Markets Extend Losses for 5th Week: Key Triggers, Winners, Losers & What to Expect Next

Markets have extended their losses for the fifth consecutive week. This report breaks down key market movements, the winners and losers of the week and insights on what to expect next in this volatile market environment.

Weekly Recap

Markets extended their losing streak to a fifth straight week — the longest decline in two years. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly stock market report.

Continued Downtrend

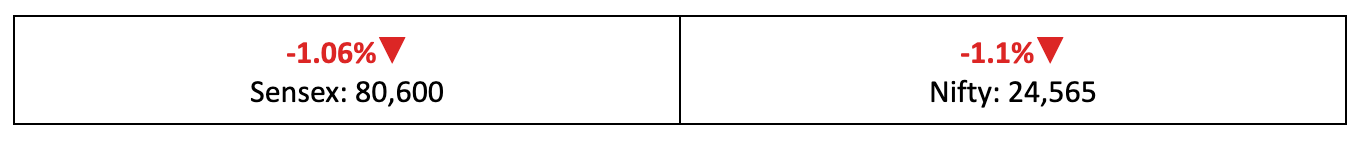

- The bumpy ride investors have been experiencing continued last week, as the Nifty dropped another 1.1% compared to last Friday's levels.

- Among the broader indices, the BSE Large-cap index slipped 1.2%, the BSE Mid-cap index fell 1.8% and the BSE Small-cap index shed 2.5%.

- Volatility spiked, with the India VIX fear gauge climbing 6.2% by week’s end, reflecting heightened investor nervousness for the near to medium term.

Key Triggers

- The earnings season continues with mixed results from key Nifty 50 stocks, with some, like TCS, announcing significant layoffs, adding to the uncertainty.

- Global markets remain on edge due to recent trade policy announcements from the US, coupled with emerging macroeconomic challenges that are starting to impact the economy.

