Weekly Market Update: Record Highs Post Fed's Surprise Rate Cut

Explore the major market movements from last week, including record-setting highs after the Fed’s monetary policy decision. See which stocks & sectors outperformed & underperformed.

Markets continued their upward trajectory from the previous week, achieving new record highs following the Federal Reserve's decision. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly report.

Weekly Recap

Late-week surge

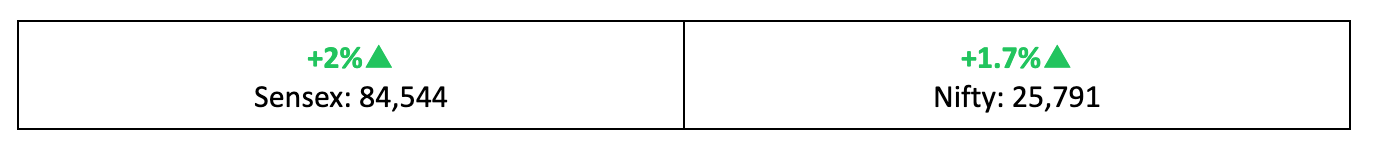

- Indices surged in the later part of the week, closing 1.7% higher than the previous week, hitting new record highs for the 59th time this year.

- While last week also saw broader indices reaching new highs, the BSE Mid-Cap and Small-Cap indices ended on a flat note, whereas the Large-Cap index rose by 1.5%.

What on Earth happened?

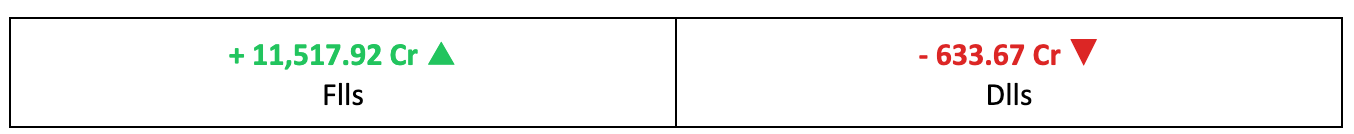

- Last week's headline was dominated by the Federal Reserve's surprise move to cut interest rates by a larger-than-expected 50 bps, with indications of more cuts to come.

- Investors welcomed the long-anticipated cuts, but there's growing concern that this could signal broader economic trouble globally.

- Also read: US Fed Cuts Interest Rates by 50 bps: Analysing the Impact on Indian Markets

The winners

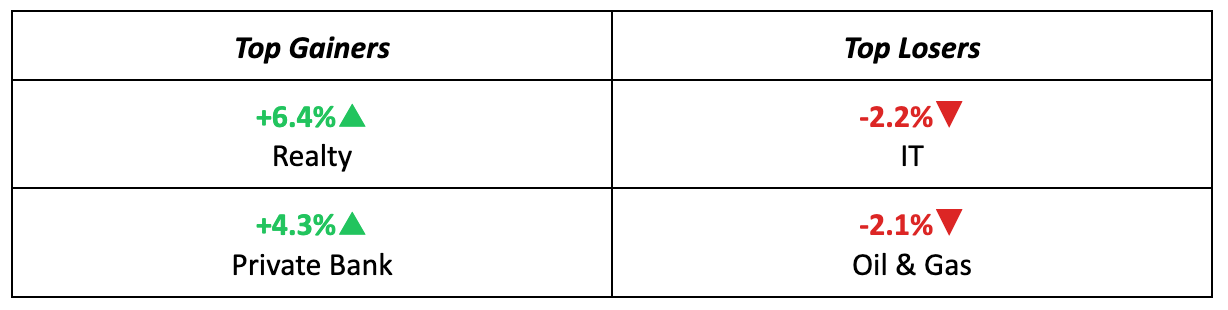

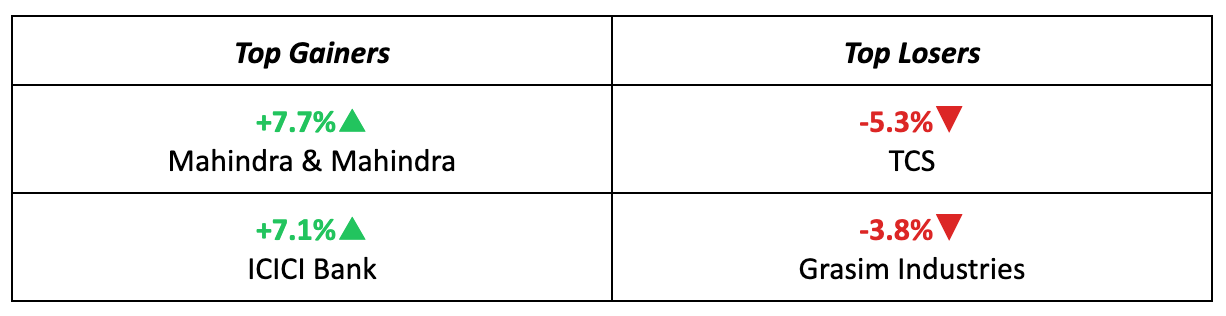

- Mahindra and Mahindra saw a 7.7% increase last week, driven by widespread market optimism and the successful introduction of its new “Veero” LCV category.

- ICICI Bank came runner-up last week, buoyed by expectations of domestic interest rate cuts that are likely to benefit its interest margins.

The losers

- TCS, along with other IT majors, was hit hard due to the uncertainty leading up to the Fed’s decision to cut rates, resulting in a 5.3% weekly loss.

- The Oil & Gas sector also had a tough week, with the sectoral index dropping by 2.1% amid volatile crude oil prices, although there may be signs of improvement on the horizon.

Meanwhile…

- The government has decided to scrap windfall taxes on petroleum crude starting September 18, following a significant drop in crude oil prices over recent months.

- In Asia, the Bank of Japan opted to hold interest rates steady rather than raise them, while also upgrading its outlook on the economy's consumption.

Market Brief

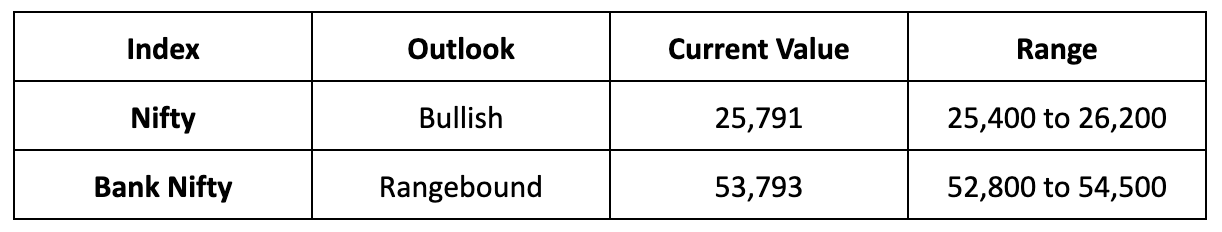

Market Outlook

Our take

- The Fed's move to cut interest rates is prompting investors worldwide to reassess the potential for a soft landing and adjust their strategies accordingly.

- We believe the positive response to this rate cut will extend into next week, leading us to adopt a bullish stance on the Nifty with an anticipated trading range between 25,400 and 26,200.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store or Apple App Store, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download today and enhance your financial journey with Liquide's cutting-edge features.