Weekly Recap: PSU Banks Surge & L&T Hits Highs

Markets endured a volatile week as the India VIX spiked by 8%. From PSU banks outperforming private lenders to L&T hitting all-time highs and the US Supreme Court's tariff ruling, here is everything you missed and the key levels to watch for Nifty and Bank Nifty this week.

Weekly Recap

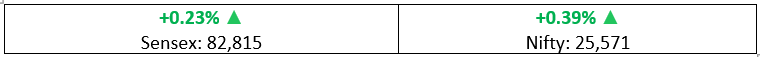

Markets witnessed a volatile week, navigating sharp swings and ultimately closing 0.4% higher compared to last week. Explore the biggest developments, overlooked stories, and our outlook for the week ahead in your Weekly Report.

Testing the Highs & Lows

- Investors were taken on a bumpy ride last week as volatility persisted throughout the period, with the Nifty eventually closing 0.4% higher compared to last Friday.

- The India VIX fear gauge spiked on Thursday, ending the week 8.1% above last week’s levels — a clear sign that nervousness made a noticeable return to D-Street.

The Big Stories

- Global markets, including India, remained on edge last week as geopolitical tensions took centre stage, particularly around developments involving the US and Iran.

- Meanwhile, the latest Fed meeting minutes revealed divisions within the policymaking committee over the possibility of near-term rate hikes, adding to global uncertainty.

The Winners

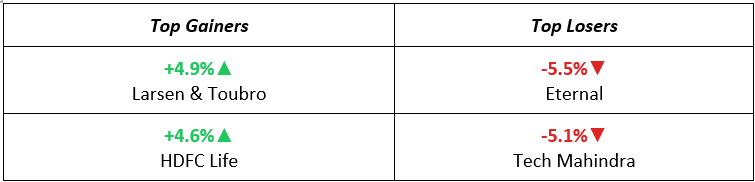

- L&T emerged as the top gainer on the Nifty last week, surging 4.9% to touch a new all-time high following the announcement of its agreement to fully divest from Nabha Power.

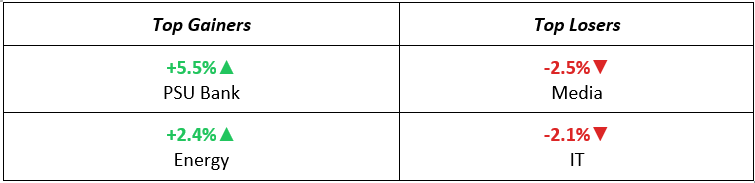

- PSU banks outperformed, rising 5.5% during the week, supported by RBI’s draft norms to curb mis-selling — a move that could weigh more on private lenders’ fee income than on PSUs.

The Losers

- Eternal fell 5.5% last week after announcing plans to partner with OpenAI to strengthen AI deployment across its platforms and internal systems.

- Tech Mahindra extended its losses, falling 5.1% amid persistent concerns over AI-led disruption and elevated valuations.

Meanwhile…

- In a 6–3 verdict, the US Supreme Court ruled that the Trump administration’s unilaterally imposed tariffs were unconstitutional and unlawful.

- Back home, core sector growth slowed from 4.7% in December to 4% in January, reflecting persistent weakness across energy-related segments.

Key Indices

Trending Stocks

Sector Insights

Market Outlook

Sectors To Watch

Our Take

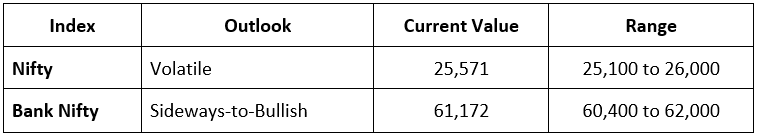

- With geopolitical tensions still unfolding and frequent policy updates around the Trump administration’s tariffs, markets are likely to remain sensitive to headlines, keeping volatility elevated in the near term.

- Against this backdrop, we expect the Nifty to trade within the 25,100–26,000 range, pointing to another week of swings for D-Street investors to navigate.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.