Weekly Recap: Nifty Gains 1.6% Amid Geopolitical Tensions & RBI Announcements

Markets ended a volatile week with a 1.6% gain, driven by a late rally in Nifty. Despite geopolitical tensions and global economic shifts, key sectors like consumption and infra saw strong performance. Find out what triggered the surge, which stocks gained and where we're headed next.

Weekly Recap

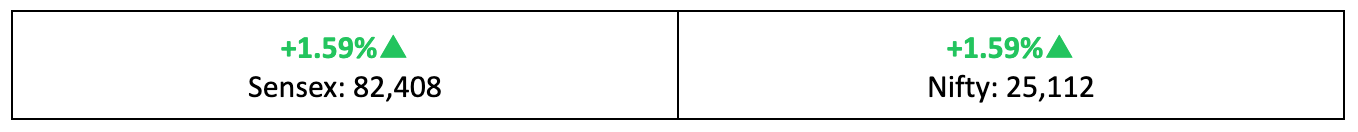

Markets wrapped up a volatile week with a late rally, delivering a 1.59% weekly gain to investors. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

TGIF!

- A late-week surge on Friday helped the Nifty recover from an otherwise flat, mildly negative week, closing with a 1.59% gain over the past week.

- Among the broader indices, the BSE Large-cap index led the pack, gaining 1%. Meanwhile, the BSE Mid-cap and Small-cap indices saw declines of -0.44% and -1.9%, respectively.

- It was a hectic week for global investors, with geopolitical tensions and central bank activities providing plenty to digest.

The Big Picture

- Tensions between Israel and Iran have continued to escalate and fluctuate throughout the week, keeping global observers on edge.

- Back home, the RBI's announcement to ease norms for infrastructure and real estate project financing provided a welcome boost to market sentiment.

The Winners

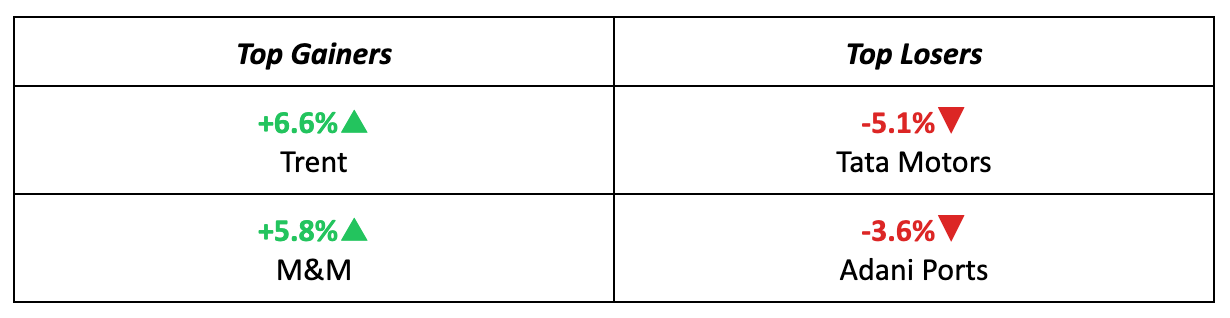

- Trent led the pack, surging 6.6%, as investors welcomed bullish notes issued by brokerages for the stock.

- Mahindra & Mahindra secured second place, rising 5.8% driven by robust volume growth, particularly in its tractor segment, bolstered by a healthy southwest monsoon.

The Losers

- Tata Motors saw a 5.1% decline last week, following news that its top profit-generating unit, JLR, expects lower EBIT margins this fiscal year compared to last.

- Adani Ports continued its downward trajectory, weighed down by the ongoing geopolitical tensions between Israel and Iran, with its key port located in Haifa, Israel.

Meanwhile…

- The US Fed kept rates unchanged for the fourth consecutive time, signalling the possibility of two rate cuts later this year as it revises its US GDP growth forecasts downward.

- At home, core sector growth in May dropped to a nine-month low of 0.7%, although steel and cement sectors remained resilient, supported by government capital expenditure initiatives.

Market Brief

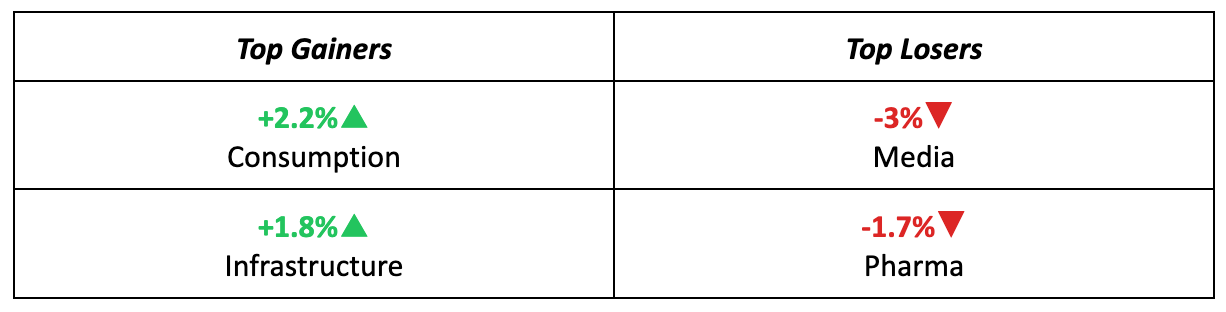

Sectors in Focus this Week

Our Take

- Markets wrapped up the week on a positive note, rebounding after a few muted sessions and reflecting fresh optimism. However, geopolitical tensions following the US strike on Iran may weigh on sentiment.

- In the coming days, global cues will be crucial. Investors will closely track the US Manufacturing and Services PMI data, along with further developments in the Middle East.

- Given these dynamics, markets are expected to remain volatile with an upward bias, with Nifty likely trading between 24,700 and 25,500.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.