Weekly Market Recap: Key Factors Behind the 1.5% Decline in Nifty

Explore the reasons behind last week’s 1.5% decline in the Sensex and Nifty, understand sector performances, and get insights into future market trends and potential investment opportunities.

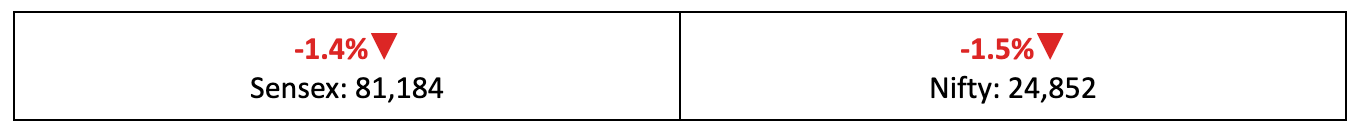

Markets snapped a 3-week gaining streak, with the benchmark indices falling 1.5%. Here's our take on this week gone by, some stories you might have missed out on, and our thoughts on what to do going ahead, in your weekly market report.

Weekly Recap

Losing steam

- The Nifty found itself unable to escape the red last week, declining 1.5% as the India Vix fear gauge jumped by 10%.

- This downturn wasn't isolated to domestic markets. Globally, many indices struggled - the S&P 500 fell by 3.64% over the week.

What’s going on?

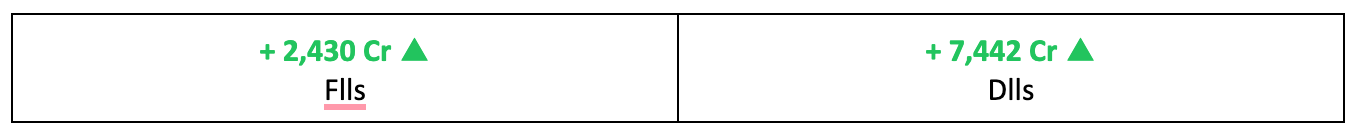

- The sell-offs come at a time of marked global pessimism - Asian and US markets saw broad-based selling due to unnerving US macroeconomic figures.

- Particularly hard-hit were tech stocks (chip maker Nvidia tanked by over 9%), prompting investors to reassess the likelihood of a recession in the offing.

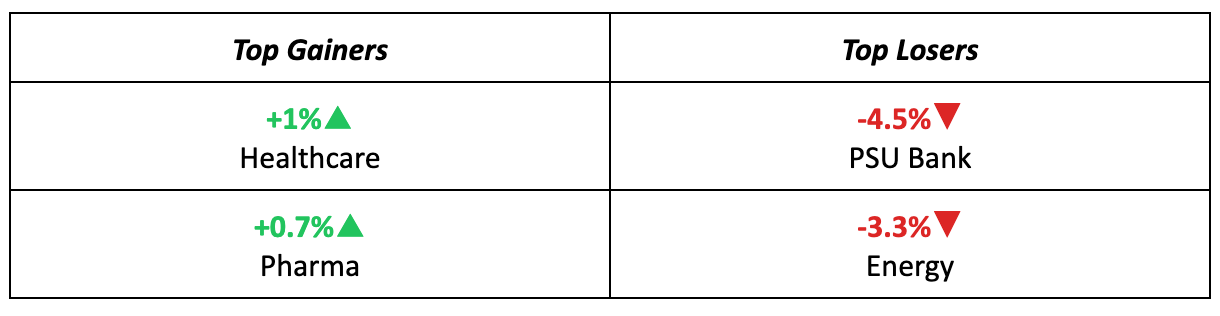

The winners

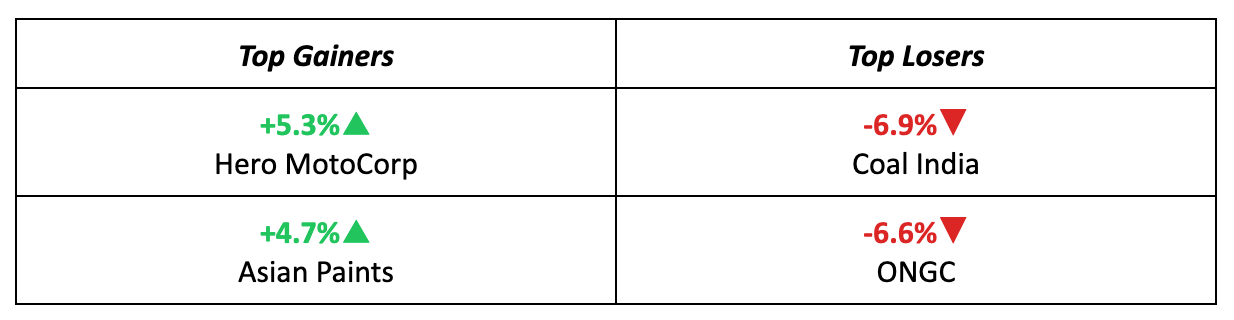

- Hero Motocorp had a great start to September, leading the way as the week’s top gainer on better-than-expected sales reports for August.

- Asian Paints also reached an eight-month peak, benefiting from the sharp decline in global crude oil prices last week—a positive turn for industries dependent on crude oil as a raw material.

The losers

- Coal India led the losses last week, falling 6.9% after Nuvama, a brokerage, reduced its target price by 4% due to concerns over sales volumes.

- ONGC also struggled, dropping 6.6% due to the declines in crude oil prices (one man’s fruit is another man’s poison!).

Meanwhile…

- Polls of economists indicate that domestic inflation may have eased to a 60-month low in August, while industrial production growth inched upward in July.

- In the US, a decline in new jobless claims last week could help alleviate concerns about weakening labor markets.

Market Brief

Market Outlook

Our take

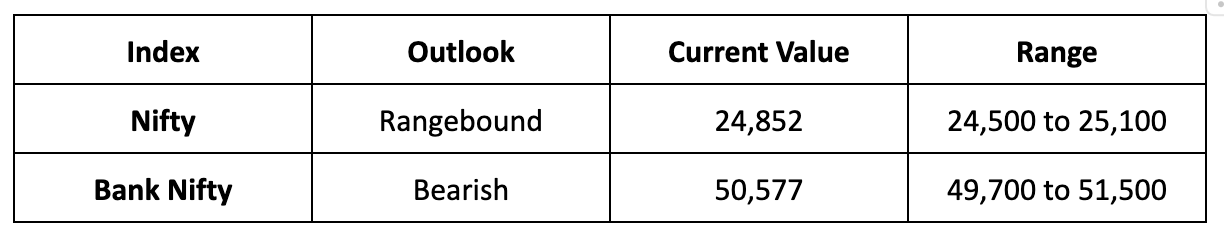

- We anticipate continued volatility next week as investors assess the recent shifts in the global economic outlook.

- Despite the positive US macro data from Friday, we expect markets to remain rangebound, with the Nifty likely trading between 24,500 and 25,100.

- In light of these conditions, it is advisable to avoid taking aggressive trading positions and maintain strict stop loss orders. With valuation discomfort across the broader market, focusing on quality large-caps may offer a safer avenue for long-term investment.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple App Store, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions. Download today and enhance your financial journey with Liquide's cutting-edge features.