Weekly Recap: Earnings and Trade Talks Weigh on Markets

Markets fell for the third consecutive week, driven by weak corporate earnings and ongoing trade uncertainties with the US. Discover the key market trends, top gainers and losers and our outlook for the coming week in this detailed weekly stock market report.

Weekly Recap

Markets fell for the third straight week, driven by weak corporate earnings and ongoing trade uncertainties with the US. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Continued Slippage

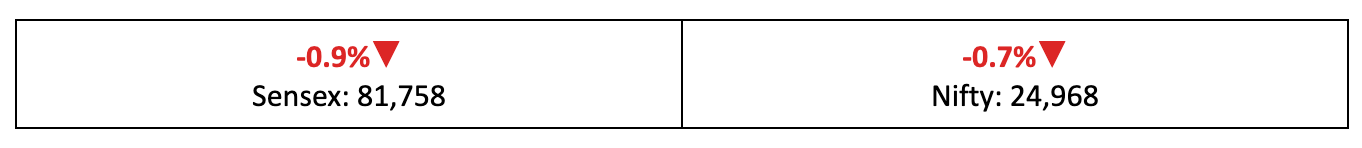

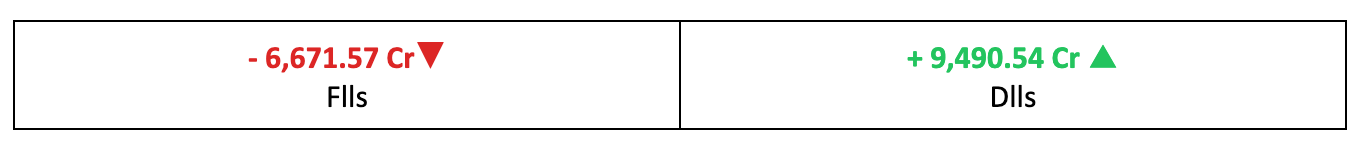

- Benchmark indices extended their correction for the third consecutive week, with the Nifty falling 0.72% due to foreign institutional selling, weak corporate earnings and uncertainties surrounding trade agreements with the US.

- Among broader indices, the BSE large-cap index fell 0.5%. In contrast, the mid and small-cap indices rebounded, gaining 1% and 1.5%, respectively.

The Big Picture

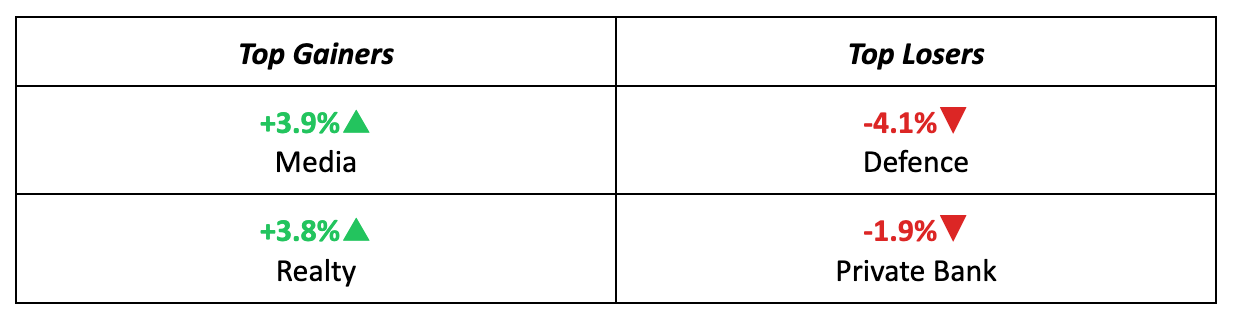

- Domestic markets were primarily pressured by a weak start to Q1FY26 earnings, particularly from the IT and financial sectors, overshadowing positive factors like above-average monsoon, 77-month low inflation and soft wholesale inflation.

