Weekly Recap: Nifty Climbs 2% As Geopolitical Tensions Ease

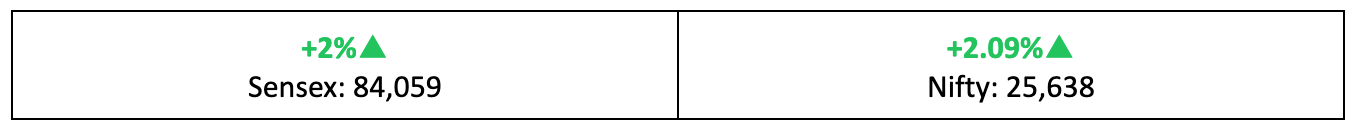

Markets saw a bullish week, with Nifty gaining 2.09% and surpassing the 25,600 mark for the first time in a while. Discover the top-performers, key market trends and expert insights on what to expect in the coming week.

Weekly Recap

Markets rocketed upward last week as bulls returned in full force, pushing the Nifty up by a respectable 2.09%. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Saved from the Brink!

- D-Street was firmly bullish last week with the Nifty climbing over 2%, fuelled by a de-escalation in geopolitical tensions between Iran and the US.

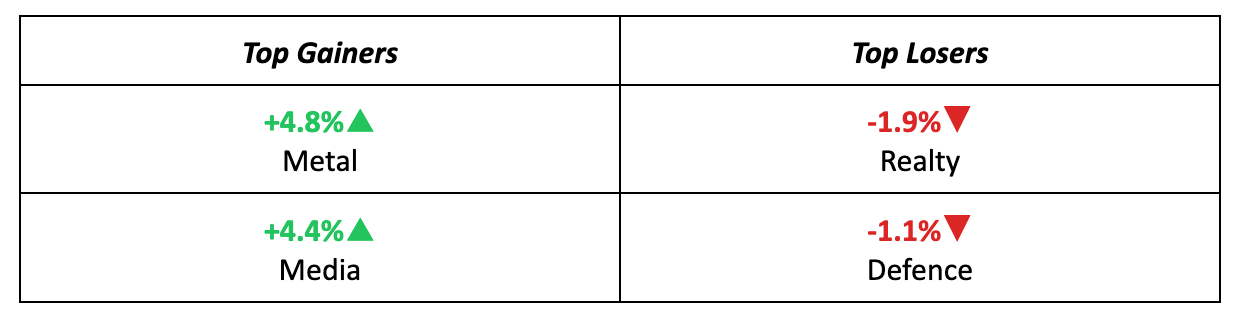

- Broader markets outperformed the frontline indices, with the Nifty Small Cap index surging more than 4% for the week.

- The India VIX, a measure of market fear, fell 9.4% over the week after spiking on Monday, as the geopolitical situation calmed.

The Big Stories

- Early in the week, all eyes were on the US' potential actions in the escalating Israel-Iran conflict. As tensions eased, so did negative sentiment among investors.

- Back home, a positive monsoon forecast and easing inflation figures lifted market confidence, propelling the Nifty Bank index to an all-time high.

The Winners

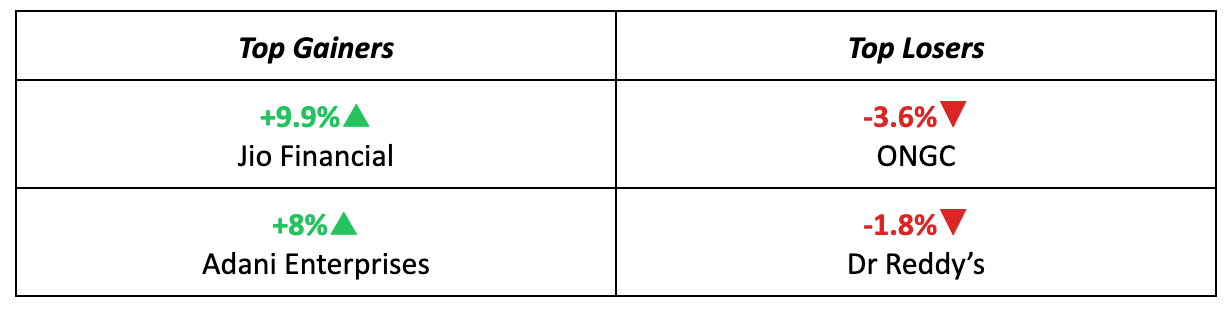

- Jio Financial emerged as the top performer of the week, surging 9.9% after SEBI approved Jio BlackRock as a stock broker and clearing member.

- Adani Enterprises trailed closely, jumping 8% following its acquisition of infrastructure firm Granthik Realtors and the launch of India's first off-grid green hydrogen plant.

The Losers

- ONGC was the biggest loser of the week, falling 3.6% as crude oil prices softened following the ceasefire declaration between Israel and Iran.

- Dr. Reddy’s also saw a notable decline after Citi Research downgraded its forecast, citing concerns over growth.

Meanwhile…

- US inflation came in slightly above expectations, but Wall Street shrugged it off, with the S&P 500 and Nasdaq hitting record highs, driven by positive trade talks and rate cut hopes.

- Citi raised its forecast for China's GDP growth, now in line with the government's 5% target, citing recent improvements in policy delivery and positive consumption and investment data.

- India’s current account deficit for FY25 came in at $23.3 billion (0.6% of GDP), improving from $26 billion (0.7% of GDP) in FY24.

Market Brief

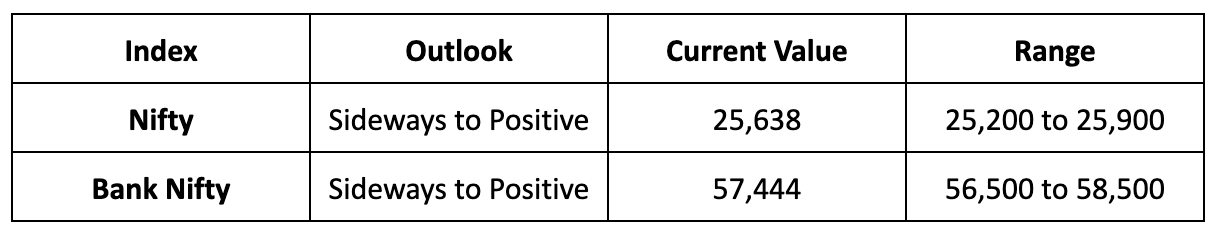

Market Outlook

Our Take

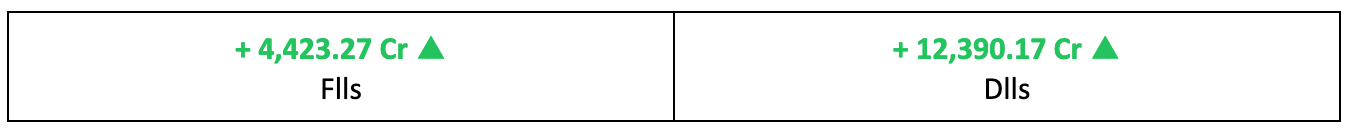

- The recent geopolitical stability has boosted risk sentiment, driving broad market participation. Additionally, positive developments surrounding potential trade agreements could strengthen the positive sentiment.

- Given these factors, we expect the markets to trend sideways to positive next week, within a range of 25,200 to 25,900.

- Going forward, global cues will be crucial. A buy-on-dips strategy seems more suitable at current levels, following the recent sharp rise.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.