Weekly Stock Market Recap: Volatility, Top Stocks & Key Sectors to Watch

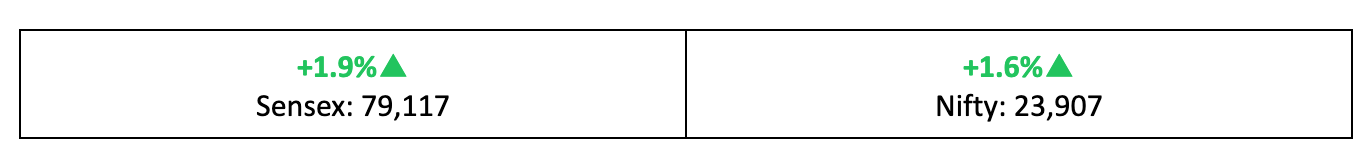

Markets swung wildly last week but closed 1.6% higher, with Power Grid leading gains and Adani Enterprises facing steep losses. Discover key insights, sector trends, and actionable strategies for the week ahead.

Investors were in for a topsy-turvy ride as markets swung in all directions before ultimately ending 1.6% higher than last Friday’s levels. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Weekly Recap

Like a rollercoaster

- Indices swung up, down, and everywhere in between during the event-filled, truncated trading week (shortened by Wednesday’s public holiday).

- The India VIX fear gauge mirrored the uncertainty, trending upward by nearly 9%, reflecting the unclear momentum in investor sentiment.

- Despite the volatility, a significant rally on Friday, the largest in five months, pushed the markets into positive territory for the week.

The big stories

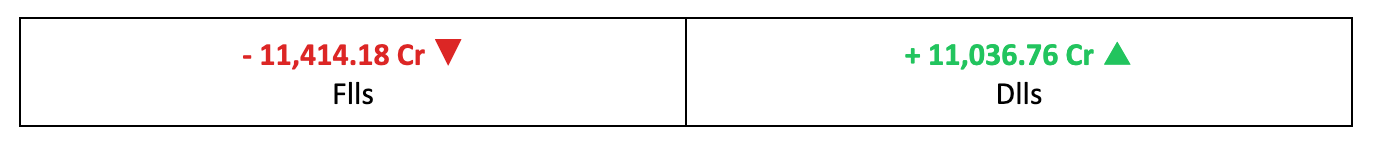

- Thursday’s trading session witnessed a sharp fall, extending the late-hour sell-off from Tuesday, triggered by Ukraine’s missile strikes deep within Russia.

- On Friday, the markets staged a strong rebound from Thursday’s lows, driven by positive global cues and buying activity during the dip.

- Notably, Friday’s rally seemed to reflect expectations of a BJP victory in Maharashtra’s state elections. The results, announced on Saturday, confirmed a landslide win for the BJP-led Mahayuti alliance, which secured 233 out of 288 assembly seats, while the opposition MVA managed only 50 seats, as per the Election Commission's final tally.

The winners

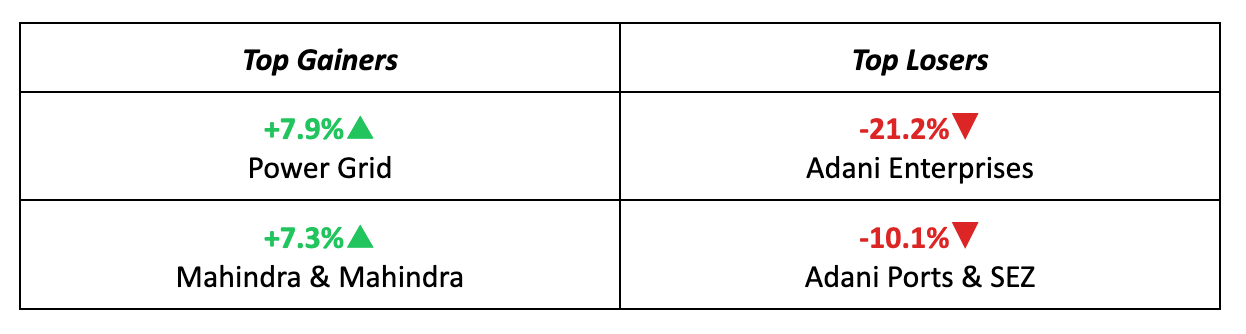

- Power Grid emerged as the week’s top performer, climbing 7.9% after securing a major transmission project in Gujarat.

