Weekly Recap: Key Trends, Sector Performances & RBI Rate Cut Impact

Markets took a breather with little movement after three weeks of steady gains. The RBI’s rate cut and a weak rupee dominated the headlines, while IT stocks stood out with strong performance. Get insights on sector trends, key stock movements and the outlook for the coming week.

The markets wrapped up the week with little change, following three weeks of steady gains. Here's our take on this week gone by, some stories you might have missed out on and our thoughts on what to do going ahead, in your weekly report.

Breather

- Investors paused to catch their breath amid current valuations, taking profits, particularly early in the week before the indices staged a recovery.

- Within the broader markets, the BSE Large Cap index declined by 0.14%, the BSE Mid Cap index fell 1.26% and the BSE Small Cap index dropped 1.85%.

- The India VIX fear gauge dropped by 11.2%, reflecting improved investor sentiment in the latter half of the week, supported by positive macro policy announcements.

The Big Stories

- Despite inflation remaining subdued at 2.2%, the RBI’s monetary policy committee unanimously decided to cut repo rates by 25 bps last week, citing concerns over potential GDP growth slowdown in the coming quarters.

- The rupee hit a record low of 90.44 against the dollar last week, adding complexity to the RBI’s rate cut decision due to its broader macroeconomic implications.

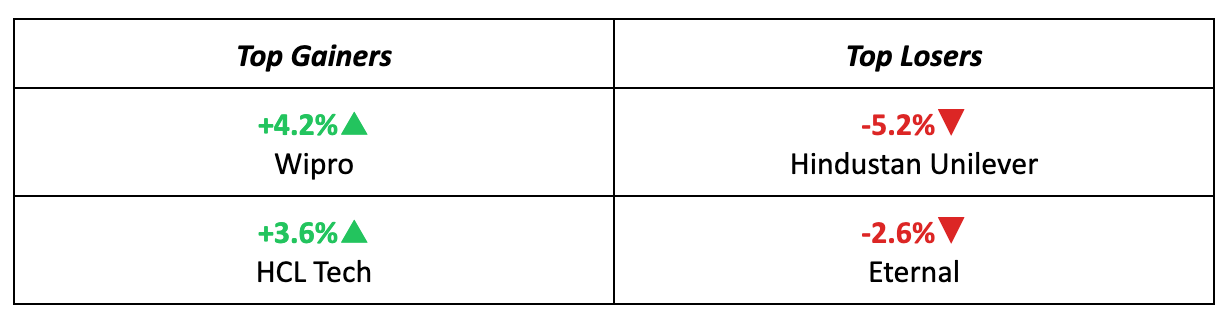

The Winners

- The standout story of the week was the strong performance of the IT sector, with the Nifty IT index reaching its highest level since July. Both top performers were IT giants—Wipro and HCL Technologies.

- The sector benefitted from a broadly positive earnings surprise for the quarter ending September 2025, along with a weaker rupee, which enhanced the sector’s competitiveness in international markets.

The Losers

- Hindustan Unilever fell a significant 5.2% last week, securing the top loser spot, following a sharp decline on Friday due to the demerger of its Kwality Walls division.

- Eternal also underperformed, slipping 2.6% amid market concerns over its margins and the growing threat from Amazon’s expansion in the quick-commerce sector.

Meanwhile…

- The Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, came in as expected for September, prompting markets to price in a potential rate cut at next Wednesday’s Fed meeting.

- The HSBC Manufacturing PMI saw its biggest month-on-month drop in November, with India losing its position as the world's fastest-growing major manufacturing economy to Thailand for the month.

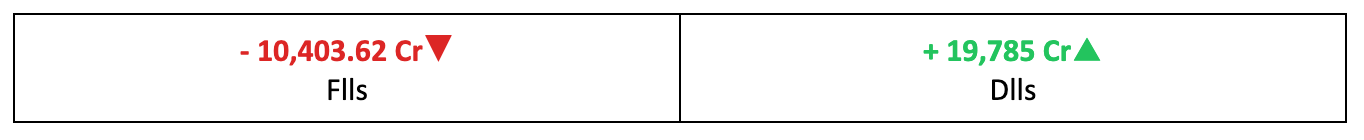

Market Brief

Market Outlook

Our Take

- The RBI’s rate cut, despite benign inflation, aims to support economic growth in the face of potential slowdown. While this should ideally provide short-term support to the Nifty, its impact could be short-lived as broader macroeconomic challenges persist.

- Based on this, we expect the Nifty to remain rangebound next week, between 25,800 and 26,400, with market movements driven by global data.

Discover Investment Opportunities with Liquide

Unlock the potential of informed investing with Liquide, featuring pioneering tools like LiMo, an AI co-pilot for stock investing. Available on both Google Play Store and Apple Appstore, Liquide offers up-to-date market analysis, expert recommendations, and real-time insights to guide your investment decisions.

Download the Liquide App today and enhance your financial journey with Liquide's cutting-edge features.