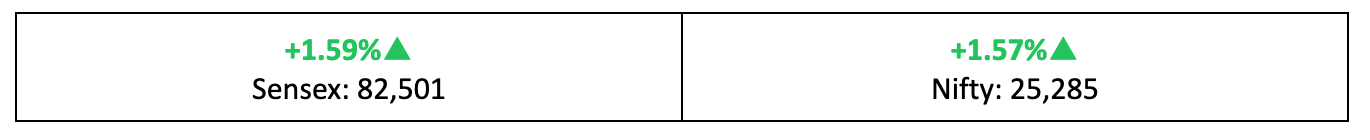

Weekly Recap: Nifty up 1.57%, FIIs Turn Buyers, Q2 Earnings in Focus

Markets advanced for a second straight week, with the Nifty up 1.57%. FIIs turned net buyers, Q2 results drove sector moves and India VIX stayed steady. Here’s your weekly market recap covering top gainers, losers, key indices and outlook for the week ahead.

Markets closed higher for a second consecutive week —the strongest weekly advance in three months. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Rally Time!

- Investors wrapped up a broadly positive week with the Nifty rising 1.57% and finishing near a one-month high.

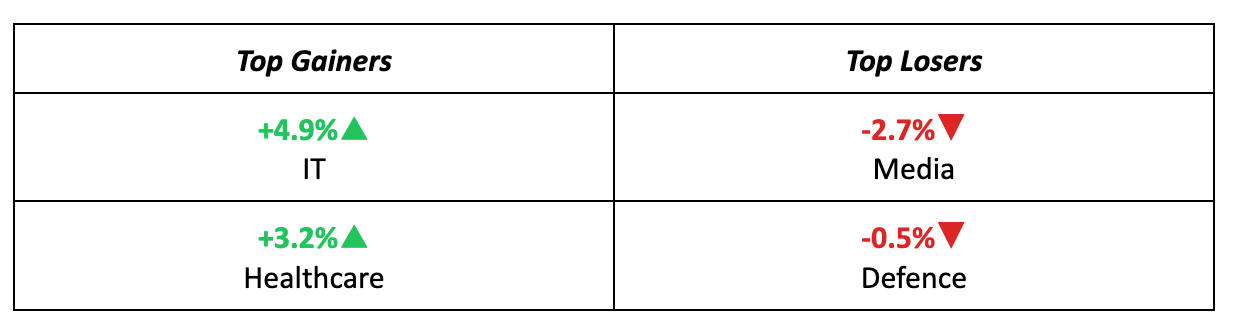

- Among the broader indices, the BSE Large-cap Index gained 1.4% and the BSE Mid-cap Index climbed 1.5%. In contrast, the BSE Small-cap Index was largely unchanged.

- Meanwhile, India VIX fear gauge barely moved—up just 0.4%—keeping conditions benign and trend-friendly.

The Big Stories

- With Q2 earnings underway, several sectors saw positioning and fresh trades as investors priced in results.

- Macro mood improved on signs of progress in India–US trade discussions, albeit with negotiations ongoing.

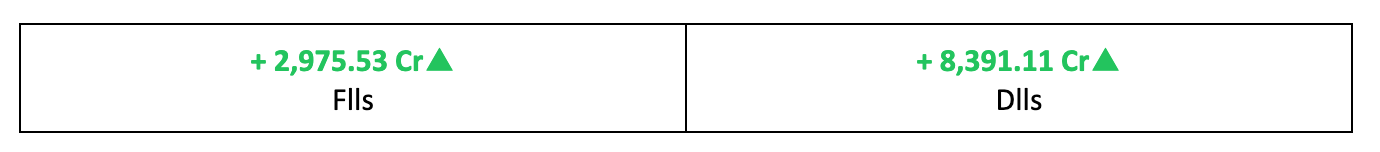

- Flows turned supportive: after 12 consecutive weeks of net selling, Foreign Institutional Investors (FIIs) were net buyers last week.

The Winners

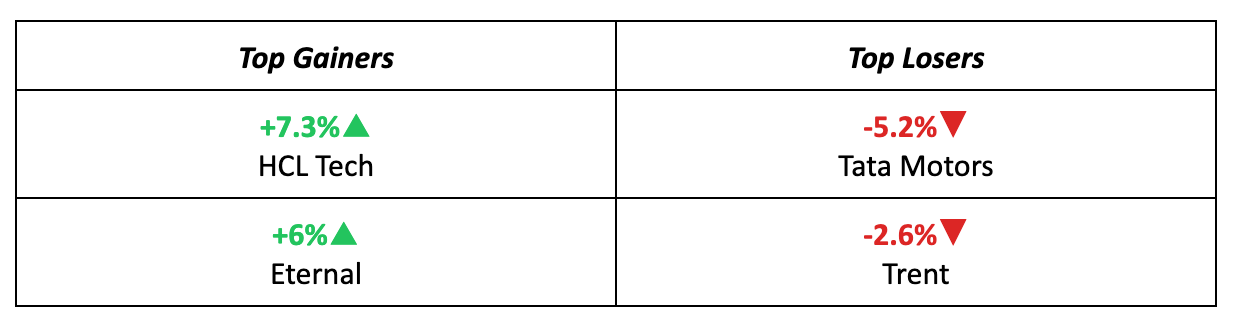

- HCL Tech led the pack with a 7.3% weekly gain, buoyed by expectations of sequential growth in Q2 PAT and an improvement in margins.

- Eternal followed close behind, up 6% to fresh all-time highs after Citi raised its price target, citing a stronger growth outlook into FY26.

The Losers

- Tata Motors topped the laggards, down 5.2% as shares adjusted post the demerger becoming effective on 1 October.

- Trent was next, slipping 2.6% after a quarterly performance that fell short of expectations and failed to impress the street.

Meanwhile…

- U.S. equities plunged on Friday evening (post India close) after the Trump administration threatened fresh tariff hikes on China, souring risk sentiment into the weekend.

- At home, the World Bank nudged India’s FY26 growth forecast up to 6.5%, a constructive signal for the medium term—even as the possibility of fresh tariffs poses a headwind for export momentum in the coming year.

Market Brief

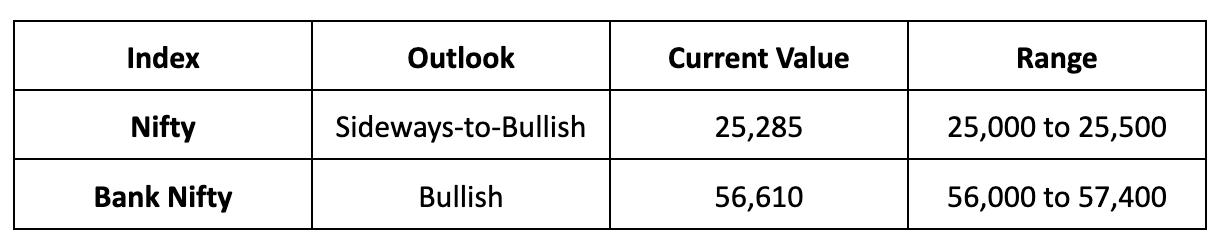

Market Outlook

Our Take

- Sentiment on Dalal Street improved last week, but Friday’s late Wall Street sell-off on renewed US–China tariff threats leaves an overhang—expect some reaction at Monday’s open.

- Overall, base case remains sideways-to-bullish for Nifty this week, but fresh tariff headlines could override the setup. Keep risk tight, stagger entries and track global cues before sizing up.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.