Weekly Market Recap: Nifty Rises Despite Tariff Concerns

Get the latest stock market insights in our weekly recap. Nifty rises 0.72%, key sectors like Defence lead gains, and tariff concerns weigh on global markets. Explore expert stock picks and market outlook.

Weekly Recap

Markets extended gains for the second consecutive week, despite volatility driven by mixed signals from global markets. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Bated breath

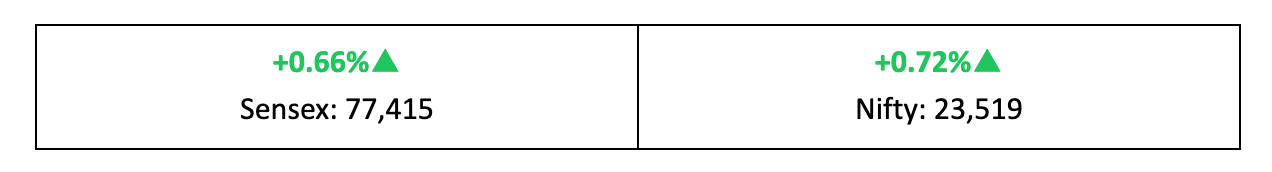

- The Nifty rose by 0.72% last week, continuing its upward trend after the recent bull rally. Strong buying from both domestic and foreign investors, coupled with a rupee appreciation against the dollar, helped propel the market into positive territory.

- However, the overall sentiment remained cautious, as uncertainty driven by concerns over upcoming US tariffs continued to limit the market's upside potential.

- In the broader market, the BSE Large-cap Index gained 0.6%, while the BSE Mid-cap Index dropped 0.7%, and the BSE Small-cap Index shed 1.4%.

The big stories

- Last week, the Trump administration imposed a blanket 25% tariff on all car imports into the US, sparking significant concern among automakers globally.

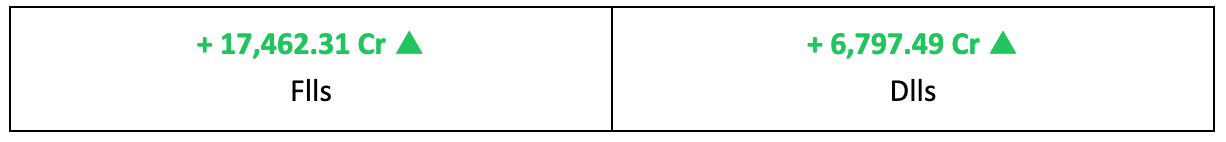

- On a more optimistic note, Foreign Institutional Investors (FIIs), who have been consistent sellers in recent months, have turned net buyers in the past few days.

The winners

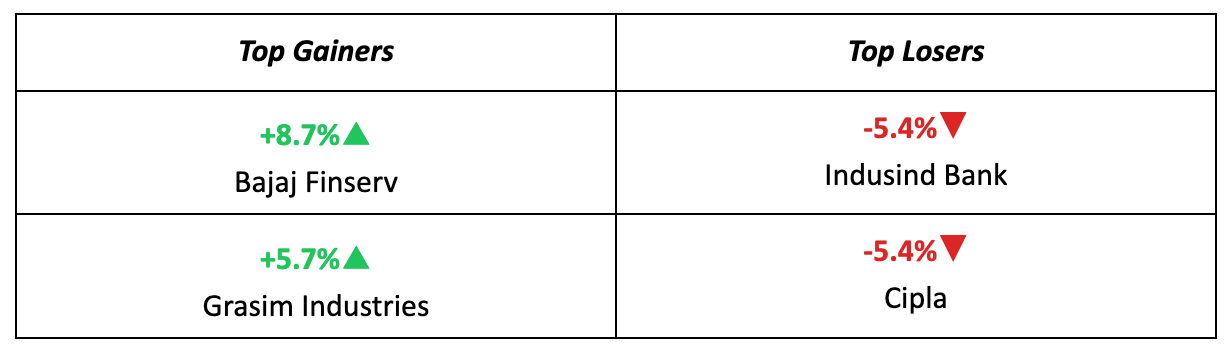

- Bajaj Finserv emerged as the top winner of the week, with an 8.7% gain following its agreements to acquire a 26% stake in its two insurance joint ventures with Allianz SE.

