Weekly Market Recap: Nifty Breaks Losing Streak, Precious Metals Soar

Markets ended the week with modest gains, as Nifty broke its three-week losing streak. Discover key stories, top gainers and losers, and what to expect in the week ahead.

Markets ended the week with modest gains, as Nifty broke its three-week losing streak. Here's our take on this week gone by, some stories you might have missed out on and our thoughts on what to do going ahead, in your weekly report.

Back in Green

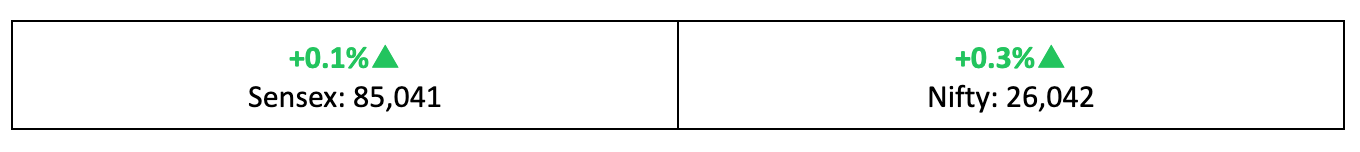

- The markets traded with a holiday mood during the shortened trading week, but ended on a positive note despite lower trading volumes, with Nifty closing up by 0.3% compared to last Friday.

- In the broader markets, the BSE Large-Cap index gained 0.3%, the BSE Mid-Cap index rose by 0.4% and the BSE Small-Cap index surged by 1%.

- Meanwhile, the India VIX fear gauge hit a record low of 9.15.

The Big Stories

- Precious metals like Gold, Silver and Platinum soared to fresh record highs as investors flocked to safe-haven assets amidst geopolitical uncertainties and currency fluctuations.

- Japan's government announced a ¥122.3 trillion budget for FY2026, aiming to stimulate growth while keeping new government bond issuance at its lowest ratio since 1998.

- The U.S. Conference Board consumer confidence index for December fell to its lowest level since April, reflecting growing concerns over inflation, tariffs and labor market conditions.

The Winners

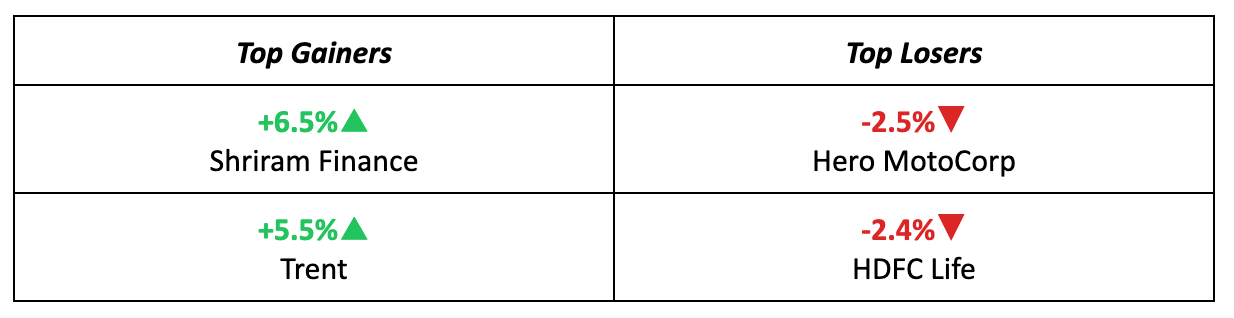

- Shriram Finance continued its winning streak (up 6.5%), emerging as the top gainer for the second consecutive week, following Japan’s MUFG announcement of acquiring a 20% stake in the NBFC for $4.4 billion.

- Trent also performed well, gaining 5.5%, fuelled by short-term technical strength, which likely led to increased trading activity in the counter.

The Losers

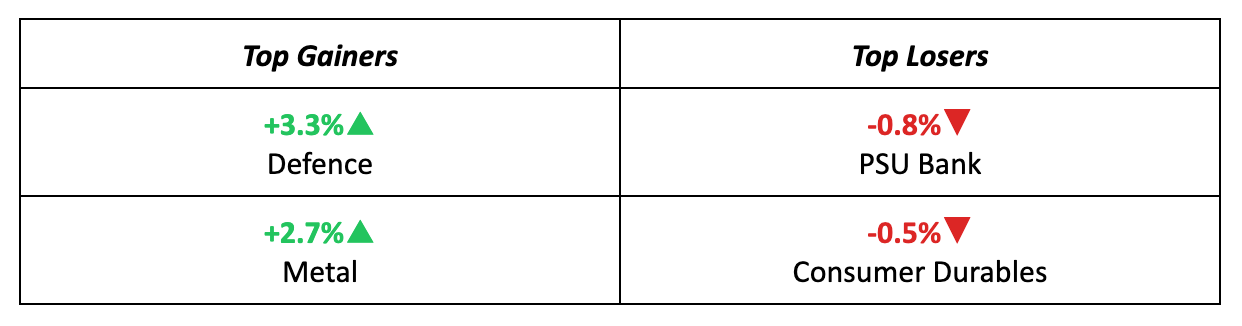

- The PSU Bank index fell 0.8% last week as investors sought to profit-booking after a strong performance the previous week. The softness in the Indian rupee also added pressure on financial stocks broadly.

- Hero MotoCorp fell 2.5% after international brokerage Jefferies downgraded the stock, citing concerns about fading demand, valuation risks and limited near-term upside.

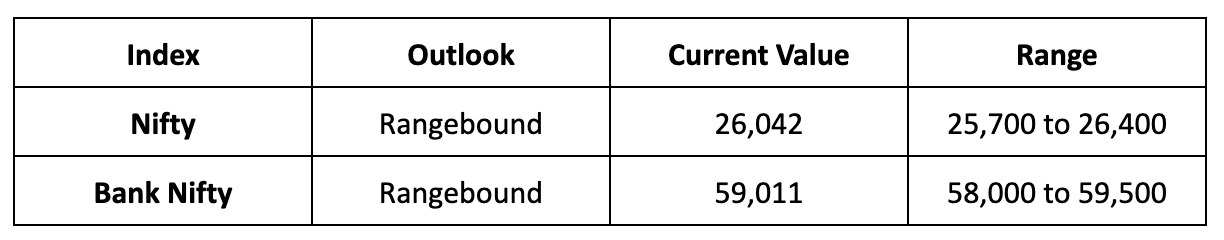

Market Brief

Market Outlook

Our Take

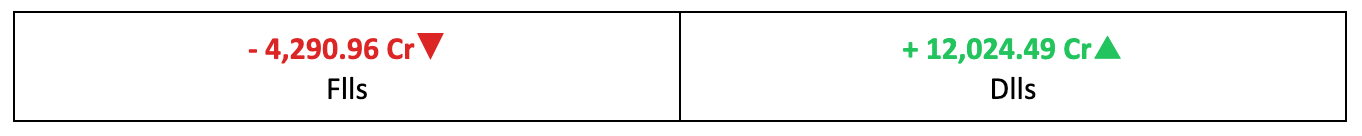

- Investor sentiment showed signs of revival early in the week, but momentum slowed as profit-taking set in, keeping the markets largely rangebound, with no fresh triggers to drive movement.

- The year-end period typically sees a slowdown in business and financial activity as market participants shift into holiday mode. As a result, we expect the Nifty to remain rangebound next week, with a trading range between 25,700 and 26,400.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.