- Coal India also fell 2.6%, continuing its post-results slide.

Meanwhile…

- Fed Chairman Jay Powell hinted at a potential rate cut in the September meeting during the Jackson Hole conference, sparking a rally in US stocks.

- Back home, business activity flash indices surged to all-time highs in August, driven by strong manufacturing momentum and record growth in the services sector.

Market Brief

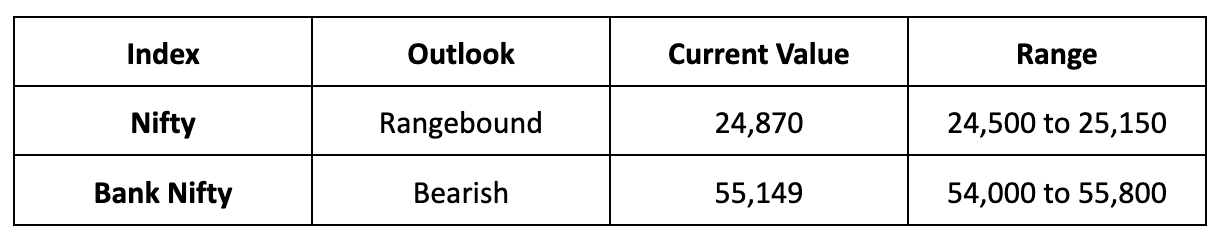

Market Outlook

Sectors to Watch

Our Take

- With the August 27 deadline for additional 25% tariffs approaching, investors will remain cautious and attentive to developments before making their next moves.

- We anticipate the Nifty to remain range-bound next week, with a likely trading range between 24,500 and 25,150.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.