Stock Market Weekly Recap: Nifty Up 1.28%, Top Stocks & Sectoral Insights

Catch up on last week's market highlights, from Nifty's steady climb to the top-performing sectors and stocks. Get insights on global market trends, top winners like Reliance Industries and the outlook for next week with expert analysis.

Weekly Recap

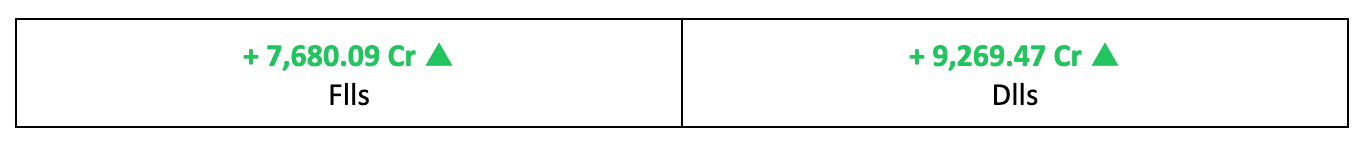

Markets climbed for the third consecutive week, the longest streak since December 2024, driven by strong FPI inflows and RIL's best week in five years. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Making Progress

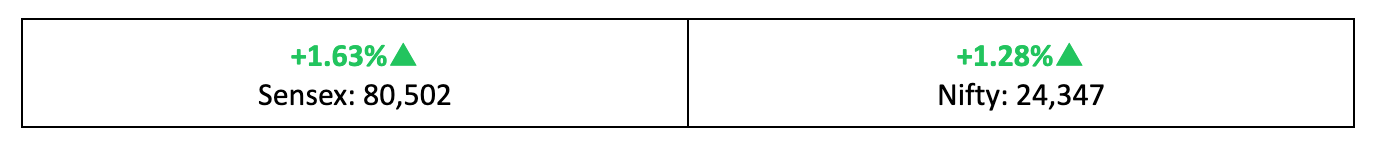

- The indices enjoyed another positive week, with Nifty advancing by 1.28% compared to last Friday’s levels. In the broader market, the BSE Large-Cap index gained 1% and the Mid-Cap index rose by 0.4%. However, the BSE Small-Cap index shed 1.3%.

- Volatility remained a key concern, with the India VIX climbing 6.4% over the week as markets reacted to mixed Q4 earnings, record GST collections, recession fears in the US and expectations of further tariff war de-escalation.

Key Drivers

- On the global front, investors found relief in the perception that trade talks between the US and China are moving in a positive direction, driving markets higher worldwide.

- Back home, investors responded to mixed corporate earnings, with several companies reporting their fourth-quarter numbers.

The Winners

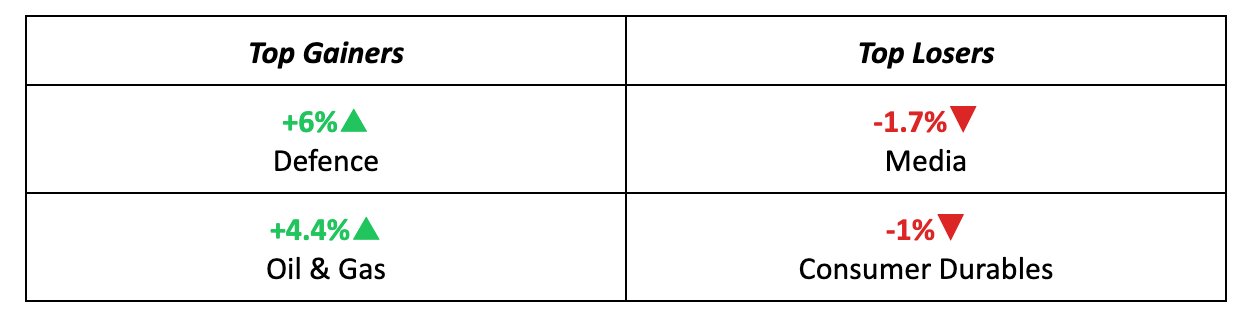

- In a time of heightened geopolitical uncertainty, Defence stocks performed well, with the sector posting an overall gain of 6% last week.

