Weekly Wrap: Nifty Slips as IT Crumbles; SBI & Eicher Motors Surge

Nifty closed 0.87% lower last week as a tech sell-off and global cues dampened sentiment. While IT giants like Infosys and HCL Tech struggled, SBI and Eicher Motors hit new highs. Get the full breakdown of the biggest winners, losers and our market outlook for the week ahead.

Markets wiped out part of the previous week’s gains to close in the red, pressured by weak global cues. Explore the biggest developments, overlooked stories, and our outlook for the week ahead in your Weekly Report.

Slipping & Sliding

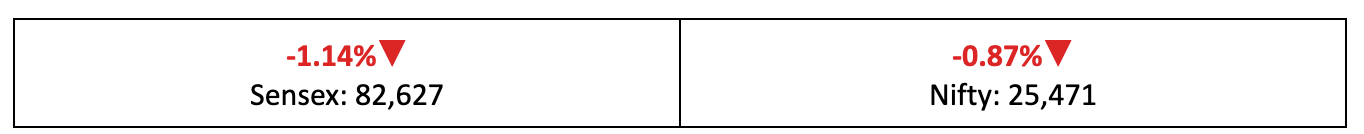

- Markets trended lower toward the latter half of the week, with the Nifty ultimately ending 0.87% below the previous week’s close.

- Volatility returned sharply, as the India VIX — the market’s fear gauge — surged over 11% during the week, including a steep 15% spike between Thursday and Friday alone.

The Big Stories

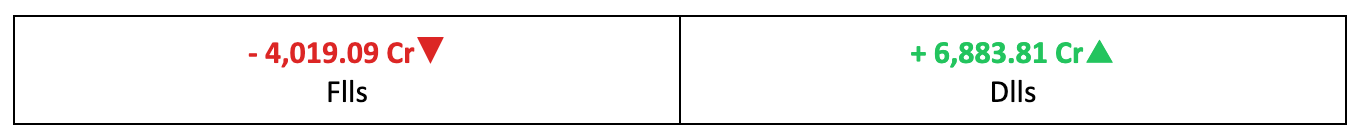

- Global sentiment remained fragile, exemplified by the tech-heavy Nasdaq which tumbled over 2% during the week.

- On the domestic front, a muted corporate earnings season disappointed investors, while rising concerns around AI-led disruption added pressure on traditional business models.

- Read more: Is Indian IT “Dead” or “Discounted”?

The Winners

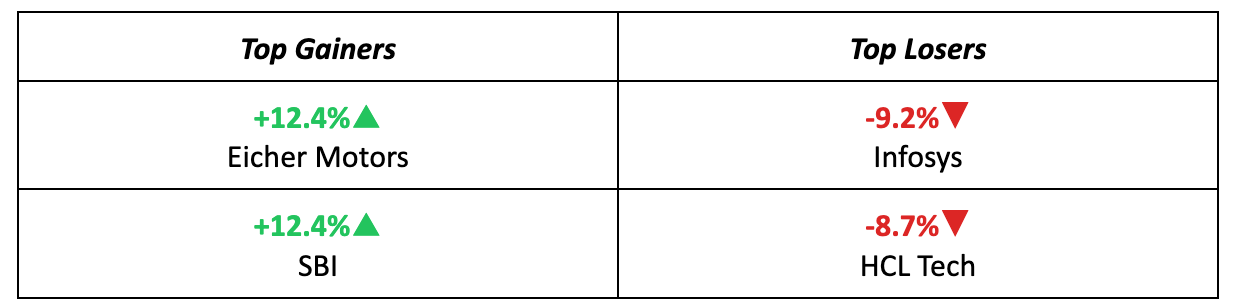

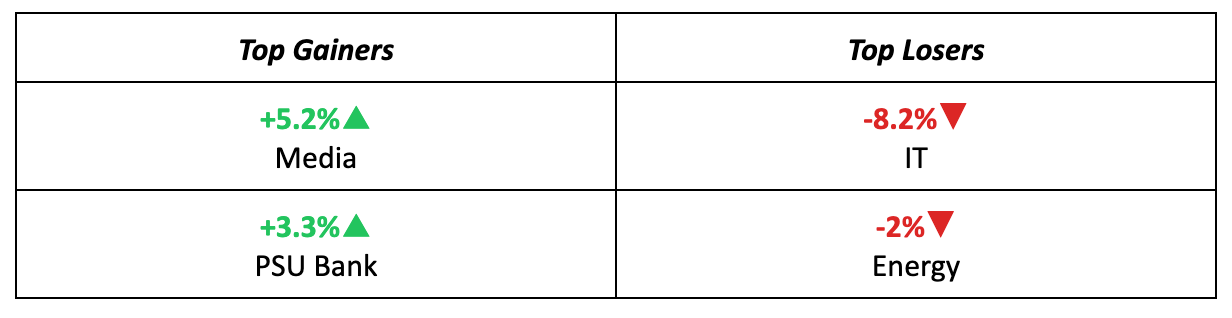

- Eicher Motors emerged as the week’s top gainer, surging 12.4% after delivering its strongest-ever Q3 earnings, while easing trade tensions between the US and India further supported sentiment.

- SBI matched Eicher’s performance with a 12.4% rally, surpassing TCS in market capitalisation following its record Q3 profit.

The Losers

- IT heavyweights Infosys and HCL Tech were the week’s biggest laggards, sinking by 9.2% and 8.7% respectively, and pulling the sectoral index down by 8.2%.

- The decline mirrored the broader sell-off in the Nasdaq, reflecting Indian IT’s significant exposure to the US market, while newly announced hikes in US visa fees further unsettled investor sentiment.

Meanwhile…

- The latest CPI data showed retail inflation at 2.75% in FY26, marking the third consecutive rise since November.

- Unemployment edged lower in the October–December quarter to 6.7%, supported by a rise in self-employment and improved job absorption across sectors.

Market Brief

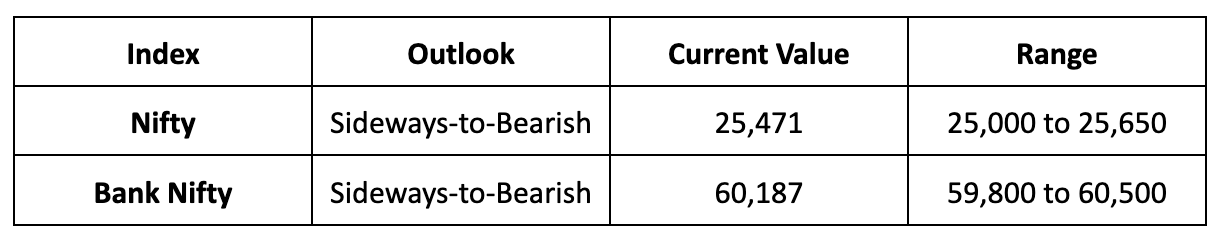

Market Outlook

Our Take

- Global indicators continue to signal lingering downside risks, suggesting markets may remain under pressure in the near term.

- We expect the Nifty to trade with a cautious, sideways-to-bearish bias next week, likely moving within the 25,000 to 25,650 range.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.