Weekly Stock Market Recap: Nifty Falls 2.68%, Volatility Spikes!

Markets posted their biggest weekly loss in two months, with Nifty slipping 2.68% and volatility surging. Here’s a quick recap of the market trends, key winners & losers, and what lies ahead.

Weekly Recap

Markets tumbled back into the red last week, posting their biggest weekly loss in two months. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

There It Goes Again!

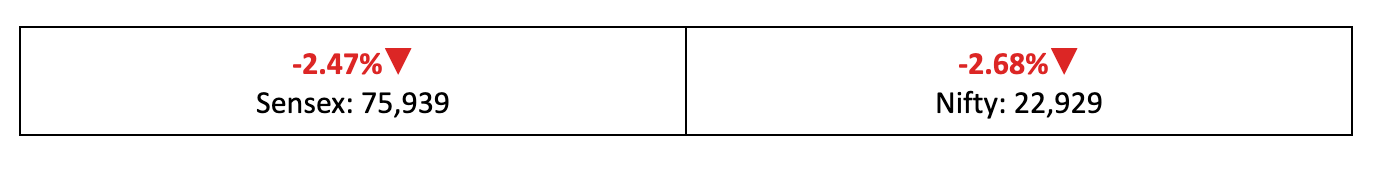

- Markets took another substantial hit last week, extending a rough patch for investors on D-Street, with Nifty closing 2.68% lower than the previous week.

- Broader markets faced even steeper declines, as the BSE Large-Cap, Mid-Cap, and Small-Cap indices dropped 3.3%, 7.7%, and 9.5%, respectively.

- The India VIX fear gauge spiked 9.7% over the past five days, reflecting rising investor anxiety amid intensifying market volatility.

What Gives?

- The spotlight remained on the Trump administration’s tariff policies, with India becoming the latest major economy to face reciprocal tariffs on a range of goods.

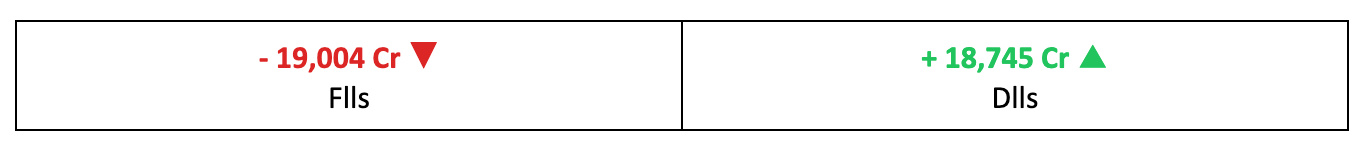

- FII outflows, coupled with weak earnings results, further weighed on the markets, keeping returns under pressure.

The Winners!

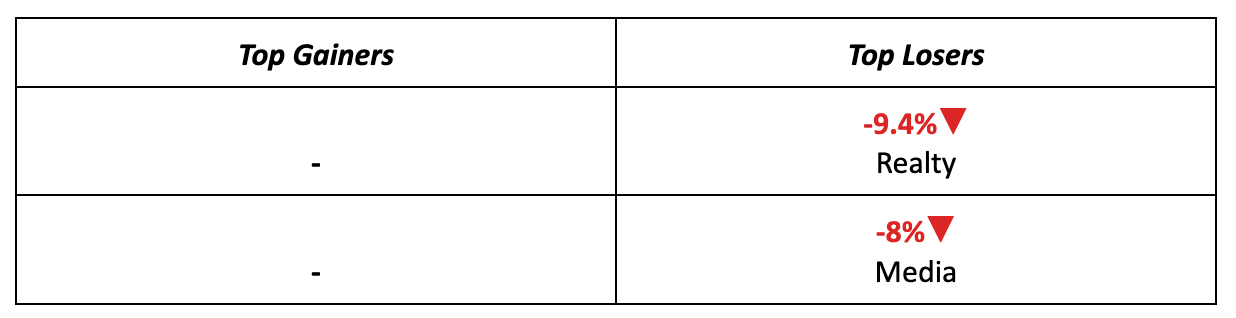

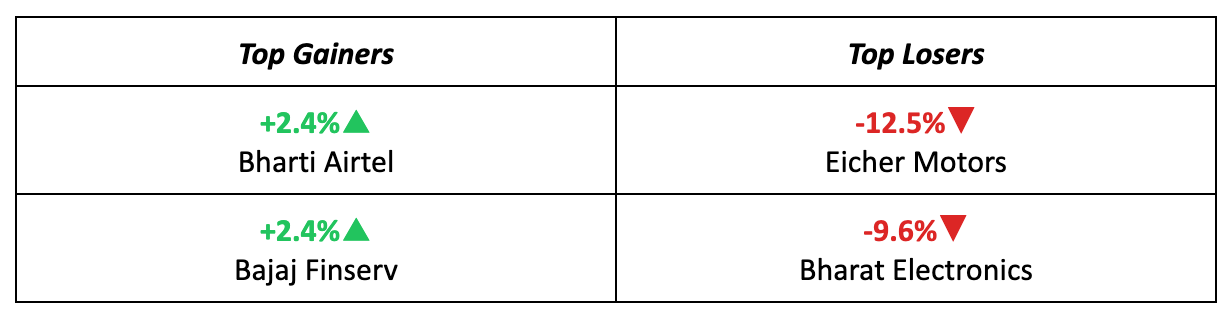

- No sectors managed to post gains last week, but a few stocks stood out. Bharti Airtel led the pack, buoyed by strong Q3 results.

- Bajaj Finserv followed closely, gaining from a rally in financial stocks as easing domestic inflation raised hopes of an RBI rate cut.

The Losers!

- Eicher Motors took the biggest hit last week, sliding on weak Q3 numbers despite record Royal Enfield sales.

- Realty stocks struggled as concerns over the regulatory environment, liquidity challenges, and stagnant demand continued to weigh on the sector.

Meanwhile…

- Wholesale inflation eased to 2.31% in January, while Consumer inflation fell below 5% for the first time in five months.

- On the flip side, fruit inflation surged to a decadal high of 12.2% in January, up from 8.6% the previous month, with coconuts and pineapples among the worst affected.

- The Indian rupee tested a fresh record low of 87.95 per dollar but managed to recover, closing 59 paise higher at 86.83, compared to 87.42 last Friday.

Market Brief

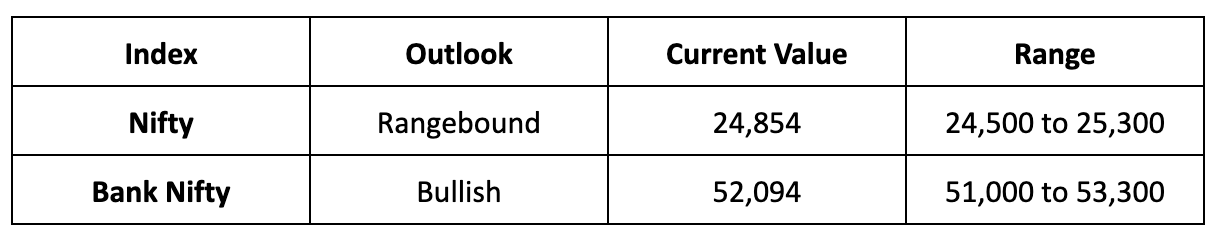

Market Outlook

Our Take

- Pessimism continues to cloud Indian markets as trade tensions with the US escalate and earnings remain weak, painting a challenging outlook.

- Given the current trends, we expect the Nifty to remain bearish next week, likely trading within the 22,500 – 23,200 range.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.