Weekly Recap: Nifty Outlook, Sector Winners & Central Bank Actions

Nifty remained rangebound last week amidst key global central bank decisions, with the broader markets showing mixed performance. Discover insights into sector movements, market volatility and key trends for the coming week.

The indices saw a slight decline compared to last Friday, amid a week filled with several global macroeconomic announcements. Here's our take on this week gone by, some stories you might have missed out on and our thoughts on what to do going ahead, in your weekly report.

Cautious

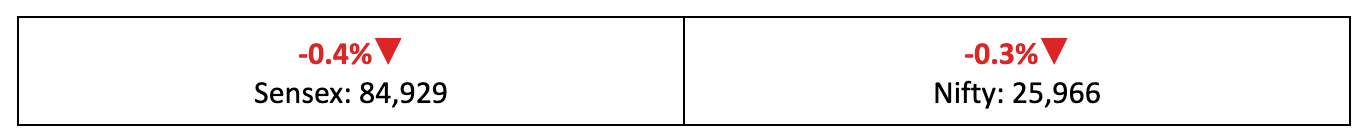

- Investors remained vigilant on global markets last week, with the Nifty experiencing a slight dip of 0.3% and largely staying within a rangebound zone.

- Among broader markets, the BSE Large-Cap index fell 0.3%, the BSE Mid-Cap index gained 0.15% and the BSE Small-Cap index decreased by 0.18%.

- The India VIX fell to a record low of below 10, signalling reduced expectations for significant market volatility in the near term.

The Macro Picture

- The Bank of England lowered rates to 3.75% following softer inflation data, while cooling inflation in the US fuelled expectations that the Federal Reserve may follow suit.

- On the other hand, the Bank of Japan increased interest rates to their highest level since 1995, responding to the ongoing cost of living crisis in the country.

The Winners

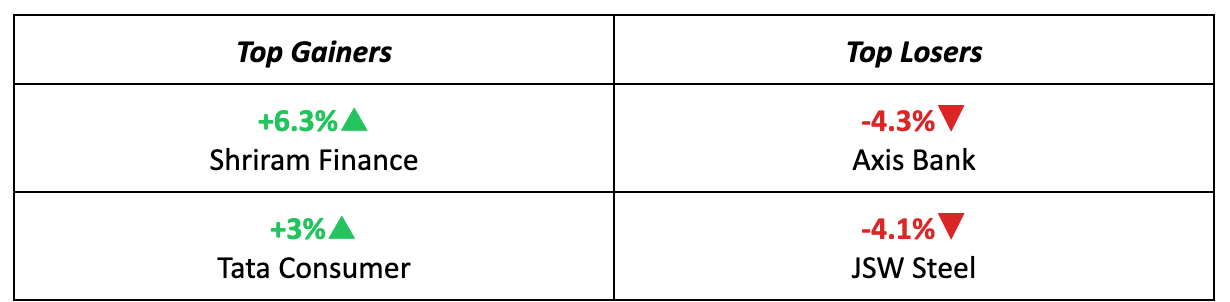

- Shriram Finance surged by 6.3% last week after Japan’s MUFG announced it would acquire a 20% stake in the NBFC for $4.4 billion.

- Tata Consumer also performed well, gaining 3% driven by short-term technical strength and positive investor sentiment in the FMCG sector.

The Losers

- Axis Bank dropped 4.3% last week after Citi Research highlighted the potential for a slower-than-expected recovery in its net interest margins.

- JSW Steel also declined by 4.1%, along with several other metals giants, as weakening domestic macro momentum weighed on sentiment in the sector.

Meanwhile…

- India and Oman signed a significant trade deal on Thursday, covering 99.38% of India's exports to Oman, with implementation expected in the next three months.

- Unemployment in India dropped to an eight-month low of 4.7% in November, driven by improved rural employment and higher female labor force participation.

Market Brief

Market Outlook

Our Take

- Last week saw several major announcements from global central banks, providing investors with a lot to digest alongside other macroeconomic news.

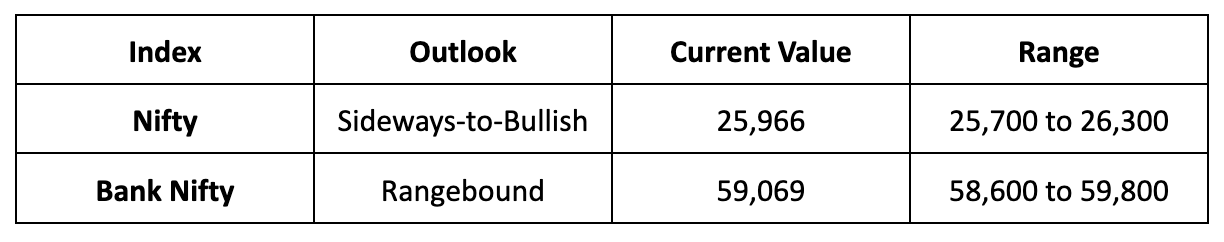

- Given the recovery in the second half of the week, we anticipate the Nifty to trend sideways-to-bullish, with a trading range between 25,700 and 26,300 next week.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.