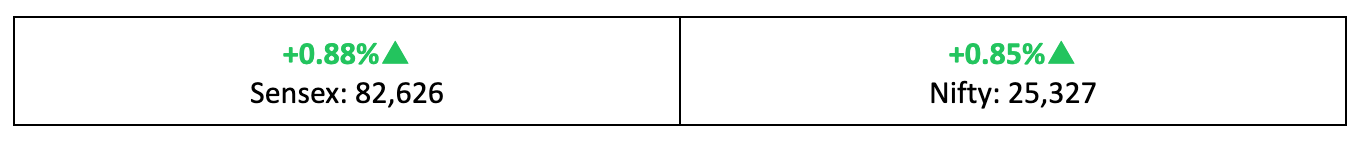

Weekly Market Recap: Nifty Rises 0.85% as Global Cues Lift Sentiment

Markets gained for the third consecutive week, with indices hitting a nine-week high. Here’s your weekly stock market recap with top winners, losers and what to watch ahead.

Markets gained for the third consecutive week, finishing at a nine-week high. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Moving Forward

- Indices maintained their strong momentum, closing 0.85% higher than last week, marking a third consecutive week of gains—the first such streak in five months.

- Among the broader indices, the BSE Large-cap Index rose by 1.1%, the BSE Small-cap Index climbed 2% and the BSE Midcap Index gained 1.5%.

- The India VIX continued its decline, closing the week at 9.96, reflecting a significant reduction in market fear on D-Street.

The Big Stories

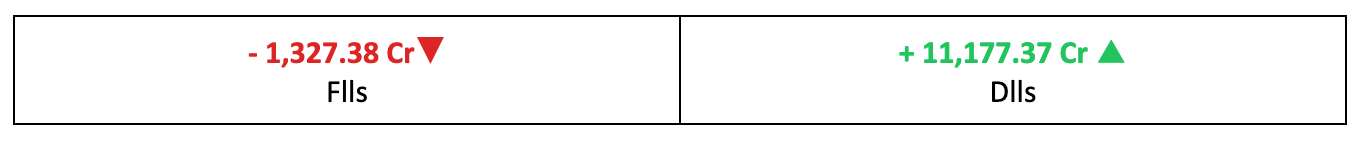

- Investors cheered the apparent thawing of trade tensions between India and the US, which boosted sentiment and alleviated pressure on FII selling activity.

- Global liquidity conditions showed signs of improvement, with the US Fed cutting rates for the first time in nine months, providing some relief to markets.

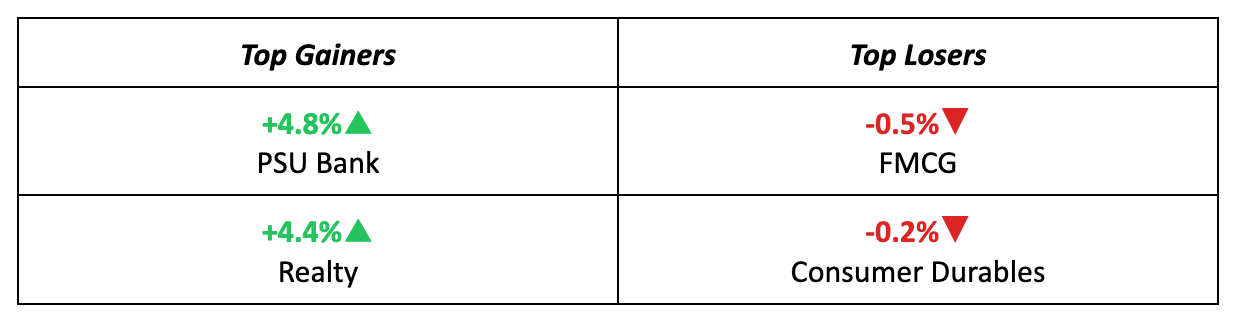

The Winners

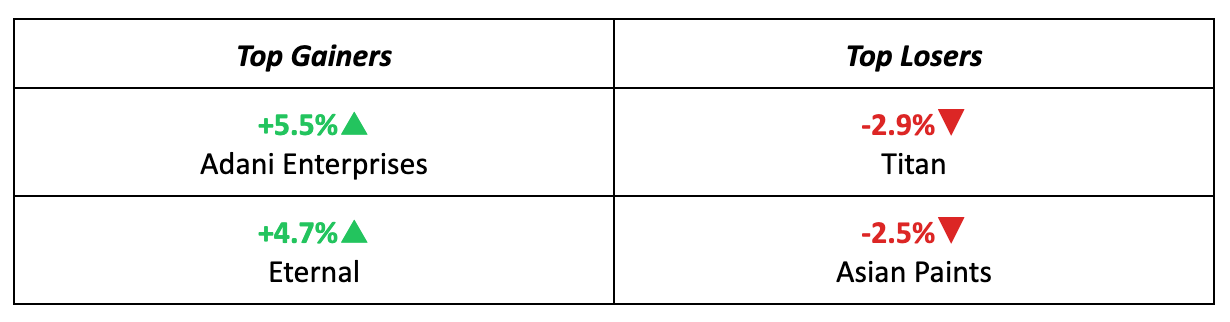

- Adani Enterprises emerged as the week's biggest winner, rising 5.5% after SEBI cleared the company of stock manipulation charges previously alleged by Hindenburg Research.

- Eternal also did well, hitting a 52-week high as Goldman Sachs raised their price target, citing improving profitability and strong growth prospects.

The Losers

- Asian Paints declined 2.5% last week, with brokerages highlighting ongoing competitive pressures and reaffirming their underperform ratings on the stock.

- FMCG stocks also stumbled after strong gains in recent weeks driven by the anticipated GST reforms, as investors consolidated positions and booked profits.

Meanwhile…

- In a positive development for India’s creditworthiness, R&I Inc., a sovereign credit-rating agency, became the third agency to upgrade India’s long-term sovereign credit rating to BBB+.

- A day after the Fed cut interest rates, the Bank of England kept rates steady at 4%, as annual inflation in the UK remained sticky at 3.8% in August.

Market Brief

Market Outlook

Our Take

- The last three weeks have seen a steady return of bullish sentiment, with investors taking advantage of the recent dip in valuations.

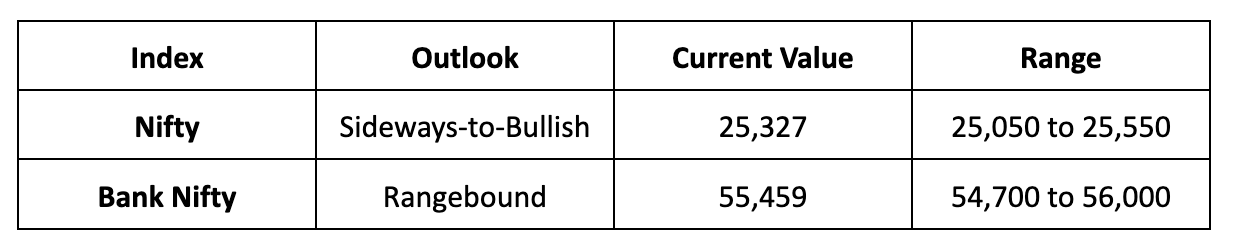

- Looking ahead, we expect the Nifty to remain in a sideways-to-bullish trend, with a projected trading range between 25,050 and 25,550.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.