Weekly Recap: Volatility, Earnings Disappointments, and Sector Highlights

Explore our weekly stock market report for a detailed recap of market performance and factors influencing the Nifty. Gain key insights into the latest stock trends, sector performances, and investment opportunities.

Markets ended lower amid volatility in a news-heavy week. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Weekly Recap

On shaky ground

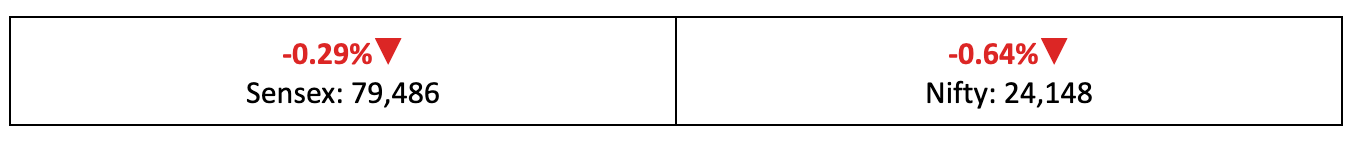

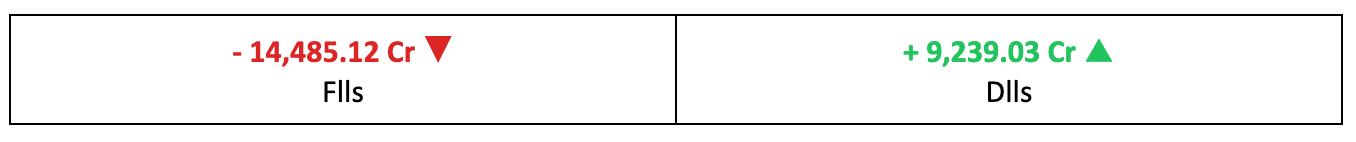

- In a week marked by volatility, markets erased last week’s gains, closing down 0.6% due to persistent FII outflows and disappointing Q2 earnings from Indian Inc.

- Broader indices underperformed the key indices, with the BSE Large-cap Index dropping by 0.7%, the BSE Mid-cap Index by 0.4%, and the BSE Small-cap Index by 1.3%.

The big stories

- Last week saw considerable volatility, with markets reacting first to Trump's U.S. election win and then to the Federal Reserve's 25 bps rate cut. Also read: How Trump's Win and Fed’s Rate Cut Affect Indian Markets

- China on Friday announced a $1.4 trillion, five-year package to address local government debt. However, the debt swap deal failed to meet many investors' hopes for stronger fiscal action.

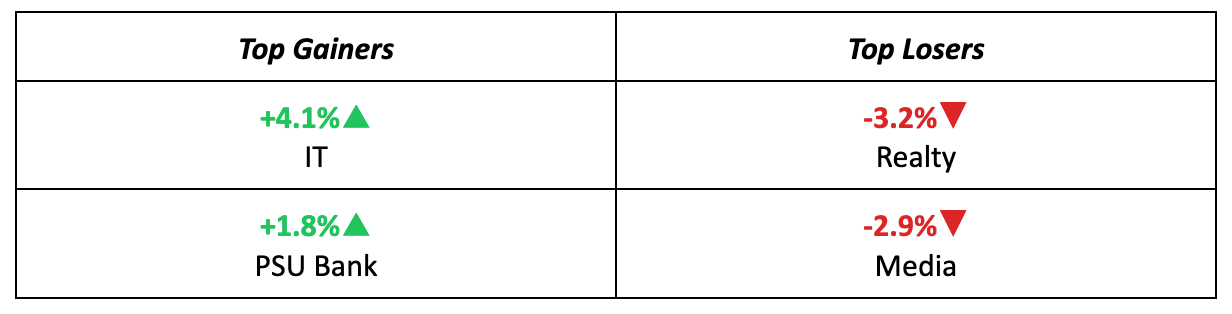

The winners

- IT made a strong comeback after last week's downturn, with investors growing bullish on the sector, especially since tech has historically thrived under Trump's policies.

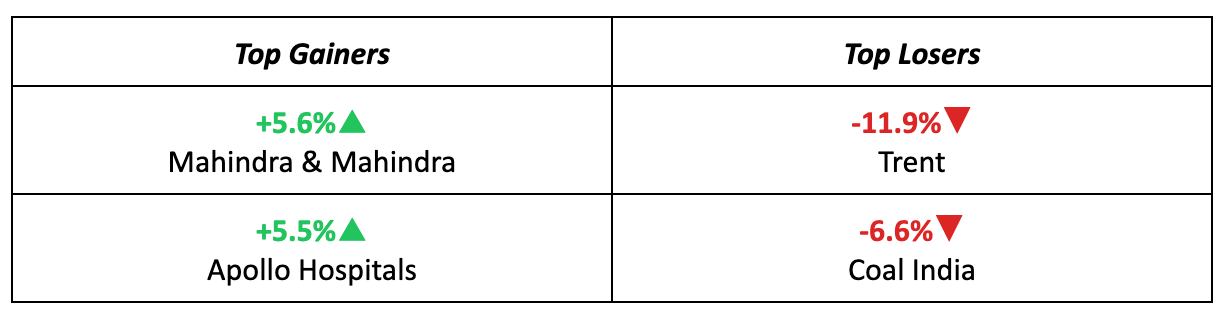

- M&M had a strong week too, up 5.6%, with brokers pointing to its steady earnings growth and fair valuations.

The losers

- The rate-sensitive Realty sector took a hit, with its index cracking 3.2%, making it the week's biggest loser.

- Trent really felt the pinch, diving 12% as revenue growth fell below 50% for the first time since Q4FY21, worsened by the closure of 25 stores, which didn't sit well with expectations.

Meanwhile…

- The U.S. economy grew at a 2.8% pace in the third quarter, trailing the expected 3.1% and down from 3% in Q2, though private job growth surged by 233,000 in October, well above expectations.

- The Bank of England cut its main interest rate by a quarter of a percentage point as UK inflation dipped below the 2% target.

Market Brief

Market Outlook

Our take

- Indian markets lagged their global counterparts last week, as the Q2FY25 earnings season continued to disappoint, showing more misses than hits. This could keep valuation concerns in play.

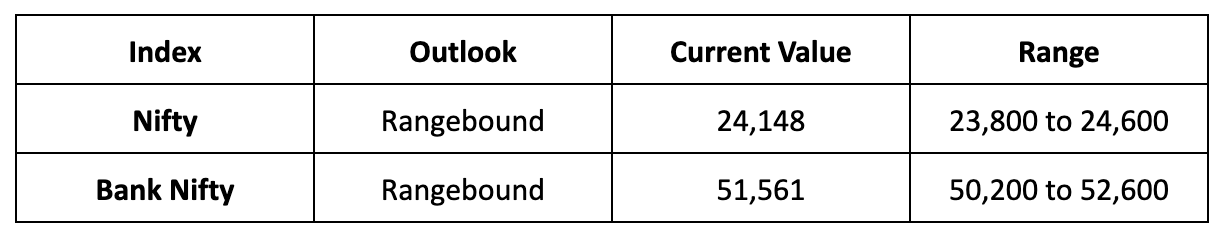

- Consequently, we expect the Nifty to be rangebound next week, fluctuating within a trading range of 23,800 - 24,600, with 24,000 as a key level to monitor.

- In light of current market conditions, a cautious and hedged investment strategy is recommended. Investors may consider selectively accumulating quality stocks at attractive valuations.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.