Stock Market Weekly Recap: Nifty Up 0.78%, Top Stocks & Sectoral Insights

This week saw Nifty rise by 0.78%, with mixed movements and sectoral shifts. While geopolitical concerns weighed on markets, the IT sector emerged as a key winner. Dive into the weekly stock market report for detailed insights, top gainers and losers and what to expect next.

Weekly Recap

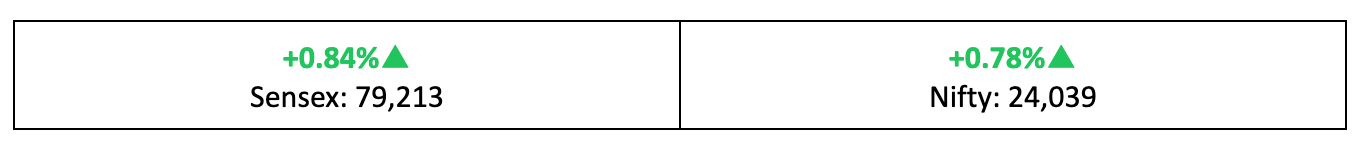

Markets climbed for the second week in a row, with Nifty up 0.78% amid some volatility. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Mixed Moves

- A week of cautious optimism nearly turned around on Friday, as key benchmark indices fell up to 0.86% amid rising geopolitical tensions following the Pahalgam terror attack.

- Despite this, the Nifty closed the week up 0.78% while the VIX fear gauge surged 10.57%, reflecting growing uncertainty amid escalating tensions.

- Among broader indices, the BSE Large-cap Index gained 0.6%, the BSE Mid-cap Index rose 1.3% and the BSE Small-cap Index saw marginal gains.

The Big Stories

- The tragic events in Kashmir and rising tensions along the border spooked investors, with many factoring in the risk of military conflict. For more, read: Indian Markets on Edge: Geopolitics & Earnings Shake Sentiment

- On the global stage, the Trump administration seems to be dialling back its tariff rhetoric, leading investors to hope that a deal between the US and China is on the horizon.

The Winners

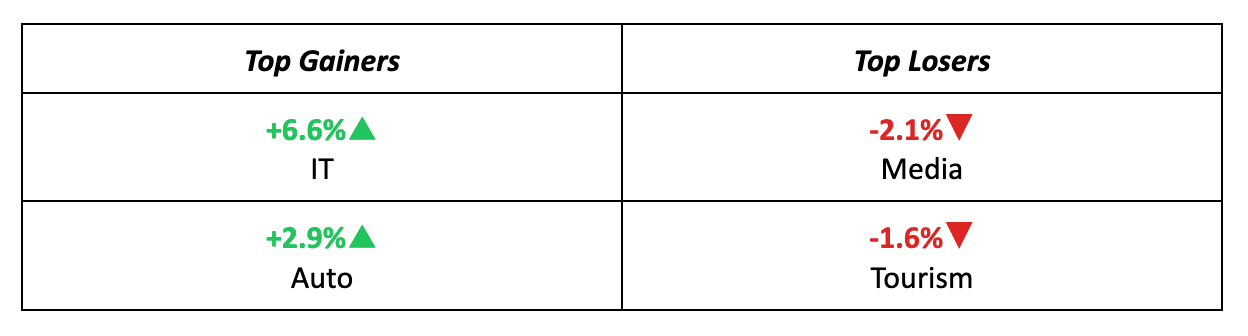

- The IT sector was the week's standout performer, with the sectoral index jumping 6.6%.