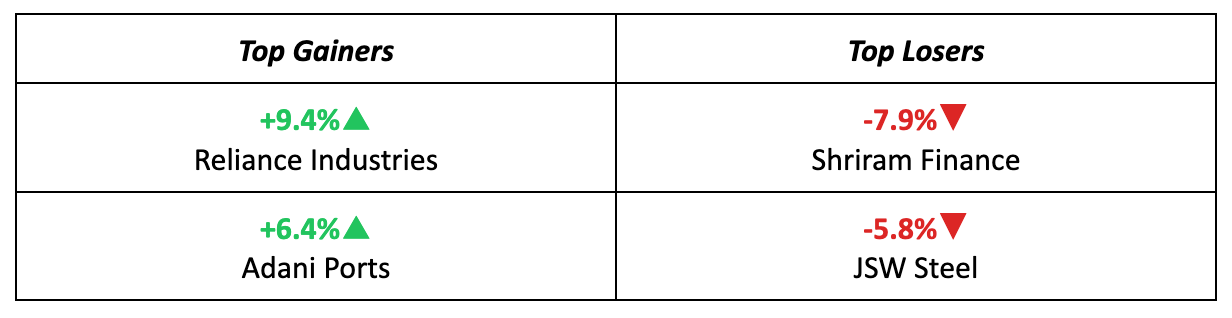

- Reliance Industries emerged as the top winner of the week, soaring 9.4% as analysts praised its stronger-than-expected retail revenue figures for the quarter.

The Losers

- Shriram Finance faced significant pressure last week, plunging 7.9% due to weak results, with brokerages particularly concerned about its relatively high credit costs.

- JSW Steel saw a 5.8% drop after the Supreme Court ruled against its resolution plan to acquire Bhushan Steel & Power, leading to the liquidation of the indebted business. Read more: SC Strikes Down JSW’s Deal

Meanwhile…

- Manufacturing activity at home surged to a 10-month high in April, while export orders grew at their second-fastest pace in 14 years.

- On a less positive note, the US saw a surprising 0.3% GDP contraction, marking its first economic shrinkage since 2022 and sparking recession fears. However, the stronger-than-expected jobs data released late Friday helped calm concerns about an economic slowdown.

Market Brief

Market Outlook

Our Take

- Last week, investors had a brief window to assess quarterly earnings and capitalize on cheaper valuations, which fuelled buying activity. The improvement in market breadth was also supported by sustained foreign investor participation.

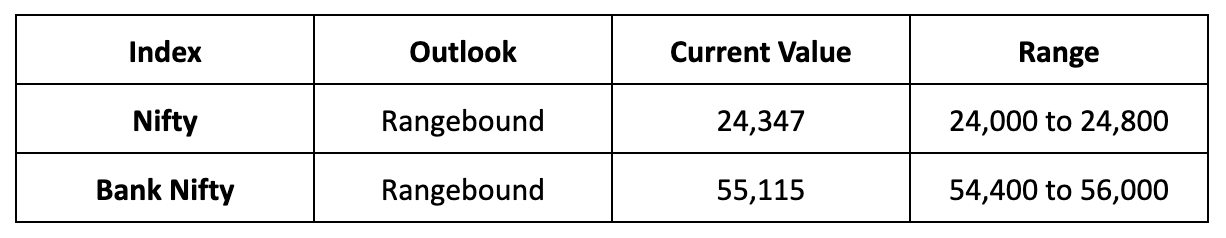

- However, given the ongoing volatility, we expect the Nifty to remain rangebound next week, trading between 24,000 and 24,800 levels. Investors should stay selective, focusing on sectors and stocks with strong earnings and positive management guidance.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.