- In addition, investors are closely watching the US-India trade talks, which wrapped up the fifth round of negotiations for the proposed Bilateral Trade Agreement. This uncertainty is likely driving cautious sentiment and contributing to the market’s downtrend.

The Winners

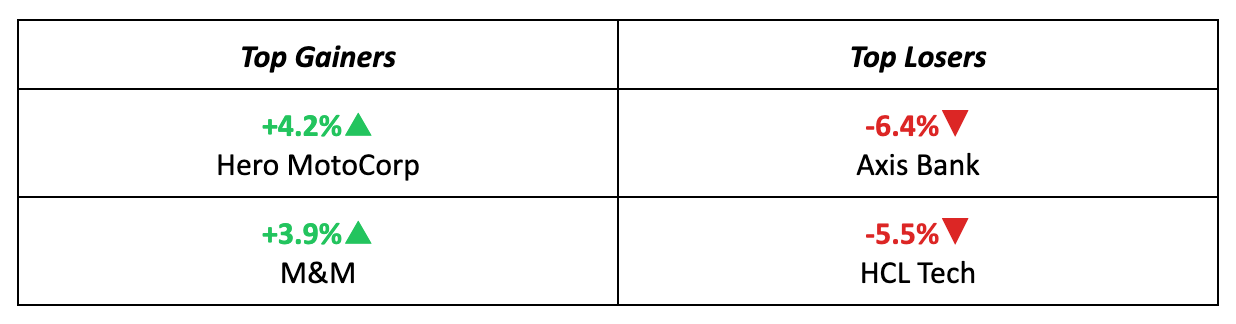

- Among stocks, Hero MotoCorp topped the charts last week, with its stock price climbing 4.2%. This surge followed the company's announcement of an ambitious global expansion plan and positive guidance in its latest annual report.

- M&M also performed well, rising 3.9%, fuelled by reports suggesting the company was exploring a collaboration with Uno Minda on rare earth production. However, the management later refuted these claims.

The Losers

- Axis Bank was the biggest loser of the week, falling 6.4% after reporting a 3.8% drop in Q1 profits and a deterioration in asset quality.

- HCL Tech continued its downward trend from the previous week, as its June quarter results fell short of expectations on D-Street.

Meanwhile…

- UK inflation unexpectedly spiked to 3.6% in June, marking an 18-month high, posing a setback for the Bank of England's efforts to cut interest rates and support the slowing economy.

- On the other hand, India’s retail inflation eased to a 6-year low of 2.1% in June, down from 2.8% the previous month, primarily driven by a drop in food prices.

Market Brief

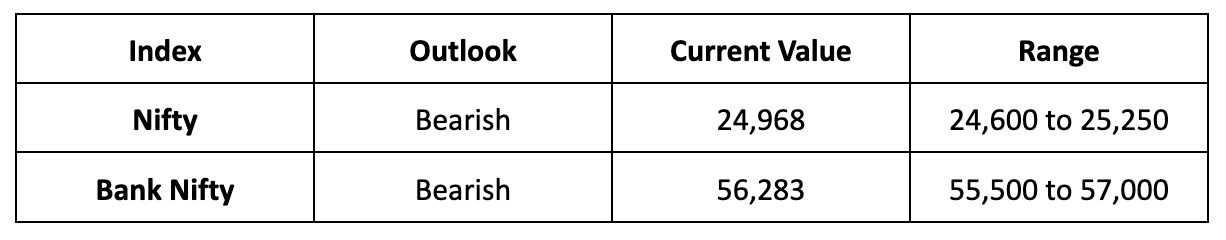

Market Outlook

Our Take

- With earnings season in full swing and most results falling short of expectations, investor sentiment is likely to remain cautious.

- The Nifty has breached the key psychological support level of 25,000, signalling a weak underlying trend unless trade talks or earnings bring positive developments.

- Considering these factors, we expect the Nifty to trade within the range of 24,600 to 25,250 next week.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.