Stock Market Weekly Review: Nifty Ends 2024 On A Positive Note

Discover the highlights from the final week of 2024 in our latest stock market review. Explore Nifty trends, top performers, sector analysis, and expert forecasts to gear up for profitable investing in 2025.

Markets recorded positive gains in a week that was both shortened by holidays and marked by low trading volumes. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Weekly Recap

Some relief

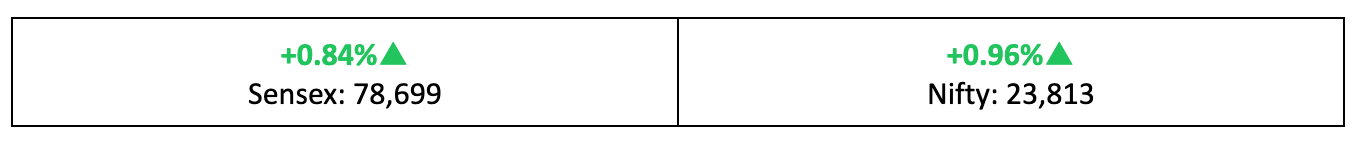

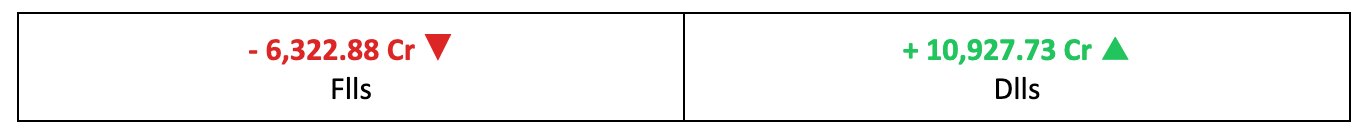

- Following a week of sharp decline, the markets showed signs of recovery with the Nifty gaining nearly 1% compared to the previous Friday, buoyed by domestic institutional investor support, despite ongoing volatility in global markets and continued sell-offs by foreign institutional investors.

- On the broader market front, the BSE Large-cap Index rose by 0.7%, while the BSE Mid-cap Index saw a modest increase of 0.2%. The BSE Small-cap Index remained unchanged.

- Meanwhile, the India VIX fear gauge, a measure of market volatility, dropped by almost 9%, amidst reduced trading activities globally during a holiday-thinned trading week.

What’s going on?

- The markets are adjusting to the Federal Reserve's cautious stance on rate cuts, alongside concerns about slow growth and a growing trade deficit.

- While there were no significant movements in the secondary market due to the absence of major triggers, the primary market was bustling, with five mainboard IPOs making a strong debut. Mamata Machinery stood out, achieving a remarkable listing return of 147%!

The winners

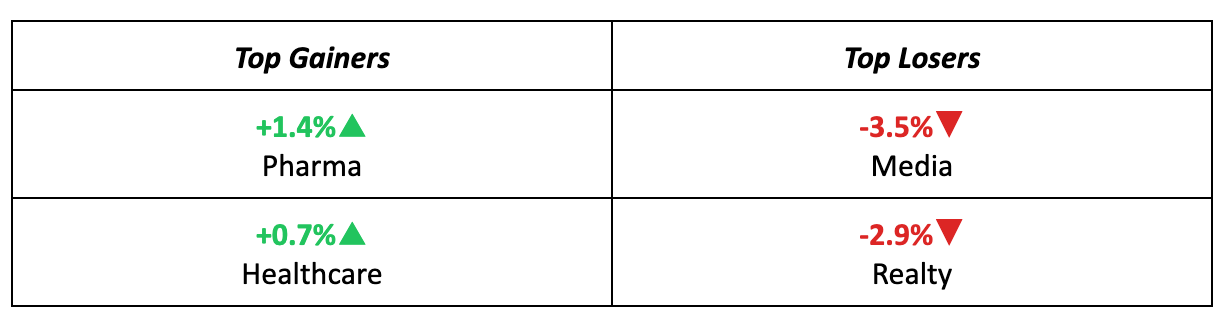

- The Pharmaceutical and Healthcare sectors topped the charts once again, continuing their upward trajectory from the previous week.

