Weekly Recap: Top Stocks, Sector Movers & Expert Outlook

Stay updated with the latest market trends, Nifty performance, stock gainers and losers and expert insights. Get a detailed recap and our outlook for next week.

Weekly Recap

Markets struggled through a choppy week, finishing lower for the second week in a row. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Choppy Trading

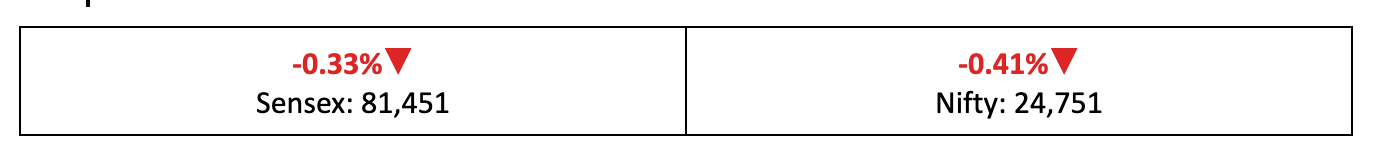

- Markets remained volatile throughout the week, with Nifty ultimately closing down by 0.41%. Broader indices outperformed, with the Mid-Cap index rising 1.3% and the Small-Cap index gaining 1.4%.

- The India VIX, however, fell sharply by nearly 7%, reflecting that investor anxiety has eased considerably.

Tariffs & Earnings

- At the global level, a US federal trade court blocked the broadest set of tariffs announced on “Liberation Day,” sending Wall Street sharply higher.

- On the domestic front, India Inc’s earnings reports were mixed, resulting in market consolidation during an otherwise quiet week.

The Winners

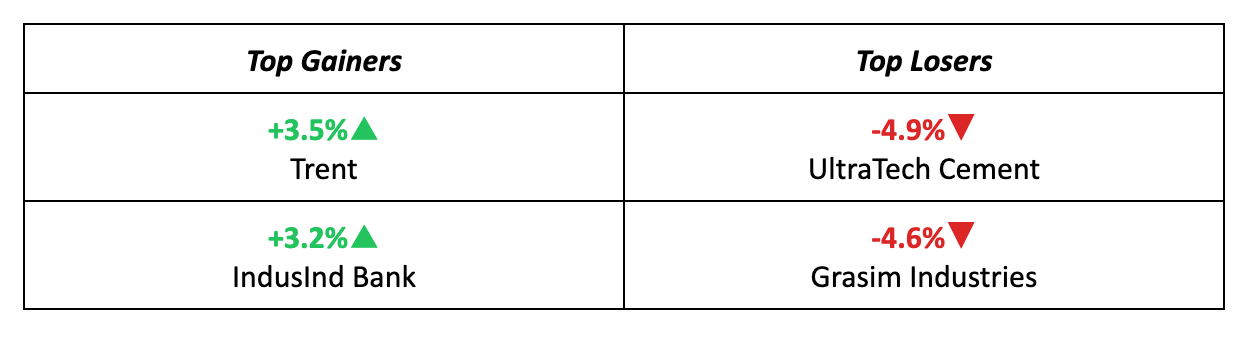

- Trent led the gains, rising 3.5% during the week, buoyed by investor optimism over its strong FY25 revenue growth.

- IndusInd Bank gained 3.2% following SEBI’s ban on its ex-CEO and four senior executives for insider trading and audit discrepancies.

The Losers

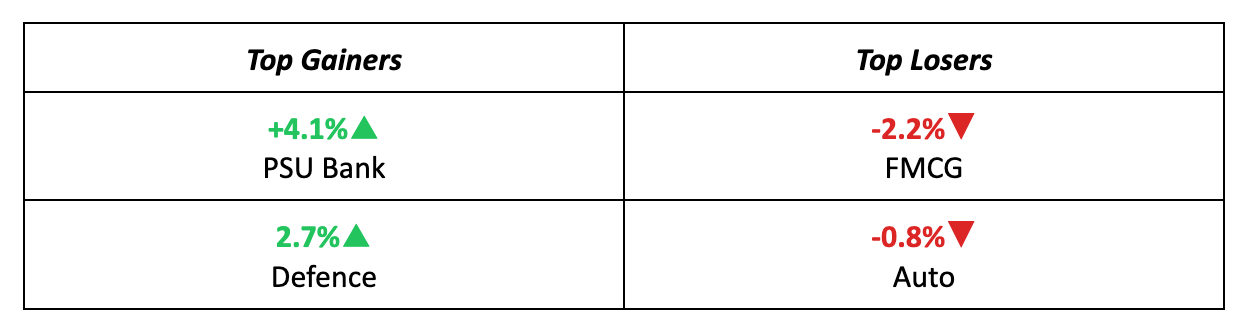

- The FMCG sector emerged as the biggest loser last week, followed by Auto.

- Among individual stocks, Grasim Industries slipped 4.6%, weighed down by a 58% year-on-year drop in EBITDA reported this quarter.

Meanwhile…

- The Indian economy showed signs of resilience, with quarterly GDP growth hitting a strong 7.4%, lifting FY25’s overall growth to 6.5%.

- In contrast, the US economy contracted by 0.2% in Q1, according to revised data — marking its first contraction since 2022.

Market Brief

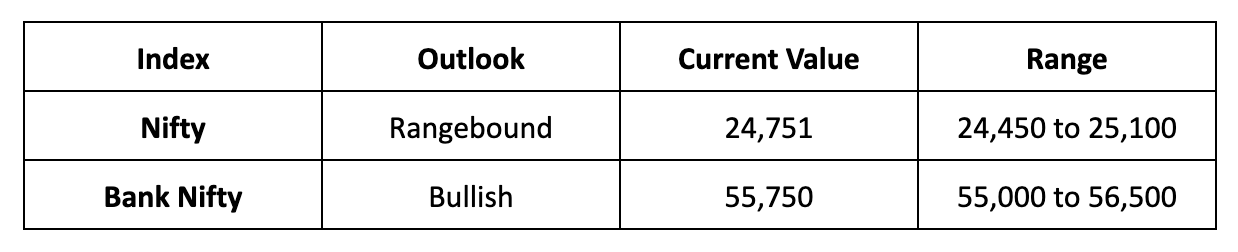

Market Outlook

Our Take

- Markets will react to key economic indicators and the RBI’s monetary policy decision this Friday. With global trade tensions still unresolved, macroeconomic uncertainties may lead to short-term consolidation.

- As a result, we expect the Nifty to remain rangebound next week, likely trading between 24,450 and 25,100.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.