- Mahindra & Mahindra followed closely, delivering a 7.3% return as anticipation built around its advanced electric SUV launch set for November 26.

The losers

- The Adani Group faced significant setbacks last week, with Adani Enterprises taking the hardest hit, plunging 21.2%, and Adani Ports recording a 10.1% decline.

- The group’s stocks came under heavy selling pressure following news of chairman Gautam Adani’s indictment by US prosecutors over an alleged $250 million bribery scheme. Read more about it here.

Meanwhile…

- The USA's flash Composite PMI, a key indicator of business activity, surged to a 31-month high of 55.3 in November, signalling strong near-term growth prospects for the economy.

- This starkly contrasted with Eurozone data released last week, which revealed a renewed contraction in the region’s economy for November.

Market Brief

Market Outlook

Our take

- The BJP-led Mahayuti's decisive victory in Maharashtra ensures continuity in policies and reforms for India's most economically significant state. This outcome is likely to boost investor confidence, setting a positive tone for the markets next week.

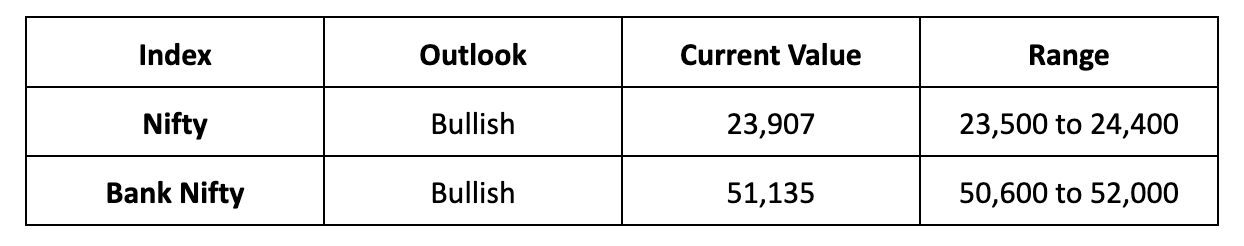

- Consequently, we anticipate a bullish trend in the Nifty, likely trading within the range of 23,500 to 24,400. However, investors should remain vigilant to any significant geopolitical developments that could affect market sentiment.

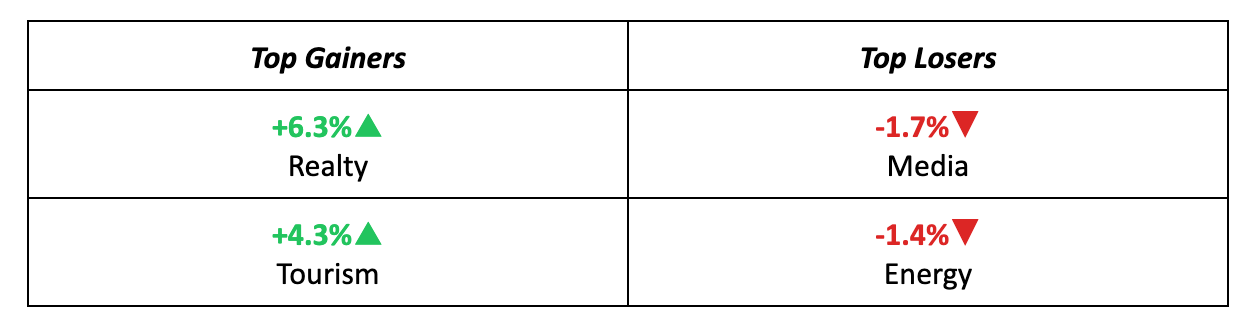

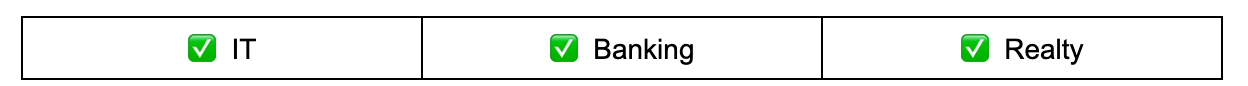

- A stock-specific approach is recommended, particularly in sectors like IT, Banking, and Realty which are currently showing stronger momentum.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.