Weekly Stock Market Recap: Auto Sector Accelerates, Realty Stumbles

Indian markets extended their winning streak. Discover the stocks and sectors that led the rally, and what lies ahead. Dive into last week’s stock market highlights and actionable insights for investors.

Markets kicked off the new year with optimism, recording gains for the second week in a row. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Weekly Recap

See-sawing

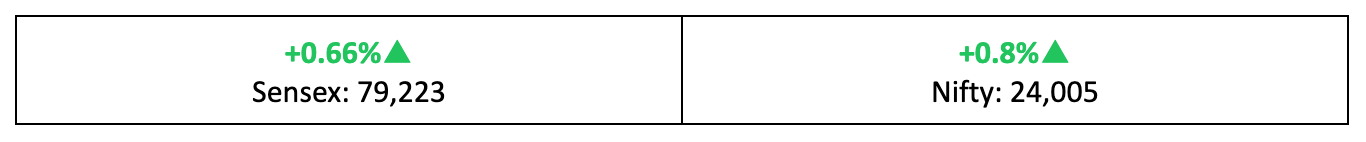

- The Indian stock market extended its winning streak into a second week, propelled by strong auto sales figures and improved GST collections. However, some gains were offset by a sell-off on Friday.

- On the broader market front, the BSE Small-cap Index led the gains with a 2% increase, followed by a 1.3% rise in the BSE Mid-cap Index. The BSE Large-cap Index also advanced 1%.

- Meanwhile, the India VIX fear gauge, a measure of market volatility, dropped by almost 4%, amidst reduced trading activities worldwide during a holiday-thinned trading week.

The trading environment

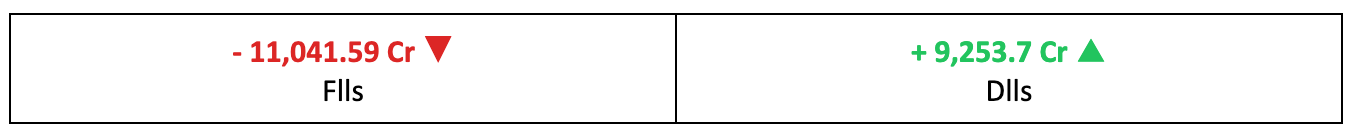

- The new year kicked off with mixed performances across global stock markets. European stocks dipped slightly, while U.S. markets posted modest weekly losses despite a sharp rebound on Friday led by tech giants like Tesla and Nvidia, pushing the Nasdaq ahead.

- Markets are adjusting to the Federal Reserve's cautious stance on rate cuts, alongside concerns about valuations and slow growth.