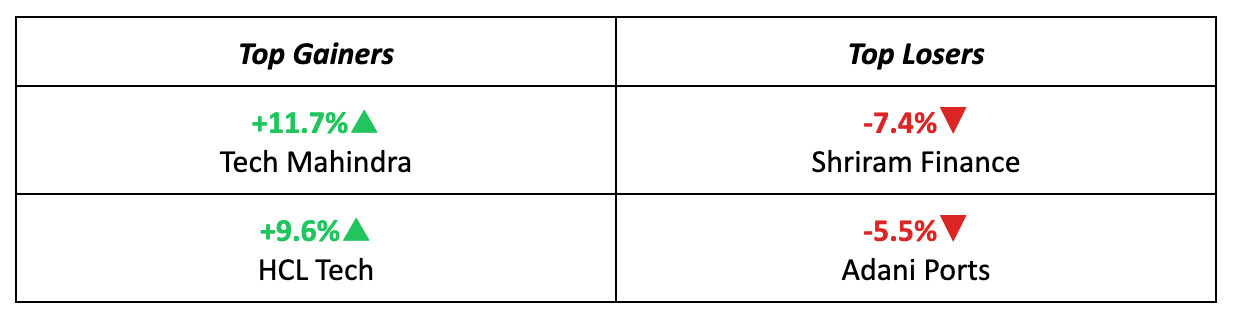

- Tech Mahindra led the charge, climbing 11.7% after posting a 8.7% YoY growth in Q4 profits, while HCL Tech met expectations, with its stock rising a solid 9.6% last week.

The losers

- Shriram Finance was the top loser on the Nifty, dropping 7.4% after its earnings fell short of expectations due to squeezed margins.

- Adani Ports also took a hit, falling 5.5% amid concerns over its all-share acquisition of a major Australian coal export terminal, which could dilute its EPS.

Meanwhile…

- US business activity slowed to a 16-month low in April, according to the latest S&P survey, with US tariff policies being the key culprit.

- On a brighter note, PMI data showed business growth in India reaching an 8-month high thanks to strong demand, though business confidence may be easing slightly

Market Brief

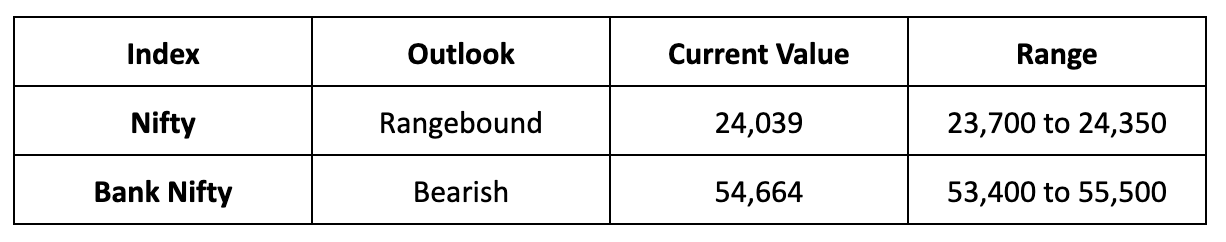

Market Outlook

Our Take

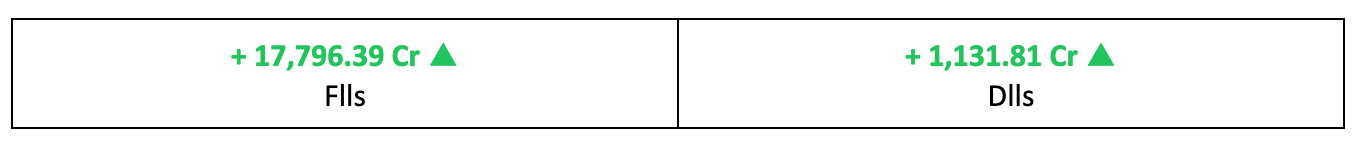

- Geopolitical uncertainty has prompted investors to take a risk-off approach, leading to profit-booking following the recent rally. In the coming week, geopolitical tensions are likely to remain in the spotlight, while Q4 reports from companies will present opportunities for investors.

- We expect Nifty to remain rangebound between 23,700-24,350 levels next week. Investors should stay selective, focusing on sectors and stocks with strong earnings reports and positive management commentary.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.