Weekly Recap: Sensex and Nifty Pause Rally; PSU Banks Gain

Markets ended their four-week winning streak with minor losses as investors booked profits near record highs. PSU Banks and Energy stocks outperformed, while Healthcare lagged. Here’s your complete weekly recap, sector analysis and what to watch in the coming week.

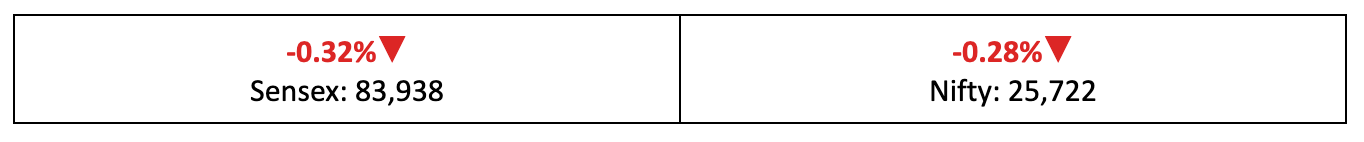

Markets broke their four-week gaining streak, with both the Sensex and Nifty slipping by 0.3% each. Here's our take on this week gone by, some stories you might have missed out on and our thoughts on what to do going ahead, in your weekly report.

Hitting Pause

- The indices took a breather last week as Dalal Street witnessed mild declines, weighed down by weak cues from Asian markets, profit-booking near record highs and a cautious undertone ahead of key earnings releases.

- Within the broader market, the BSE Large-Cap Index slipped -0.12%. In contrast, the BSE Mid-Cap Index advanced almost 1% while the BSE Small-Cap Index rose 0.7%.

- The India VIX climbed close to 5% during the week, signalling rising investor unease amid global and domestic uncertainties.

The Big Stories

- The US Federal Reserve cut interest rates by 25 bps to 3.75%, but signalled a cautious stance by indicating that further cuts at the December meeting are not assured.

- The US and China reached a preliminary trade deal framework, with the US agreeing to reduce tariffs on select Chinese goods — a move that, however, did little to lift sentiment across Asian markets.