The winners

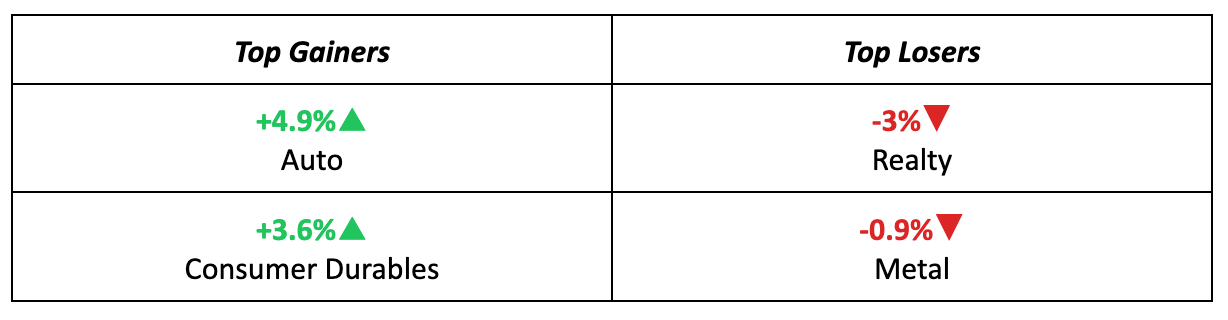

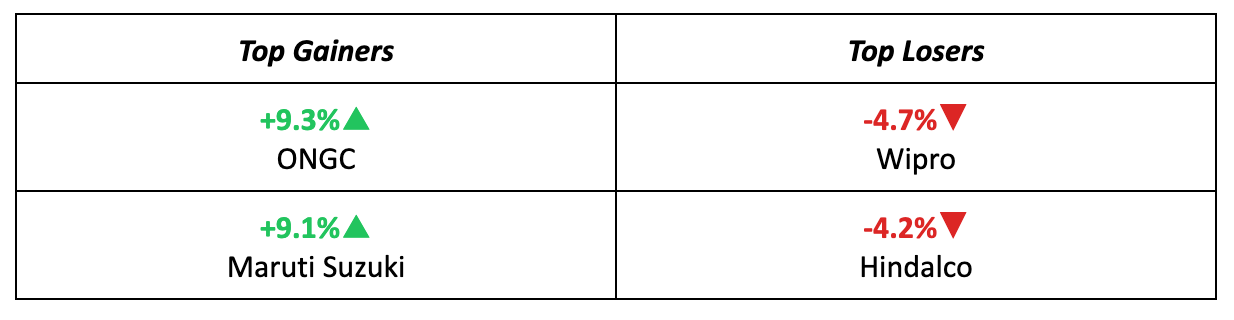

- The Auto sector topped the charts, buoyed by upbeat business updates from auto companies for December. Maruti Suzuki was at the forefront, surging 9% after reporting a 30% increase in total wholesales to 178,248 units in December 2024.

- ONGC was another highlight, climbing over 9% as Brent crude oil prices reached a two-month high. Additionally, the stock received a boost from brokerage firm Jefferies, which initiated coverage with a "buy" rating due to an improved earnings outlook.

The losers

- Realty and Metals emerged as the bigger sectoral losers last week, with Hindalco leading the losses, declining by 4.2%.

- Wipro was also under pressure, falling over 4% following a downgrade by global brokerage CLSA, which projected flat growth in Constant Currency for the December quarter on a sequential basis.

Meanwhile…

- With U.S. rates expected to stay higher for longer, it's the dollar that reigns supreme. The dollar index, albeit a touch softer on Friday, remains near its highest level in over two years, pushing the pound to multi-month lows and the euro ever closer towards parity.

- India's GST collections for December hit Rs 1.77 lakh crore, maintaining levels above Rs 1.7 lakh crore for the tenth consecutive month. This represents a 7.3% increase compared to the same period last year.

Market Brief

Market Outlook

Outlook for the coming week

- While the first week of the new year closed on a positive note, concerns about valuations and global macroeconomic uncertainties continue to weigh on market sentiment. Markets world over appear to be in a state of uncertainty, awaiting clarity on whether Trump, in his potential second term, will adopt a more measured or aggressive approach. Until then, a cautious, wait-and-watch approach is likely to prevail.

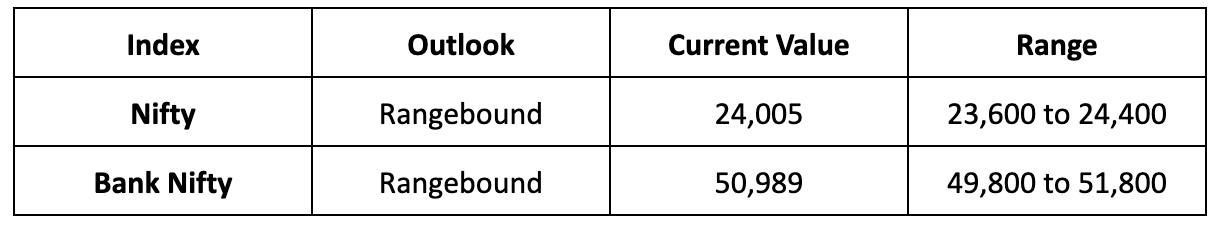

- In the absence of significant immediate triggers, the Nifty is likely to remain rangebound between 23,600–24,400 levels in the coming week. Stock-specific activity may gain momentum, driven by December quarter business updates from companies.

Explore our 2024 Market Recap for insights into election impacts, geopolitical tensions, and major IPOs that shaped the year. Gain a deeper understanding of market trends and what to anticipate in 2025.