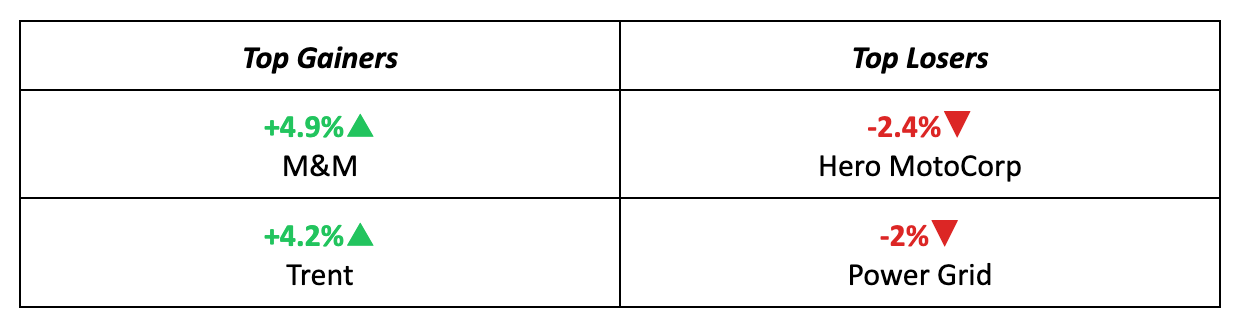

- M&M was a standout last week, rising 4.9% as it unveiled a new line of electric vehicles, aiming to compete with industry giants like Hyundai Motor and Toyota.

The losers

- Hero Motocorp emerged as the biggest loser, with its shares slipping 2.4% amid an overall 24% drop in December two-wheeler registrations, as reported on the government’s Vahan portal.

- Brokerage firm UBS noted that December retail sales figures are expected to decline, with Hero Motocorp and Bajaj Auto likely leading the downturn.

Meanwhile…

- In the debt market, the anticipation of higher U.S. interest rates pushed the 10-year Treasury yield to a peak of 4.607%, the highest since early May. Concurrently, weekly jobless claims hit a monthly low.

- At home, the Finance Ministry's November 2024 Monthly Economic Review predicts a stronger growth rate from October to March compared to the first half, with easing food prices bolstered by a favourable agricultural outlook.

Market Brief

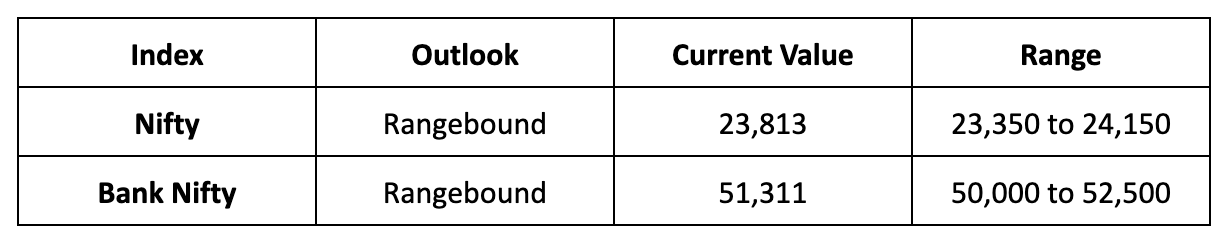

Market Outlook

Our take

- Although the last week of the year ended on a positive note, concerns over valuations, sluggish earnings growth, and global macro uncertainties remain a drag on sentiment.

- With no significant triggers in sight, the Nifty is likely to remain rangebound between 23,350-24,150 levels next week.

Recap into 2024: Riding the Highs & Lows

- Reflecting on 2024, our benchmark indices have notched up about a 10% gain, showing that the market is adjusting to what investors are now expecting. The year kicked off on a quiet note, but as we rolled through the months, investor resilience really kicked in despite the ups and downs, pushing our equity markets to soar to new heights.

- The Nifty 50 zoomed past the 26,000 mark and the BSE Sensex was hot on its heels, almost touching 86,000 by September. However, the last quarter took a bit of a nosedive, with a 9% drop from the peak, landing at 23,800.

Forward to 2025: Charting a Path for Sustainable Growth

- Stepping into 2025, we’re looking at the investment scene a bit differently—we’re shifting from quick sprints to a steadier, long-distance run. Next year’s all about stamina and strategy. It’s about pacing ourselves, keeping our eyes on the prize, and moving with purpose.

- Going forward, factors like inflation, interest rates, geopolitical developments, and the upcoming Union Budget will play big roles in shaping our market trends next year.

- As we hit the ground running in 2025, let’s remember: every milestone matters, sticking to the plan pays off, and it’s all about playing the long game. We’re upbeat about the future, confident that this decade belongs to India.

On that upbeat note, we here at Team Liquide are wishing you a happy and prosperous new year. Here’s to a profitable 2025 together!

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.