The Winners

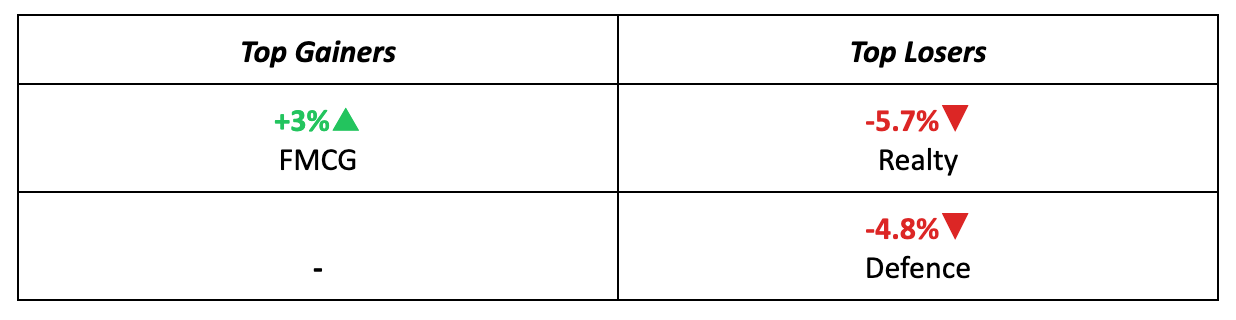

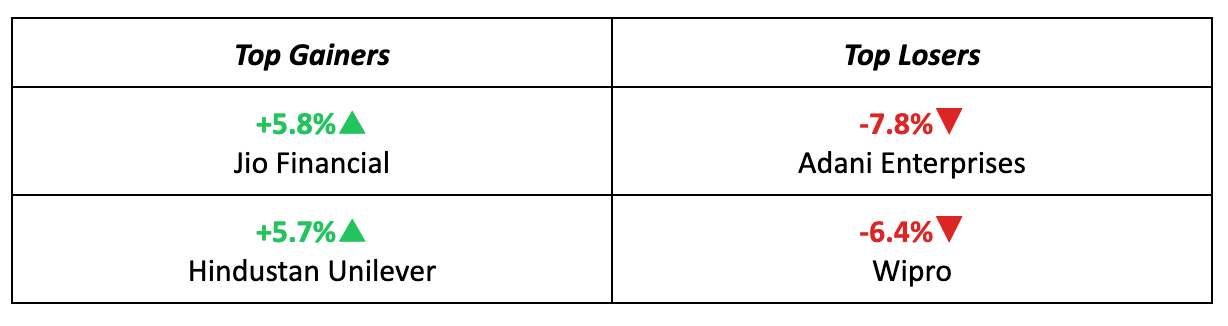

- Jio Financial Services emerged as the top performer of the week, surging 5.8% following the announcement of its $1.8 billion fundraising round aimed at expanding its competitive edge.

- Hindustan Unilever closely followed, contributing to the FMCG sector’s strong performance, with a 5.7% gain after reporting solid Q1 results.

The Losers

- Adani Enterprises saw a significant decline of 7.8% last week, as investors reacted to the company’s disappointing Q1 performance, marked by a drop in revenue and consolidated PAT.

- Wipro experienced a 6.4% sell-off, reflecting broader sectoral challenges. Despite stable results, the mass sell-off of IT stocks, triggered by TCS’s job cuts, weighed heavily on investor sentiment.

Meanwhile…

- In the US, macro data remains a concern for the Fed, with Q2 GDP growth rebounding, but a sharp slowdown in job growth, with only 73,000 jobs added in July, raising doubts.

- At home, manufacturing activity in July reached a 16-month high of 59.1. However, this momentum could be at risk due to the new 25% tariff imposed by the US. Here’s more on how this affects Indian stocks and investments.

Market Brief

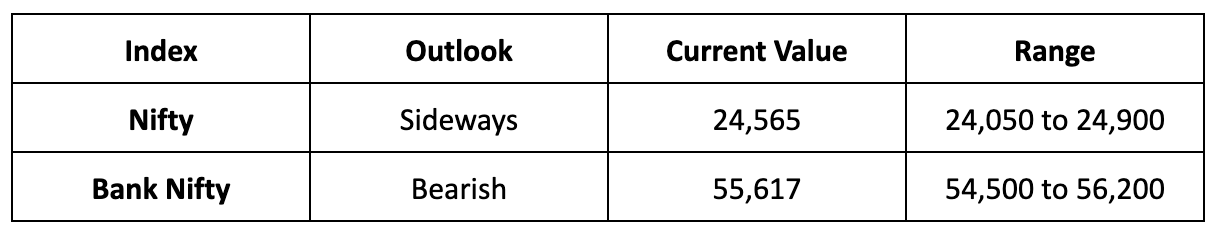

Market Outlook

Our Take

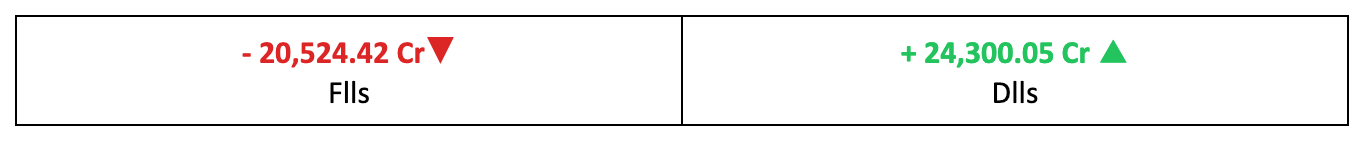

- Given the mixed outlook created by earnings, macroeconomic data and global policy shifts—factors beyond our control—we anticipate continued uncertainty dominating D-Street in the near term.

- Unless positive developments arise from trade deals or earnings, we expect the Nifty to trade sideways next week with a negative bias, forecasting a range between 24,050 and 24,900.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.