Weekly Recap: Nifty Outlook, Sector Winners & Fed Rate Cut Impact

Nifty’s sideways trend continued with a slight dip last week. Catch up on sector updates, key stock movements and investment insights to help you make informed decisions in the coming week.

Markets at home moved with the global tide last week, dipping early on and then recovering as the week progressed. Here's our take on this week gone by, some stories you might have missed out on and our thoughts on what to do going ahead, in your weekly report.

Carried Away

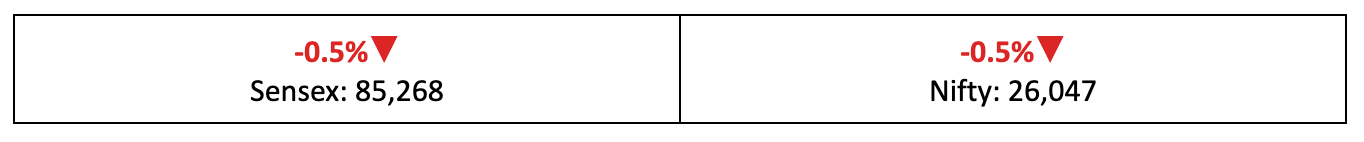

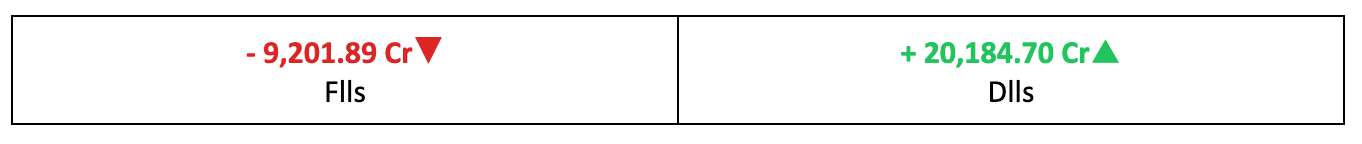

- Last week, investors at home mostly reacted to the US Fed's decisions on monetary policy, with the Nifty ultimately closing 0.5% down compared to the previous week.

- In the broader market, the BSE Large-Cap index fell 0.5%, the BSE Mid-Cap index slipped 0.3% and the BSE Small-Cap index shed 0.4%.

- The India VIX fear gauge continued to decline, as investor nerves were calmed by a stable domestic outlook and the Fed’s dovish signals.

The Big Stories

- In a split decision, the Fed decided to cut interest rates by 25 bps. Meanwhile, the Trump administration has been pushing for quicker rate cuts.

- At home, retail inflation, which had dropped to a record low of 0.25% in October, picked up a bit in November, rising to 0.71%.

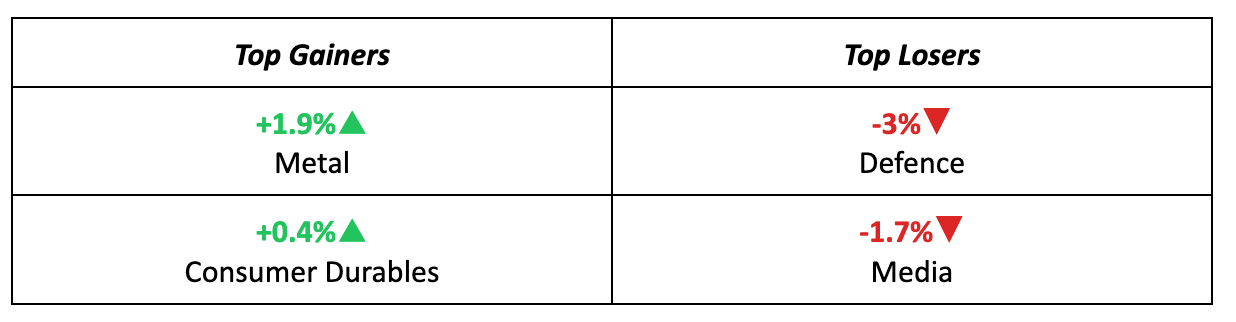

The Winners

- The metals sector had a strong week, driven by China’s announcement of a 'proactive' fiscal policy, along with a weaker Dollar and the Fed's rate cut, which helped lift share prices.

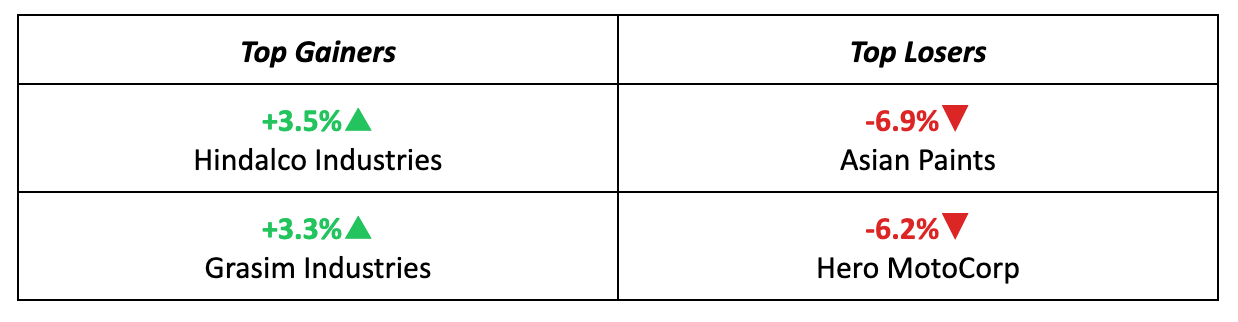

- Leading the charge was Hindalco Industries, up by a solid 3.5%, followed closely by Grasim Industries, which rose by a respectable 3.3%.

The Losers

- Asian Paints was the biggest loser of the week, shedding 6.9% as investors booked profits after the stock hit a 52-week high earlier in December.

- Hero Motocorp also made it to the losers' list, slipping 6.2% after UBS highlighted weak volume growth for the two-wheeler giant, citing the sluggish economic environment.

Meanwhile…

- AI giants like Alphabet and Nvidia took a hit last week, as concerns over a potential AI bust emerged again and weighed on investor sentiment.

- China’s trade surplus soared to $1 trillion for the year, highlighting its growing dominance in crucial sectors like semiconductors and AI.

Market Brief

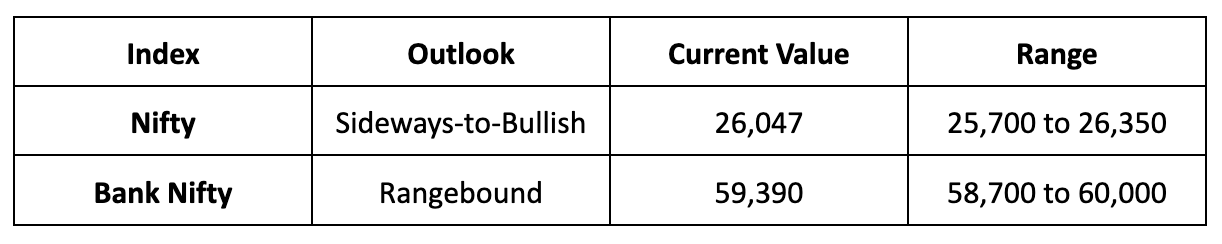

Market Outlook

Our Take

- The later-stage recovery suggests that buyers are becoming more active near key support levels, which gives us reason to maintain a cautiously optimistic outlook in the near term.

- Based on technical indicators, we expect Nifty to trend sideways-to-bullish next week, with a trading range between 25,700 and 26,350.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.