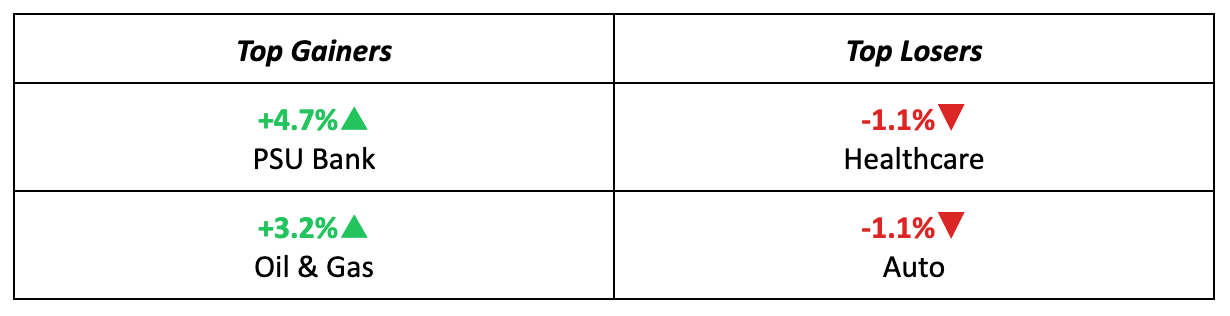

The Winners

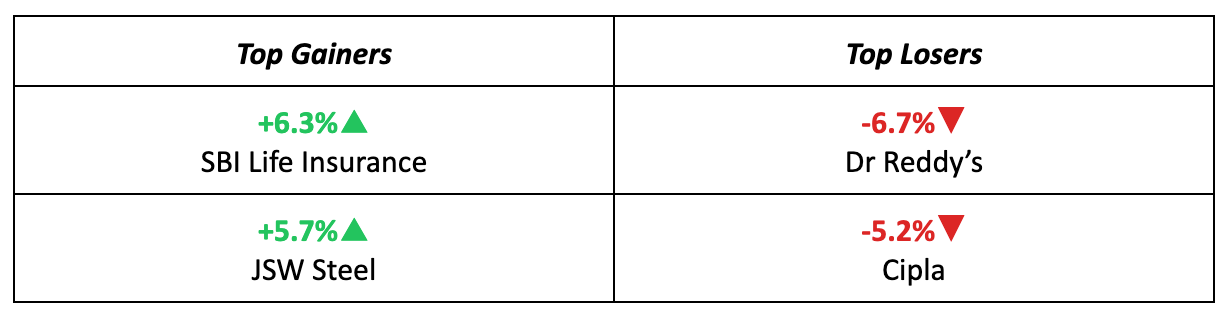

- SBI Life Insurance emerged as the top gainer of the week, advancing 6.3% after reporting steady Q2 earnings. The stock received multiple brokerage upgrades despite the impact of GST input tax credit reversals during the quarter.

- JSW Steel rallied 5.7%, supported by China’s move to curb steel overcapacity — a development that helped stabilize global metal prices and lifted sentiment across the sector.

The Losers

- Dr. Reddy’s Laboratories slid 6.7% over the week as Canada’s Pharmaceutical Drugs Directorate issued a notice of non-compliance related to its new drug applications, denting investor sentiment.

- Cipla also fell despite stable Q2 earnings, as markets reacted negatively to the announcement that MD and Global CEO Umang Vohra would not seek reappointment after March 2026.

Meanwhile…

- On Wall Street, the Magnificent Seven delivered upbeat earnings, with Apple, Amazon and Google leading gains after reporting stronger-than-expected quarterly results.

- Back home, India’s industrial growth eased to a three-month low in September, expanding 4% year-on-year as output in the mining and electricity sectors slowed.

Market Brief

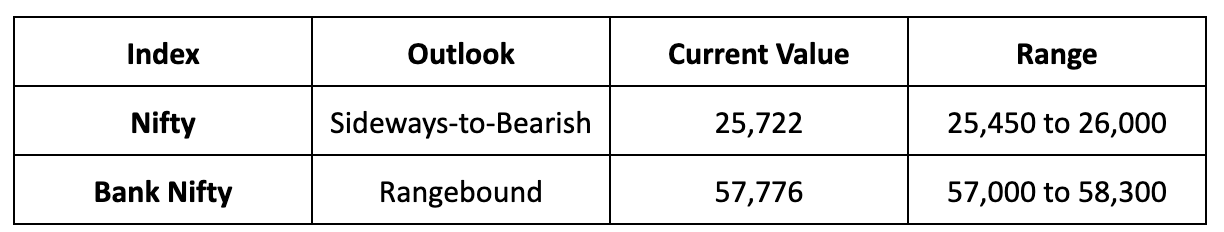

Market Outlook

Our Take

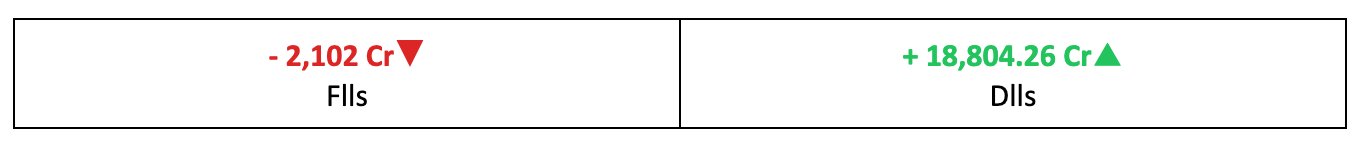

- Profit-booking dominated the week as investors turned cautious amid fast-evolving geopolitical developments and stretched valuations.

- We expect this consolidation phase to persist, with the Nifty likely to remain range-bound and trade sideways to slightly bearish between 25,450 and 26,000 in the coming week.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.