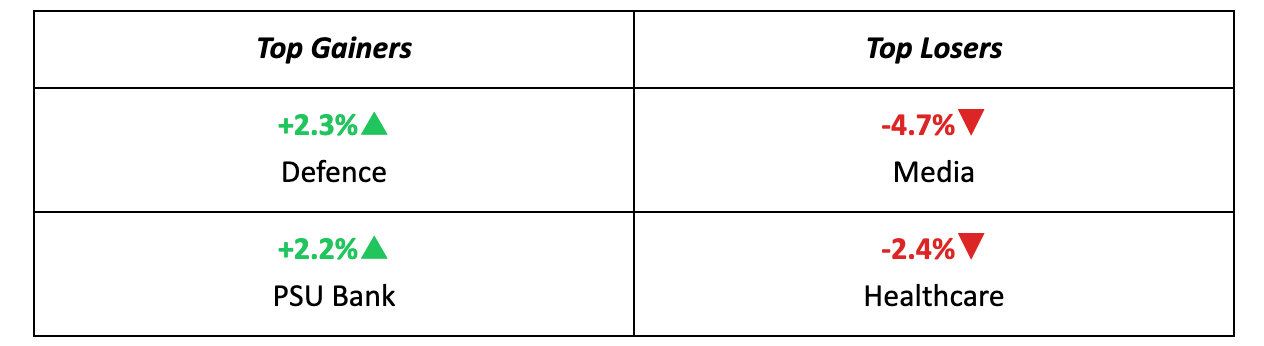

- The Defence sector maintained its strong performance on D-Street, driven by rising global momentum and increasing domestic order volumes.

The losers

- IndusInd Bank continued its downward slide, securing the week's top loser position with a 5.4% drop, ahead of PwC's audit report highlighting accounting discrepancies.

- Cipla,along with the broader healthcare/pharmaceutical sector, also saw significant declines due to concerns over the Trump administration's reciprocal tariffs and trade policies.

Meanwhile…

- India’s core sector output dropped to a five-month low in February, with growth slowing to 2.9% from 5.1% the previous month, according to data released by the government on Friday.

- In the US, core inflation remained resilient in February, while consumer confidence fell sharply, reaching 12-year lows amid growing concerns over tariffs and inflation.

Brief

Key Indices

Sectors

Stocks

Other Key Data

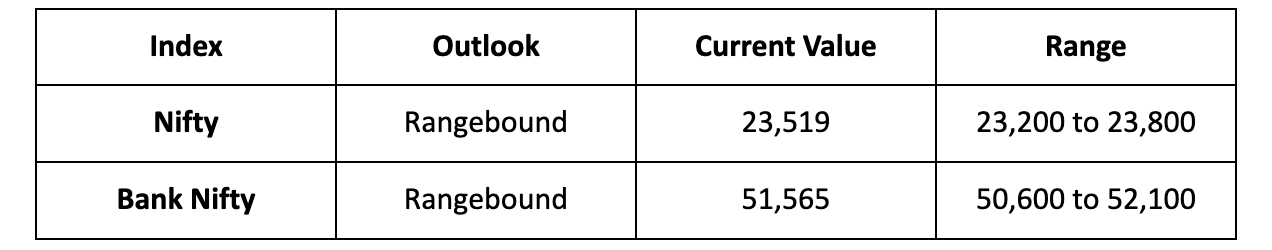

Market Outlook

Sectors To Watch:

Our take

- FIIs have played a crucial role in fuelling the bullish sentiment this March, aggressively unwinding their short positions. To explore the sectors leading this rally, check out our detailed insights here: March 2025: Sector Performance & Investor Insights

- However, despite the strong recovery in March 2025, investor sentiment remains cautious. Global uncertainties, particularly around President Trump’s tariff policies, continue to loom large. The next key date to watch is April 2, when President Trump is expected to implement reciprocal tariffs.

- The Indian stock market will be closed on Monday, March 31, 2025, for Id-Ul-Fitr (Ramzan Id). Trading will resume on Tuesday, April 1, 2025, after a three-day weekend. Looking ahead, we anticipate the Nifty to remain rangebound next week, with a forecasted trading range between 23,200 and 23,800.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.